Highlights:

- Ethereum ETFs continue to outperform Bitcoin ETFs with $1.08 billion in last week’s net inflows.

- Bitcoin ETFs bounced back with a $441 million weekly net inflow.

- Ethereum ETFs had net monthly inflows, while BTC saw net outflows.

Last week, Ethereum (ETH) and Bitcoin (BTC) exchange-traded funds (ETFs) recorded net inflows, bouncing back from $1.4 billion in combined outflows from the week ending on August 22. According to SosoValue’s statistics, Bitcoin ETFs pulled in $440.71 million last week. Ethereum funds attracted $1.08 billion in weekly net inflows and $3.87 billion in net profits last month.

From August 25 to August 29 (ET), Ethereum spot ETFs saw a total net inflow of $1.08 billion, with BlackRock’s ETHA leading at $968 million. Bitcoin spot ETFs recorded a net inflow of $441 million, with BlackRock’s IBIT topping the list at $248 million.https://t.co/Tvs2oCSxTg pic.twitter.com/OCPD2C1bR6

— Wu Blockchain (@WuBlockchain) September 1, 2025

Ethereum ETFs See $1.08B Inflows Led by ETHA

Throughout last week, Ethereum ETFs recorded net inflows except on August 29, when they suffered a $164.64 million cash outflow. BlackRock Ethereum ETF (ETHA) topped the profits chart with its $968.2 million net cash inflows.

Other funds with significant influxes were the Fidelity Ethereum ETF (FETH) and the Grayscale Mini Ethereum ETF (ETH). They pulled in $108.4 million and $54.5 million, respectively. Meanwhile, Franklin’s Ethereum ETF (EZET) had zero activity throughout last week.

Despite the net inflows, weekly cumulative indexes, including value traded and net assets, recorded declines. The total value traded dropped from $16.11 billion to $13.38 billion, while the total net assets fell from $30.58 billion to $28.58 billion. However, total net inflows rose from $12.43 billion to $13.51 billion.

