Highlights:

- Bitcoin ETFs saw $226.7M inflow on Thursday after three days of outflows.

- Ethereum ETFs gained $2.4B in six days, far ahead of Bitcoin’s $827M inflows.

- Galaxy Digital CEO expects ETH to test $4K soon as demand and institutional interest keep rising.

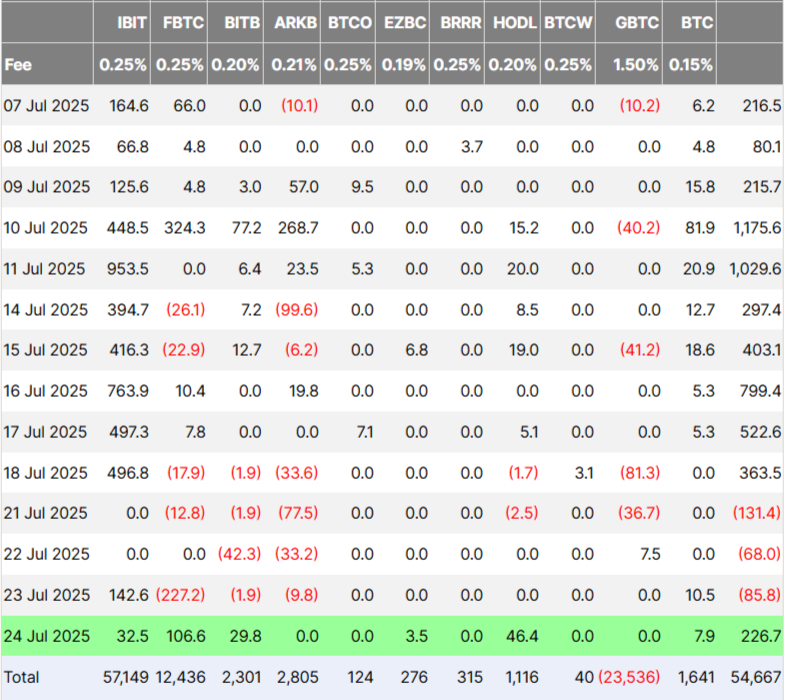

US-based spot Bitcoin (BTC) exchange-traded funds (ETFs) saw a strong recovery on Thursday with $226.7 million in net inflows, ending a three-day run of outflows. Fidelity Wise Origin Bitcoin Fund (FBTC) led the inflows with $106.6 million, followed by VanEck Bitcoin Trust (HODL), which saw $46.4 million, according to data from Farside. BlackRock’s iShares Bitcoin Trust (IBIT), the largest spot BTC ETF by net assets, recorded $32.5 million in inflows. Products from Bitwise Bitcoin ETF (BITB), Grayscale Bitcoin Trust ETF (GBTC), and Franklin Bitcoin ETF (EZBC) also posted positive inflows.

Thursday’s inflows ended a three-day run of money leaving spot Bitcoin ETFs. On Monday, $131.4 million was pulled out, followed by $67.9 million on Tuesday and $86 million on Wednesday. In the past 24 hours, Bitcoin fell 3.2% and is now trading at $114,852. Ethereum went up slightly by 0.8% and is priced at $3,609, based on data from CoinMarketCap.

Ethereum ETFs Attract Strong Investor Interest

Over the past six trading days, spot Ether ETFs have attracted more investor interest than Bitcoin ETFs, as institutional demand for Ethereum continues to grow. Data from Farside Investors shows that ETH ETFs saw approximately $2.4 billion in net inflows during this period. In comparison, spot Bitcoin ETFs brought in only $827 million. Each day over the past six sessions, Ether ETFs have seen higher inflows than their Bitcoin counterparts.

BlackRock’s iShares Ethereum ETF (ETHA) gained the most from the recent inflows. It received $1.79 billion over six days, which is nearly 75% of the total. ETHA reached $10 billion in assets in only 251 trading days, making it the third-fastest ETF to do so. At the same time, Fidelity’s Ethereum Fund (FETH) had its best day on Thursday. It saw $210 million in net inflows, breaking its earlier record of $202 million set on December 10.

Novogratz Sees ETH Hitting $4K Soon as Institutional Demand Surges

Rising institutional interest in Ethereum may give it an edge over Bitcoin in the coming months, according to Galaxy Digital CEO Michael Novogratz. He noted that Ethereum’s limited supply, combined with growing demand, could lead to a supply shock. Speaking with CNBC on Thursday, Novogratz said ETH could outperform BTC within three to six months. He also suggested Ethereum is likely to test the $4,000 level soon. If Ethereum crosses $4,000, it may enter a new price discovery phase.

“We feel kind of destined to at least knock on the $4,000 ceiling a few times,” he said. Novogratz described this price point as an important ceiling that ETH seems ready to approach. He also pointed out ETH’s strong and growing narrative. Two major firms, Sharplink Gaming and BitMine Immersion Technologies, have recently made significant ETH purchases, showing rising confidence from institutions.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.