Highlights:

- Ethereum ETFs post record $787.74 million in weekly outflows as Bitcoin funds gain $246.42 million.

- Bitcoin ETFs recorded profits on two occasions last week, marking their second consecutive week of net inflows.

- Throughout last week, all Ethereum ETFs recorded net outflows.

Last week, Ethereum (ETH) exchange-traded funds ETFs posted $787.74 million in weekly outflows, setting a new record. This figure is more than twice the previous highest net outflows of $341.35 million, recorded in the week that ended on July 26, 2024. Notably, the net outflow closely followed the funds’ over $1 billion weekly gain recorded in the week, spanning August 25 and August 29, 2025.

On the other hand, Bitcoin ETFs pulled in $246.42 million in weekly net inflows, marking the funds’ second consecutive weekly profits after gaining $440.71 million in the week ending August 29, 2025. Amid ETH’s struggle to remain above $4,000, the massive outflows have raised price decline concerns among holders.

From September 2 to September 5 (ET), Ethereum spot ETFs saw a weekly net outflow of $788 million — the largest on record — with no single ETF recording a net inflow. In contrast, Bitcoin spot ETFs posted a weekly net inflow of $246 million, marking two consecutive weeks of net… pic.twitter.com/jWWgqEfrhO

— Wu Blockchain (@WuBlockchain) September 8, 2025

Ethereum ETFs Extend Daily Outflows Streak

Throughout last week, Ethereum ETFs saw only net outflows, extending their daily loss streak to five consecutive days. BlackRock Ethereum ETF (ETHA) and Fidelity Ethereum ETF (FETH) suffered the highest outflows. They lost $312.5 million and $287.9 million, respectively.

Other Ethereum ETFs that posted significant outflows included the Grayscale Ethereum ETF (ETHE), with $83.5 million, the Bitwise Ethereum ETF (ETHE), with $49.1 million, the 21Shares Ethereum ETF (TETH), with $21.3 million, and the Grayscale Mini Ethereum ETF (ETH), with $12.4 million. Meanwhile, VanEck Ethereum ETF (ETHV), Invesco Ethereum ETF (QETH), and Franklin Ethereum ETF (EZET) traded only on September 4 and forfeited $17.2 million, $2.1 million, and $1.6 million, respectively.

As a result of the weekly net outflows, the cumulative metrics suffered losses. The net inflow dropped from $13.51 billion to $12.73 billion, value traded fell from $13.38 billion to $9.34 billion, while net assets valuation dropped from $28.58 billion to $27.64 billion.

Bitcoin ETFs Sustain Weekly Profitable Streak

Between September 2 and September 5, 2025, Bitcoin ETFs had daily net profits on two occasions and outflows on the other two. Unlike Ethereum, some funds gained, a few recorded zero flows, while others posted outflows.

Bitcoin ETFs with significant weekly net inflows included the BlackRock Bitcoin ETF (IBIT), with $434.3 million, the Grayscale Mini Bitcoin ETF (BTC), with $33.2 million, and the Fidelity Bitcoin ETF (FBTC), with $25.1 million. On the other hand, ARK 21Shares (ARKB), Bitwise Bitcoin ETF (BITB), and Grayscale Bitcoin ETF (GBTC) posted weekly net outflows worth $81.5 million, $76.9 million, and $69.7 million, respectively.

Notably, Valkyrie Bitcoin ETF (BRRR) and WisdomTree Bitcoin ETF (BTCW) recorded neither inflows nor outflows. Overall, Bitcoin ETFs’ total net inflows added roughly $250 million, while the net asset value increased by $4.1 billion. On the contrary, the total value traded fell from $17.59 billion to $13.27 billion.

