Highlights:

- Top crypto chief has warned that the market declines could dive Ethereum to $1,500.

- Ethereum ETF sales delay is highlighted as one of the token’s price decline drivers.

- Technical analysis spotlights $3,200 as a critical price level for Ethereum to stage a potential bounce back.

The world’s most valuable altcoin, Ethereum (ETH), suffered a significant blow as the bear continues to gain momentum. At the time of writing, the global crypto market has dipped by about 9% in the past 24 hours, underscoring the declines ravaging the crypto market.

Worryingly, Bitcoin (BTC), the most-priced digital asset and determinant of market trends, has continued to bleed. On its part, BTC has dropped by approximately 7% in 24 hours, trading around the $54,000 price level. Notably, BTC’s recent decline implies that it is presently 26.7% below its estimated $73,700 all-time high (ATH).

Ethereum Suffering Losses Despite Anticipated Spot ETF Sales

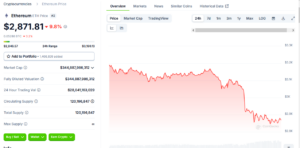

Meanwhile, despite the positive sentiments stemming from Ethereum’s spot Exchange Traded Fund (ETF) potential sales kick-off in July – Ethereum has also been accumulating losses. Notedly, the Ether-based token is selling at about $2,870, following a 9.8% decline in the past 24 hours.

On its specific periods-to-date indices, Ethereum has recorded only losses aside from its year-to-date variable, reflecting a 48.6% upswing. Considering the timeframe, a 48.6% increment does not seem impressive, which sums up ETH’s dwindling state.

Amid the unrest and sell-off sprees in the crypto market, a crypto chief has warned that the dip has just begun. Interestingly, the crypto boss’ analysis on X centered around Ethereum. This insight shall reveal what the expert thinks of the Ether-based token while also analyzing ETH’s future price actions.

Why Ethereum Could Dive to $1,500

A leading market expert Peter Schiff has speculated that Ethereum could dive to $1,500. With his over one million followers, Schiff’s assertion has attracted considerable attention in the crypto community. Remarkably, at the time of press, Schiff’s tweet has accumulated over 41K views, emphasizing the weight of his claims.

According to the crypto boss, Ethereum is breaking key support levels by trading below $2,900. Going further, he noted that he envisages an Ethereum crash to $1,500, citing the impact of the delayed Ether ETF sales.

Notably, Schiff’s tweet read in part, “ I think a crash down to $1,500 is coming. It looks like those buying the Ether ETF rumors couldn’t wait for the fact to sell.”

#Ethereum is also breaking key support. It's trading below $2,900, down 30% from its March high. I think a crash down to $1,500 is coming. It looks like those buying the #Ether ETF rumors couldn't wait for the fact to sell. pic.twitter.com/XXEyX67BXK

— Peter Schiff (@PeterSchiff) July 5, 2024

Implications of a Potential Ethereum’s Dive to $1,500

If Schiff’s prediction plays out, it will undoubtedly have a widespread negative impact across the entire crypto market. Aside from ETH holders losing significantly, altcoins will also drop immensely.

Consequently, panic sell-offs will become more prominent, resulting in more crypto exchange inflows than outflows. The case scenario will eventually result in crypto losing significant funds to other investment projects. In the end, the severely depleted market will need sufficient time to recover and convince potential investors to stake their money.

Ethereum Market Analysis Suggests Key Optimistic Points

As Schiff asserted in his tweet, ETH has broken below several resistance levels on its way to its current price level. If the bear continues to gain momentum, possibly driving Ethereum’s further decline, chances are high that recovery might be tricky.

Analyzing ETH’s price chart, the token must convert the newly formed resistance level at $3,261 to support before staging a recovery. Should the bull take charge and Ethereum eventually break above the $3,261 resistance, it will target $3,520. Finally, at any point, Ethereum succeeds in converting $3,520 to support, which could imply appreciation spells as high as $5,000.