Highlights:

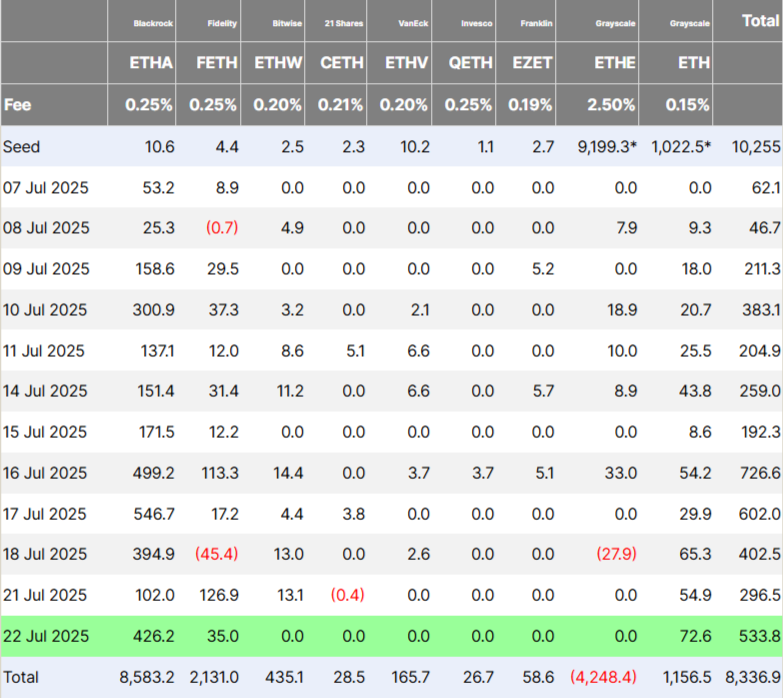

- Spot Ethereum ETFs saw strong demand with $533.8M in net inflows on Tuesday.

- BlackRock led with $426.2M, while total ETF assets now approach $19.85 billion.

- Big names like JPMorgan and Visa use Ethereum for tokenized assets and finance tools.

U.S. spot Ethereum (ETH) exchange-traded funds (ETFs) received $533.8 million in net inflows on Tuesday. This was the third-biggest daily inflow since they were launched. According to the data from Farside, BlackRock’s iShares Ethereum Trust (ETHA) led with $426.2 million in inflows.

Grayscale Ethereum Mini Trust ETF (ETH) received inflows totaling $72.6 million, while Fidelity Ethereum Fund (FETH) attracted another $35 million. At the same time, other firms like Franklin Ethereum ETF (EZET) and Bitwise Ethereum ETF (ETHW) reported no inflow activity during this period. This third-highest daily inflow comes after they recorded $726.6 million last Wednesday and $602 million last Thursday, which remain the top two single-day inflows so far.

Total net inflows into spot Ethereum ETFs have now climbed to $8.34 billion overall. On July 22 specifically, trading activity reached $1.97 billion in volume. The combined net assets of all these ETFs are now close to $19.85 billion, which is about 4.44% of Ethereum’s full market value.

Spot Bitcoin ETFs See $68M Outflow

On the same day, spot Bitcoin ETFs recorded a total net outflow of $68 million. Among them, only Grayscale Bitcoin Trust ETF (GBTC) saw a positive flow, gaining $7.5 million. Most other leading funds, such as Ark Invest’s ARKB and Bitwise’s BITB, experienced outflows of more than $30 million each. The total net assets in U.S. spot Bitcoin ETFs have reached $154.77 billion, making up around 6.5% of Bitcoin’s full market value. Trading activity stayed high, with all funds recording a combined daily volume of $4.01 billion.

More Big Buyers Are Turning to Ethereum

Ethereum is now a top choice for companies using crypto in their treasury plans. One example is marketing and software company SharpLink Gaming, which began collecting Ethereum after launching its ETH-focused treasury strategy in May.

Until recently, Ethereum did not get as much attention because Ether ETFs launched last July had slow growth, with just $2.5 billion in inflows by mid-May. But this changed quickly when spot ETH ETFs started buying Ethereum in large amounts.

Bitwise’s chief investment officer Matt Hougan said that since May 15, ETPs and company treasuries bought 2.83 million ETH. This is worth over $10 billion at today’s prices and is 32 times the new ETH supply during that time. Hougan thinks this buying will keep growing because investors hold much less Ethereum than Bitcoin. He also said new stablecoin rules and growing tokenization of real-world assets will increase Ethereum demand even more.

The Ethereum Demand Shock

A thread on why ETH's price is rising and why it will continue to rise in the months ahead.

🧵

— Matt Hougan (@Matt_Hougan) July 22, 2025

He also mentioned that the Ethereum network could generate about 800,000 ETH during the same timeframe. This means demand might exceed supply by nearly seven times based on current estimates. In a blog post on Tuesday, BitMEX founder Arthur Hayes appeared to agree with this outlook. He suggested that Ethereum’s next bull run could be explosive and predicted ETH might reach $10,000 before year-end.

Net new ETH issuance today: ~2,468 ETH ($13 million).

Net inflows into the ETH ETFs today: ~143,905 ETH ($534 million).

The ETH ETFs bought 58x more ETH than was net issued by the network today.

Accelerate!

— sassal.eth/acc 🦇🔊 (@sassal0x) July 23, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.