Highlights:

- US spot Ethereum ETFs saw record $1B daily inflows, led by BlackRock and Fidelity.

- ETH price nears $4,300, up 45% in a month amid strong institutional demand.

- Exchange-held ETH hits nine-year low as staked assets surpass $150B milestone.

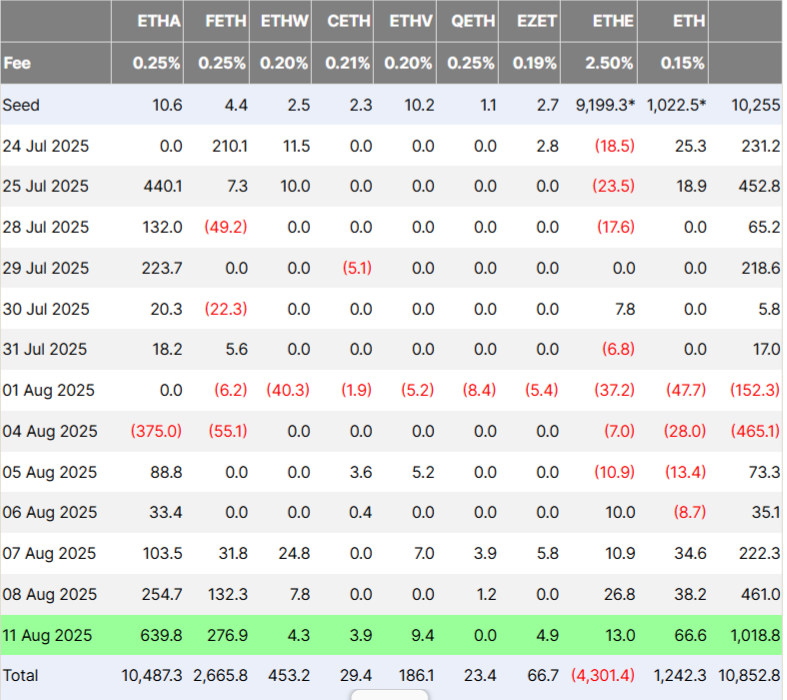

Spot Ethereum (ETH) exchange-traded funds in the US saw over $1 billion in net inflows on Monday, marking their biggest single-day total since launch, according to Farside Investors data. BlackRock’s iShares Ethereum Trust (ETHA) brought in around $638.9 million, while Fidelity’s Ethereum Fund (FETH) added about $276.9 million, both hitting record daily inflows.

Grayscale Ethereum Trust ETF (ETHE) recorded $13 million in net inflows, while its Grayscale Ethereum Mini Trust ETF (ETH) brought in $66.6 million. Funds from VanEck’s ETHV, Franklin’s EZET, Bitwise’s ETHW, and 21Shares’s CETH also ended the day with positive inflows. Monday was the first time spot ETH ETFs saw over $1 billion in daily inflows, though they have been getting steady positive flows for months. Since May, these funds have brought in more than $8 billion, and with Monday’s inflows, the total net inflows have now crossed $10 billion, standing at $10.83 billion.

