Highlights:

- Spot Ethereum ETFs saw net inflows on Monday amid increased activity on Ethereum Layer 2 networks.

- Grayscale’s ETHE reported zero outflows, marking a significant shift.

- Analysts view reduced ETHE outflows as a bullish signal for Ether’s price.

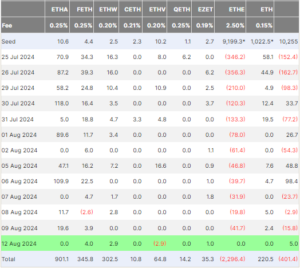

On August 12, US-based spot Ethereum (ETH) exchange-traded funds (ETFs) saw $5 million in net inflows, marking the fifth positive day since their launch on July 23. According to Farside Investors, the net inflows of the nine Ethereum ETFs reversed after three consecutive days of negative flows. The Grayscale Ethereum Trust (ETHE) supported this shift, reporting its first day of zero outflows since converting into an ETF.

ETHE has lost nearly $2.3 billion in Ether since its launch. Prior to its conversion, the fund held $9 billion in ETH, so it has shed over 25% of its total holdings in the two and a half weeks since the ETFs went live.

VanEck’s ETHV was the only spot Ether ETF to see negative flows, with $2.9 million in net outflows, marking the first outflows since July 23. Fidelity’s FETH recorded $3.98 million in net inflows, Bitwise’s ETHW saw $2.9 million in inflows, and Franklin’s EZET had approximately $1 million in inflows. On Monday, the total daily trading volume for spot Ether ETFs reached $286 million, up from $166.9 million on Friday.

Several analysts see the reduction in ETHE outflows as a key bullish factor for Ether’s price in the coming months. They believe ETH’s price might follow a path similar to Bitcoin’s, which rose after its spot ETF approvals despite significant outflows from GBTC.

Grayscale’s Zero Outflows Coincide with Surge in Ethereum L2s Activity

Grayscale’s first day of zero ETH ETF outflows coincided with a significant increase in activity on Ethereum’s decentralized exchanges (DEXs) and layer-2 networks. Last month, Uniswap recorded 8.65 million new addresses across layer-2 networks, almost doubling the 4.93 million added in June, according to Dune Analytics data. In a post on X on August 9, Leon Waidmann highlighted that Arbitrum and Base reported 1.37 million and 2.64 million weekly active users, respectively.

🤯It's mind-blowing how young most #Ethereum Layer 2s are — and yet, they've already achieved incredible milestones!👇

🔹#Base is just 1 year old but already has 2.64M weekly active users.

🔹#Arbitrum One, still under 3 years, has 1.37M.

🔹In just over a year, #Linea… pic.twitter.com/49x4rmL2TF

— Leon Waidmann | Onchain Insights🔍 (@LeonWaidmann) August 9, 2024

On August 12, 73 Ethereum layer-2 networks collectively recorded 298 transactions per second, just 34 TPS short of the all-time high of 322 TPS reached on July 18, according to L2Beat data. The total value locked across all Ethereum layer-2s is now $37.7 billion, compared to $85 billion in total value locked on Ethereum’s mainnet.

According to DefiLlama data, trading volumes on Solana-based DEXs fell by 9% in the past 24 hours, while trading volumes on Ethereum and Base rose by 10% and 11%, respectively, during the same period.

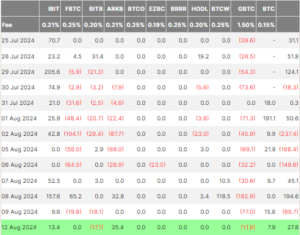

Spot Bitcoin ETFs Report Net Inflows

Meanwhile, the 12 spot Bitcoin ETFs in the US recorded $27.8 million in net inflows on Monday. Ark and 21Shares’ ARKB saw the highest net inflows among the funds, totaling $35.4 million. BlackRock’s IBIT recorded $13.4 million in net inflows, while Grayscale’s BTC saw $7.9 million in inflows. Bitwise’s BITB and Grayscale’s GBTC both experienced outflows, with $17.1 million and $11.8 million exiting the funds, respectively.

According to CoinMarketCap data, Bitcoin’s price rose 0.89% over the past 24 hours to approximately $58,961. Ether increased 2.69%, trading at $2,637.