Highlights:

- US spot Ethereum ETFs saw $52.3 million in net inflows on November 6.

- Bitcoin ETFs gained $621.9 million despite BlackRock’s BTC ETF facing outflows.

- Bitcoin hit $76,243 amid Trump’s victory, boosting Ethereum and other altcoin prices.

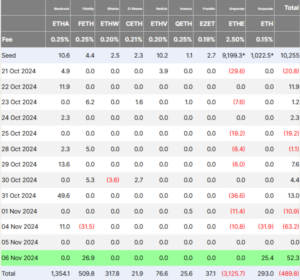

United States spot Ethereum (ETH) exchange-traded funds (ETFs) saw a net inflow of $52.3 million on November 6, according to the data from Farside Investors. This marks their highest inflow in six weeks as the crypto markets surged following Donald Trump’s victory in the 2024 US Presidential Election.

Ether ETFs experienced positive flows, despite BlackRock’s iShares Ethereum Trust (ETHA) recording no flows. Most inflows went to the Fidelity Ethereum Fund (FETH), which saw $26.9 million. The Grayscale Ethereum Mini Trust (ETH) received $25.4 million, while the other seven ETFs had no inflows.

The total net aggregate for all products is now a negative $490 million. This results from ongoing outflows from Grayscale’s high-fee Ethereum Trust (ETHE) fund. Since converting to a spot ETF in July, the fund has lost $3.1 billion in assets under management.

Ether surged 10% on Nov. 7, reaching an intraday high of $2,872 in early trading. This was its highest price since early August. ETH was trading at $2,825 at the time of writing, reflecting a 7.93% increase in the past 24 hours.

BTC ETFs Gain $622 Million Despite BlackRock’s Largest Single-Day Outflow

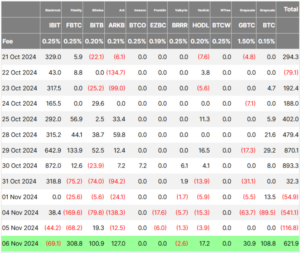

US spot Bitcoin ETFs saw a major turnaround on November 6, attracting about $621.9 million in net inflows, ending a three-day losing streak. This rebound occurred despite BlackRock’s iShares Bitcoin Trust (IBIT) facing its largest single-day outflow since its launch.

Data from Farside Investors shows that the world’s largest Bitcoin ETF experienced about $69 million in net outflows yesterday, while Valkyrie Bitcoin Fund (BRRR) saw more than $2 million in outflows.

IBIT Sees Record Trading Volume

IBIT’s loss was unexpected, especially after the fund saw over $1 billion in shares traded within the first 20 minutes of the market opening on November 6. Bloomberg ETF analyst Eric Balchunas noted that IBIT reached its highest trading volume day, with $4.1 billion.

$IBIT just had its biggest volume day ever with $4.1b traded.. For context that's more volume than stocks like Berkshire, Netflix or Visa saw today. It was also up 10%, its second best day since launching. Some of this will convert into inflows likely hitting Tue, Wed night pic.twitter.com/vy2zJBwaHd

— Eric Balchunas (@EricBalchunas) November 6, 2024

Fidelity and ARK 21Shares Lead BTC ETFs

On Wednesday, Fidelity Wise Origin Bitcoin Fund (FBTC) led with $308.8 million in net buying, followed by ARK 21Shares Bitcoin ETF (ARKB) with $127 million. The Bitwise Bitcoin ETF (BITB) fund saw around $100.9 million, its best single-day performance since mid-February.

Grayscale Bitcoin Trust (GBTC) experienced $30.9 million in net inflows yesterday, whileVanEck Bitcoin ETF (HODL) recorded $17.2 million. Grayscale Bitcoin Mini Trust (BTC) brought in $108.9 million, its second-largest daily inflow since launch.

Bitcoin Price Hits New ATH Amid Trump’s Election Victory

Bitcoin ETFs saw significant net inflows during a bullish period for Bitcoin, which hit a new all-time high of $76,243 on Nov. 6. The rally followed Donald Trump’s pro-crypto victory in the 2024 US presidential election, where he secured over 270 Electoral College votes and a majority of the popular vote. While some ballots are still uncounted, Trump has been declared the winner.

Bitcoin has pulled back slightly to $75,000, according to data from CoinMarketCap. Analysts believe that Trump’s election, along with his expected pro-crypto policies, could boost growth for Bitcoin and other digital assets.