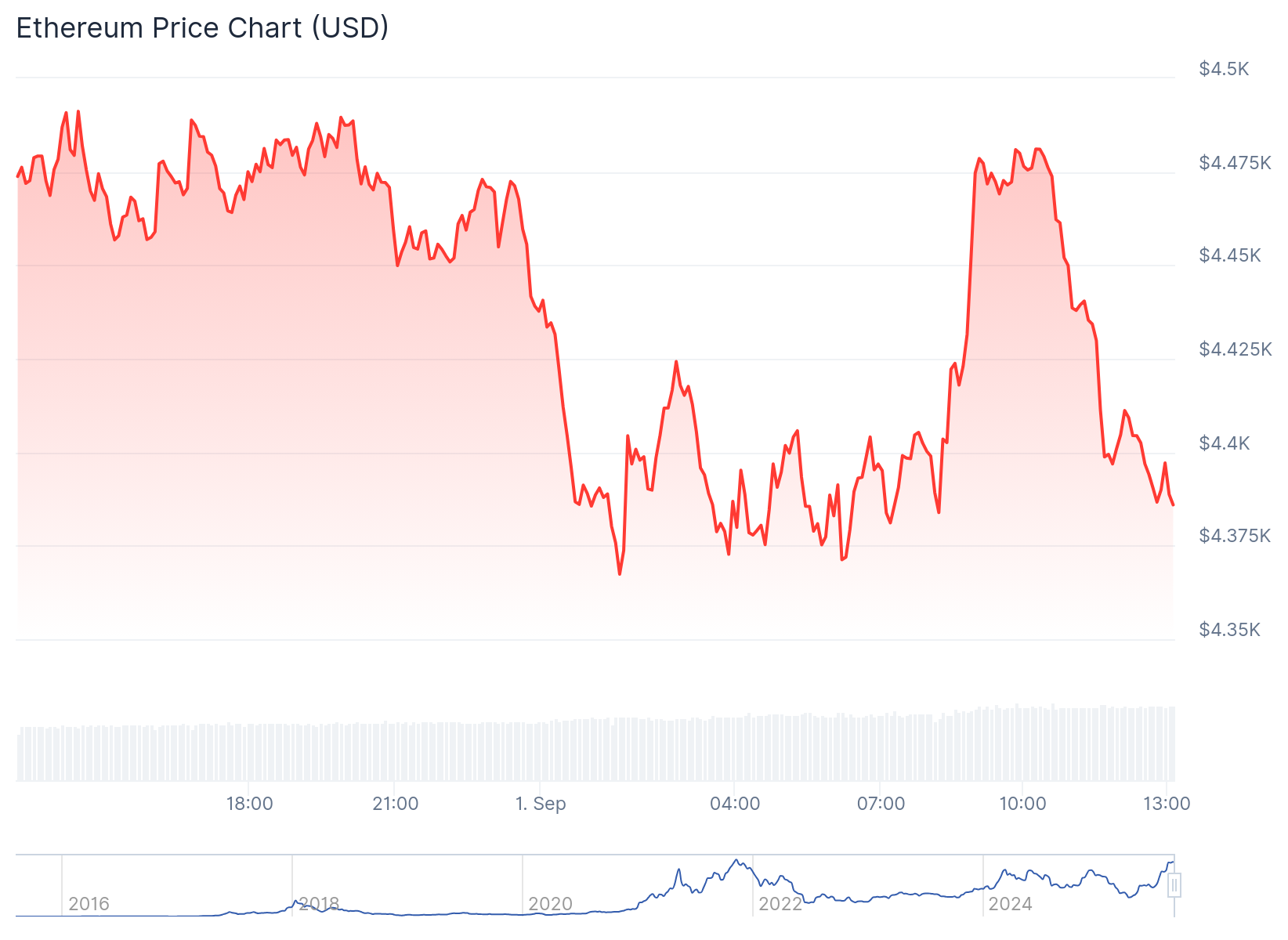

ETH’s Price Drops Slightly as Ethereum ETFs See $1.08B Weekly Inflows

Ethereum is trading at approximately $4,411, following a 1% decline in the last 24 hours. Within the same timeframe, it fluctuated between $4,367.41 and $4,491.17. In the past week, ETH dropped 4.1%, oscillating between $4,279.96 and $4,653.79.

In one of its most recent publications, Crypto2Community reported that a Bitcoin whale who started swapping BTC for ETH in August now owns 837,429 ETH, valued at approximately $3.85 billion. Notably, Lookonchain’s latest update on the whale investor’s actions disclosed that the whale recently sold 4,000 BTC.

The on-chain tracker stated:

“This Bitcoin OG has sold 4,000 BTC ($435 million) and bought 96,859 ETH ($433 million) spot over the past 12 hours.”

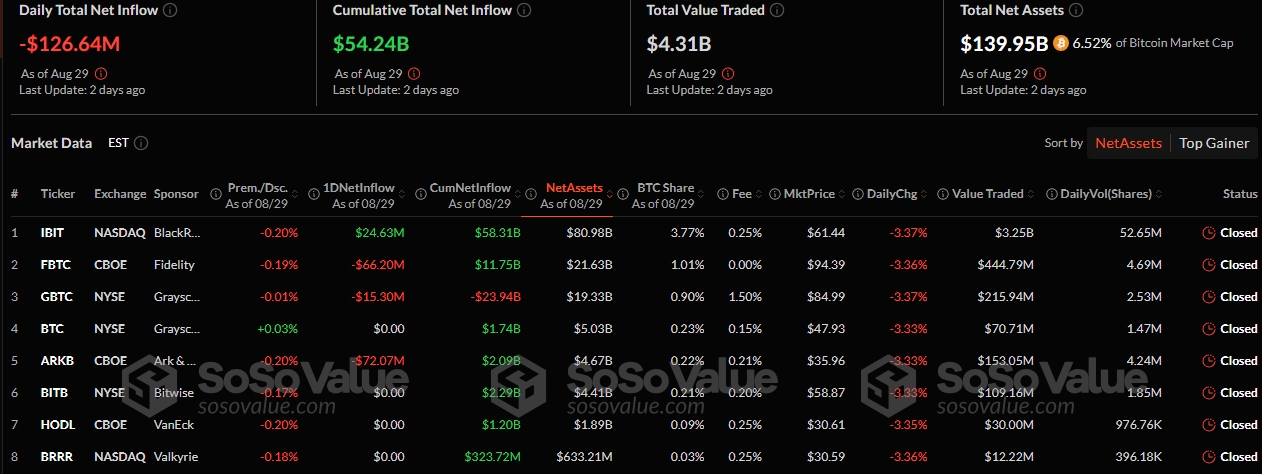

Bitcoin ETFs Detailed Statistics

BlackRock Bitcoin ETF (IBIT) also had the highest net inflows. For context, IBIT attracted only cash inflows, totalling about $247.9 million and accounting for over 50% of the funds’ net inflows for last week.

Other ETFs with significant cash inflows were ARK 21Shares Bitcoin ETF (ARKB), Bitwise Bitcoin ETF (BITB), Fidelity Bitcoin ETF (FBTC), and Grayscale Mini Bitcoin ETF (BTC). These funds pulled in $78.6 million, $46.2 million, $33.5 million, and $24.2 million, respectively. Notably, Valkyrie Bitcoin ETF (BRRR) has neither inflows nor outflows.

Like Ethereum, Bitcoin ETFs total net inflows rose from $53.8 billion to $54.24 billion, while other cumulative variables recorded decrements. For context, the total value traded dropped from $19.55 billion to $17.59 billion, while net assets decreased from $150.23 billion to $139.95 billion. In August, Bitcoin saw net weekly outflows only in the week that ended on August 22. However, the funds shed $1.17 billion in the third week of August, resulting in a monthly net outflow of about $751.12 million.