ETH Nears $4,300 as Institutional Interest and ETF Inflows Gain Momentum

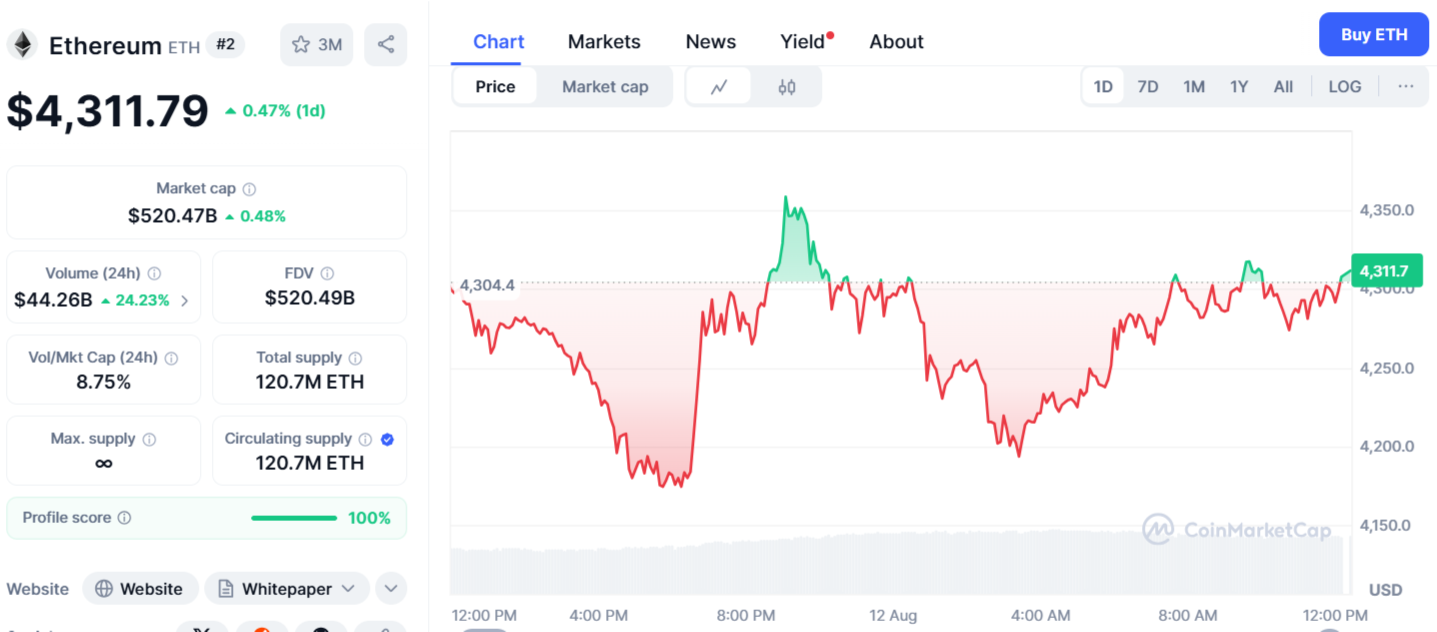

The strong performance came as ETH hovered close to $4,300, its highest level since December 2021. According to TradingView data, the cryptocurrency now sits roughly 12% below its all-time peak of $4,868 reached in November 2021 during the market’s bull run. Ethereum’s recent price rise follows heavy buying activity from publicly listed firms, including Tom Lee’s BitMine and SharpLink Gaming.

In contrast, spot Bitcoin ETFs saw much smaller inflows, amounting to $178.15 million. Ether has also seen a sharp price increase, climbing 45% over the past month. As per CoinMarketCap, it is currently up 0.47% in the past 24 hours, trading at $4,311.

NovaDius president Nate Geraci shared on X that spot Ether ETFs were significantly undervalued in the past. He said this was because traditional finance investors did not fully understand Ethereum. “Feel like spot eth ETFs were severely underestimated simply [because] tradfi investors didn’t understand eth,” Geraci said. According to him, institutional players are now showing greater interest in ETH, with the asset increasingly promoted as the “backbone of future financial markets.”

Ethereum Hits 9-Year Exchange Low as Staked Assets Top $150B

ETH’s record inflows come alongside a series of bullish signals, with the cryptocurrency rising 45% over the past month, per CoinGecko. Glassnode data shows that Ether held on exchanges fell to 15.28 million ETH on August 7. This is the lowest level recorded in nine years. The last time it was this low was in November 2016. Such outflows are often seen as a bullish sign, suggesting investors may be moving their holdings for long-term storage.

In an update on X, onchain analytics firm Token Terminal said Ethereum continues to lead the tokenized asset market. It holds about 58% of all tokenized assets across different blockchains. The firm noted that assets staked on the Ethereum network have surpassed $150 billion for the first time.

ICYMI: Assets staked on @ethereum surpasses $150 billion for the first time. pic.twitter.com/dINGzdQvPF

— Token Terminal 📊 (@tokenterminal) August 11, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.