BTC and ETH Spike Slightly as Ethereum ETFs Post Record Weekly Outflow

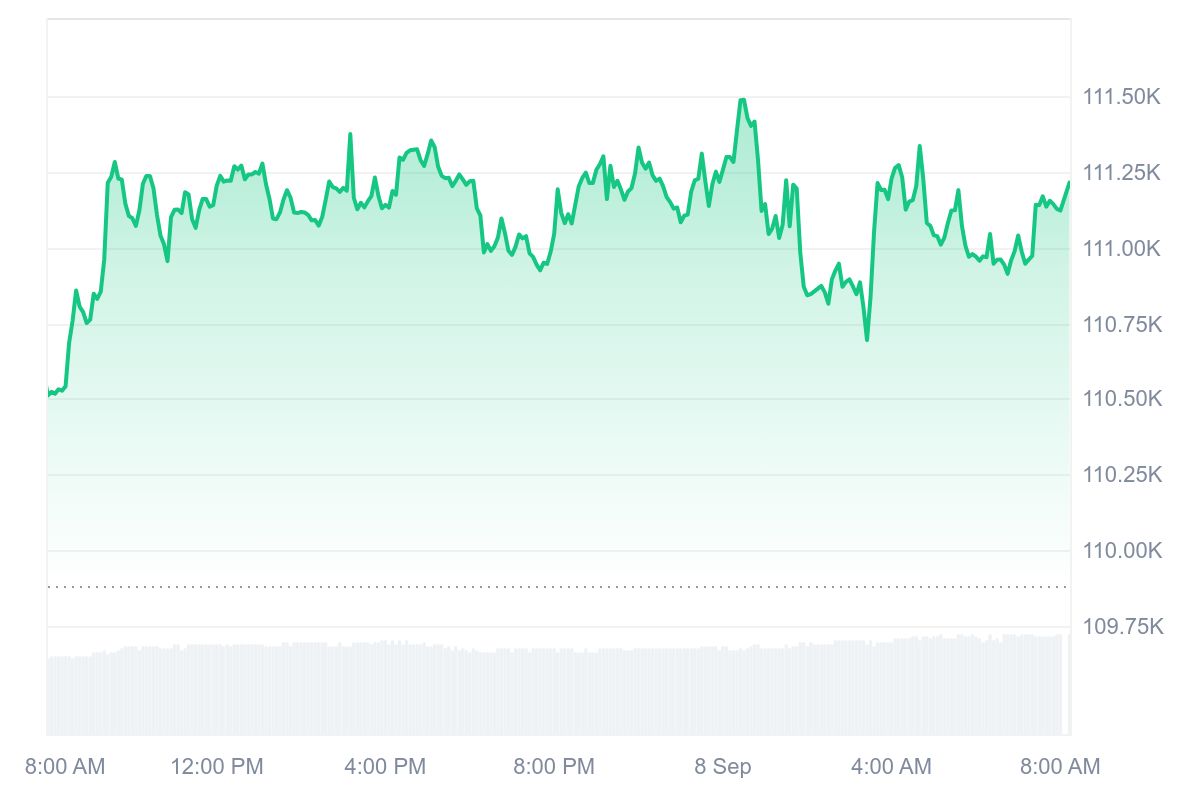

At the time of press, Bitcoin is up 0.5% in the past 24 hours, changing hands at 111,100, with price extremes fluctuating between $110,483 and $111,558. On Coincodex, Bitcoin’s 24-hour trading volume is ranked second at $38.66 billion. Meanwhile, supply inflation is low at 0.84% with medium volatility at 3.92% and a bullish sentiment.

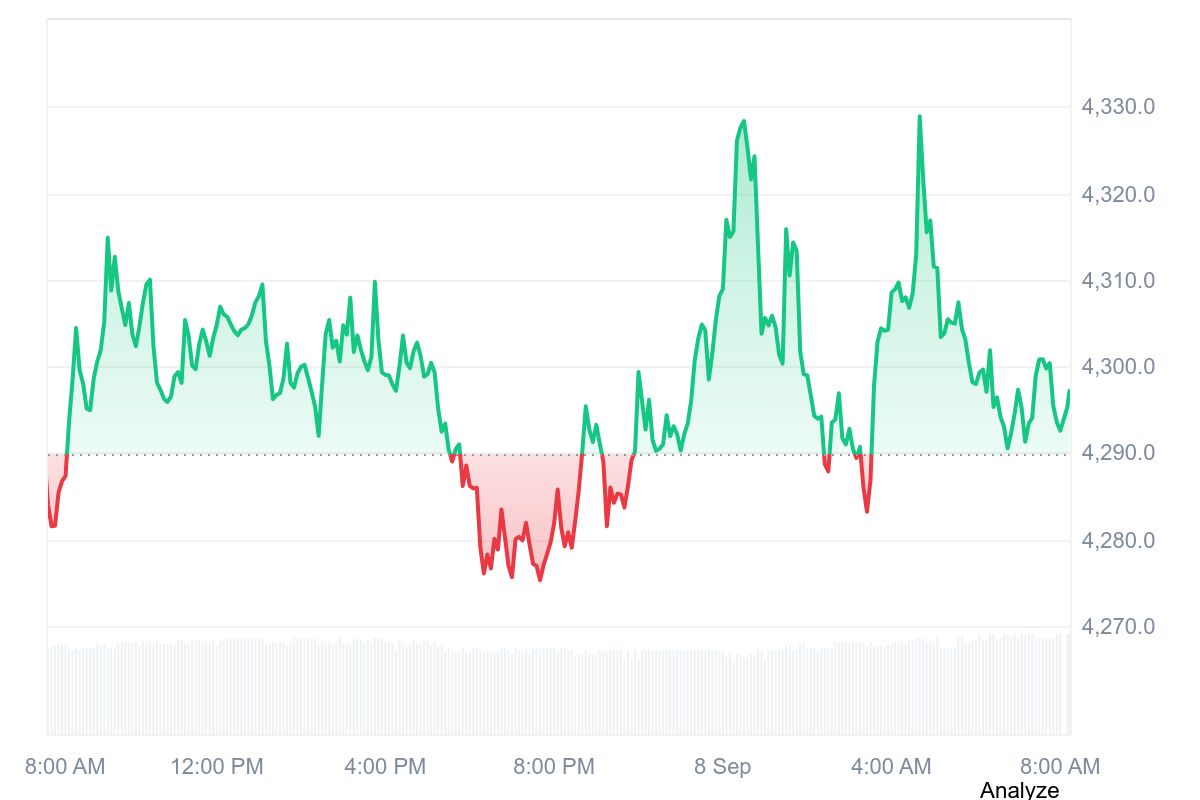

Similarly, Ethereum is priced at roughly $4,290, following a 0.1% upswing in the past 24 hours. Within the same timeframe, ETH has oscillated between $4,272.20 and $4,328.49. Coincodex data showed that ETH has the fourth-highest 24-hour trading volume, valued at $31.55 billion. It has a low supply inflation pegged at 0.32%, a 13.5% dominance, medium volatility at 3.55%, and a neutral sentiment.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.