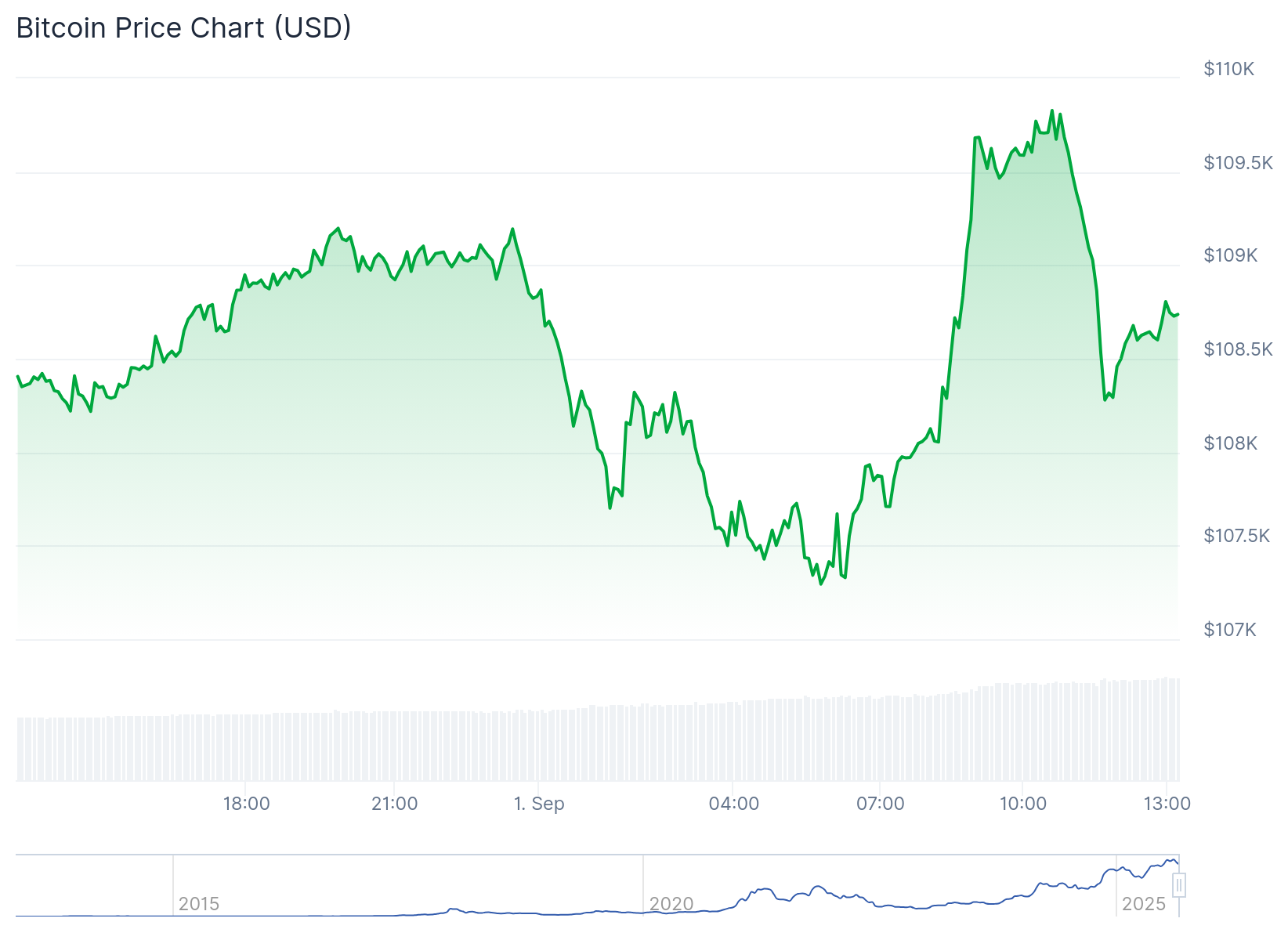

Bitcoin’s Price Reactions to Last Week’s Positive Net Inflows

Bitcoin’s price dropped 0.2% in the past 24 hours. It is changing hands at about $108,400 and fluctuating between $107,295 and $109,828. Its 7-day-to-date price variable showed a 2.8% decrement, with price extremes oscillating between $107,414 and $113,220.

Despite its current price struggles, institutional interests in Bitcoin have remained strong. Earlier today, Metaplanet announced a fresh Bitcoin investment. The Japanese investment firm bought 1,009 BTC for $112 million, increasing its holdings to 20,000 tokens.

Metaplanet has acquired 1009 BTC for ~$112.2 million at ~$111,162 per bitcoin and has achieved BTC Yield of 486.7% YTD 2025. As of 9/1/2025, we hold 20,000 $BTC acquired for ~$2.06 billion at ~$103,138 per bitcoin. $MTPLF pic.twitter.com/JUlF8gUUh2

— Simon Gerovich (@gerovich) September 1, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.