Highlights:

- U.S. spot Bitcoin ETFs saw $131M outflow, ending 12-day streak with $6.6B inflows.

- Ethereum ETFs post $296 million daily inflow, extending strong 12-day positive streak.

- Ethereum beats Bitcoin last week with record $2.12B in investor inflows.

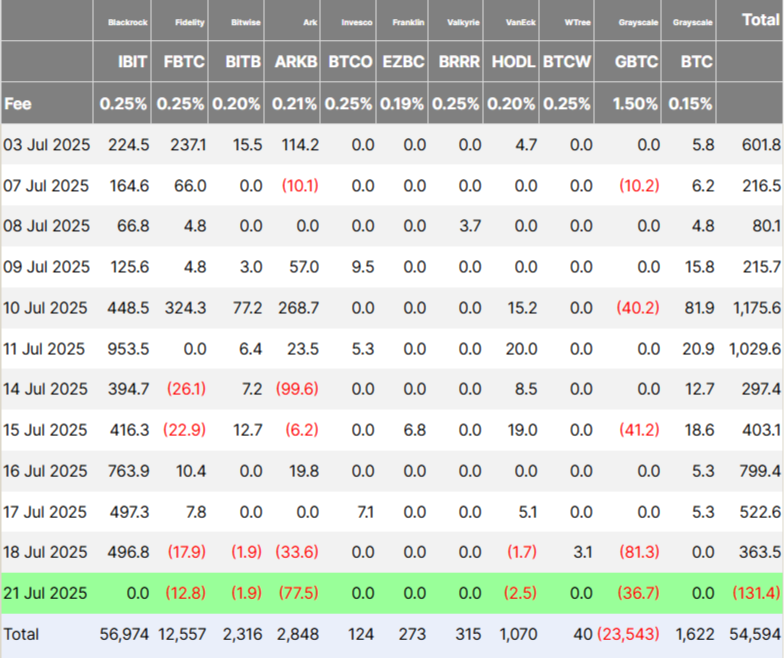

Spot Bitcoin exchange-traded funds (ETFs) saw a net outflow of $131.4 million on Monday. This interrupted a 12-day streak that brought in $6.6 billion, marking the first daily outflow since July 1. During that run, Bitcoin ETFs saw $6.12 billion in total net inflows. ARK 21Shares Bitcoin ETF (ARKB) recorded the biggest outflow at $77.5 million. Grayscale Bitcoin Trust (GBTC) followed with $36.7 million, and Fidelity Wise Origin Bitcoin Fund (FBTC) lost $12.8 million, according to Farside.

Bitwise Bitcoin ETF (BITB) and VanEck Bitcoin ETF (HODL) also had small outflows of $1.9 million and $2.5 million. BlackRock’s iShares Bitcoin Trust (IBIT), the largest ETF with $86.16 billion in assets, recorded no inflows or outflows. Meanwhile, overall net inflows continue to hold strong at $54.62 billion. Combined net assets across all spot Bitcoin ETFs have reached $151.60 billion, making up 6.52% of Bitcoin’s total market value.

ETH ETFs See $296 Million Daily Inflows

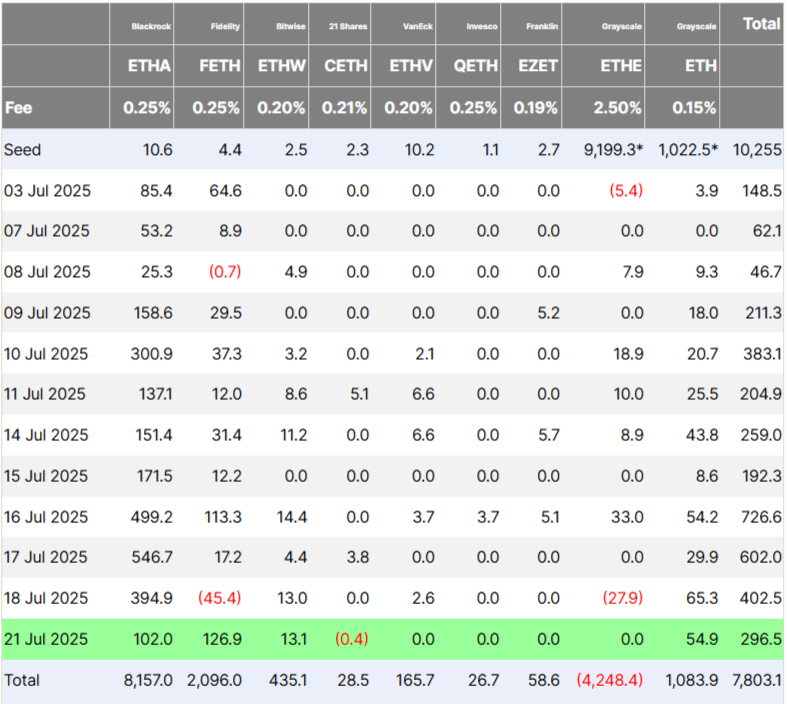

Meanwhile, spot Ethereum ETFs continued their net inflow streak for the 12th consecutive day, with $296.5 million in positive flows recorded on Monday. Fidelity Ethereum Fund (FETH) led the inflows with $126.9 million, followed by BlackRock’s iShares Ethereum Trust (ETHA), which received $102 million. Grayscale’s Ethereum Mini Trust ETF (ETH) and Bitwise’s Ethereum ETF (ETHW) also recorded positive inflows for the day.

Spot Ethereum ETFs have recently experienced their highest inflow levels since debuting on July 24, with the nine funds collecting a combined $3.53 billion over the past 12 days. On several days, daily inflows were even higher than those of Bitcoin ETFs. Ethereum ETFs now hold a total of $19.6 billion in net assets, which accounts for 4.32% of Ethereum’s overall market capitalization.

Ethereum Steals Spotlight Last Week with Record ETF Inflows, Surpasses Bitcoin

Global inflows into Bitcoin and Ethereum ETFs hit a record high last week. But it wasn’t Bitcoin that led the way. A new report from CoinShares said, “Ethereum stole the show,” as big investors showed more interest after strong price gains. Ethereum investment products brought in $2.12 billion during the week ending July 19, pushing total yearly inflows to $6.2 billion. This figure is nearly twice the previous weekly record of $1.2 billion. Meanwhile, global data shows Bitcoin and Ethereum inflows were closely matched, as investors searched for stronger returns. Bitcoin attracted approximately $2.2 billion during the same week.

📈 Digital asset products saw all-time high weekly inflows of US$4.39B.@ethereum stole the show, attracting a record US$2.12B in inflows, nearly double its previous record. @Bitcoin saw inflows of US$2.2B.

🇺🇸 + US$4.36B

🇨🇭 + US$47.3M

🇭🇰 + US$14.1M

🇦🇺 + US$17.3M

🇧🇷 -… pic.twitter.com/07HFRtcGD7— CoinShares (@CoinSharesCo) July 21, 2025

Although Bitcoin reached a new all-time high of $123,000 last Monday, its price has remained mostly steady, while altcoins have begun to rally. Ethereum, in particular, has gained 25% over the past week and is still about $1,000 short of its all-time high of $4,891, which was recorded in November 2021.

Analysts say the flows show shifting investor focus. Bitcoin’s momentum is slowing, while Ethereum gains strength from key legislation and staking benefits. These features make ETH ETFs more appealing to big investors.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.