Highlights:

- ETH ETFs have recorded zero flows for the first time since the commodities graced the crypto market.

- Bitcoin ETFs recorded only outflows from five entities to complete three consecutive days of recording only outflows in the just concluded week.

- ETF trends affecting Ethereum and Bitcoin prices, as BTC continues in its back-and-forth pattern while ETH seemed to stabilize around the $2,500 price region.

All Ethereum (ETH) Exchange Traded Funds (ETFs) marked zero flows for the first time since the commodities’ inception. The record flow statistics emerged after several Ethereum ETFs flow data websites updated the statistics for August 30, 2024. Conversely, Bitcoin (BTC) saw only net outflows from five ETF entities, underscoring unproductive ETF markets for Ethereum and Bitcoin.

🚨 US #ETF 30 AUG: 🔴$176M to $BTC and ⚪$0M to $ETH

🌟 BTC ETF UPDATE (final): -$176M

• No US Bitcoin ETFs saw an inflow yesterday.

• The total flow for the week is -$227M with outflows on the past 4 days!

🌟 ETH ETF UPDATE (final): $0M

• All US Ethereum ETFs had $0 net… pic.twitter.com/g2ek81iNSZ

— Spot On Chain (@spotonchain) August 31, 2024

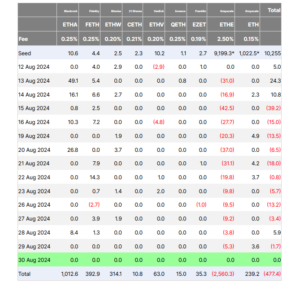

ETH ETFs Record First Zero Flows as it Ends the Week in Losses

August 30 represents the last day for ETF sales for the month. During the week, which began on August 26, ETH ETFs saw outflows for three days. Inflows happened on only one occasion, while its most recent data registered zero flows.

With its August 30 data, the netflow for the week ran into about $12.4 million in losses. Ethereum ETFs’ total flow continues to plummet, with roughly $477.4 billion in outflows. Meanwhile, Grayscale Ethereum ETF (ETHE) remains the highest contributor to losses, with an estimated $2.56 billion. On the other hand, BlackRock Ethereum ETF (ETHA) contributed the highest inflows at about $1.01 billion.

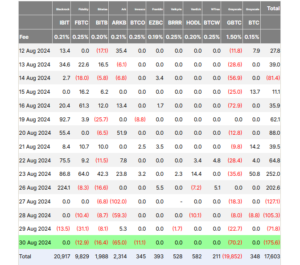

BTC ETFs Register Outflows

Contrary to Ethereum ETFs, BTC saw only outflows. August 30 data made it three different occasions of recording only outflows among Bitcoin’s eleven ETFs. Its most recent netflow data reflected outflows from five ETFs, while the remaining six commodities witnessed zero flows.

Grayscale Bitcoin ETF (GBTC) led the loss charts with about $70.2 million in net outflows. ARK 21Shares Bitcoin ETF (ARKB) and Bitwise Bitcoin ETF (BITB) followed closely in second and third places, respectively. They welcomed $65 million and $16.4 million in outflows. Fidelity Bitcoin ETF (FBTC) and Invesco Bitcoin ETF (BTCO) also registered losses of about $12.9 million and $11.1 million, respectively.

Bitcoin’s total flow for August 30 was negative at about $175.6 million. Between August 26 and 30, the netflow was also negative, with about $227 million in losses. Additionally, during the week, Bitcoin ETFs recorded inflows only once. The only net inflows occurred on August 26, implying that Bitcoin ETFs are on a 4-day spree of consecutive losses.

Ethereum’s Price Appears to Stabilize Around the $2,500 Region

Unlike Bitcoin’s price, which has been making considerable attempts to break above $60,000, ETH seemed to stabilize around the $2,500 price level. At the time of press, Ethereum is trading at approximately $2,520, mirroring a 0.1% decline in its 24-hours-to-date variable.

Within the same time frame, Ethereum recorded minimum and maximum prices ranging between $2,440.93 – $2,540.32. In its 7-day-to-date interval, the world’s number one altcoin saw prices ranging between $2,409.42 – $2,808.77. Hence, it underscores the earlier assertion about a possible stabilization around the $2,500 region.

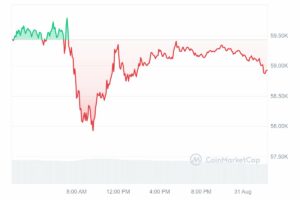

Impacts of ETF Outflows on Bitcoin’s Price Actions

At the time of writing, Bitcoin is changing hands at about $59,100, reflecting a slight 0.3% decline in the past 24 hours. Aside from the 24-hour price decline, BTC’s 7-day-to-date, 14-day-to-date, and month-to-date price changes recorded about 8%, 0.1%, and 8.2% in declines, respectively.

If Bitcoin ETF outflows persist, chances abound that Bitcoin price recovery might appear tricky. Generally, ETF outflows represent a lack of investors’ interest in a commodity. The reason for such a trend could stem from fear of accumulating losses emanating from unfavorable market actions. Overall, the outflows signify that capital inflow into a commodity is dropping, which does not depict a good outcome.