Highlights:

- ETH ETFs have ended a 5-day losing trend, with net inflows from two commodities.

- BTC ETFs witnessed gains from three entities, marking a second consecutive day of accumulating gains.

- Ethereum price remained relatively stable as Bitcoin dropped momentum from yesterday’s slight upswing.

Ethereum (ETH) Exchange-Traded Funds (ETFs) ended a five-day losing streak with about $11.4 million in inflows. Similarly, Bitcoin (BTC) ETFs recorded inflows, marking their second day of successive gains after ending an eight-day outflow trend.

September 10, 2024, flow statistics were unique, with no ETF commodities recording losses across Bitcoin and Ethereum. However, like the September 9 data, activities were minimal, even though BTC ETFs recorded about $117 million in its most recent data.

🚨 US #ETF 10 SEP: 🟢$117M to $BTC and 🟢$11.4M to $ETH 🎉

🌟 BTC ETF UPDATE (final): +$117M

• The net flow rebounded strongly to over $100M.

• For the first time in the past 36 trading days, no US Bitcoin ETFs saw outflows!

🌟 ETH ETF UPDATE (final): +$11.4M

• The net… pic.twitter.com/xrw8VB99kq

— Spot On Chain (@spotonchain) September 11, 2024

Ethereum ETFs See Net Inflows from Two Entities

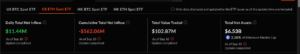

According to the latest data, seven Ethereum ETFs witnessed zero flows, while only two saw net inflows. Fidelity Ethereum ETF (FETH) and BlackRock Ethereum ETF (ETHA) recorded the only gains with about $7.1 million and $4.3 million, respectively.

Consequently, the cumulative Ethereum ETFs flow remained negative at about $562.06 million despite the most recent inflows. The total value traded increased slightly to about $102.87 million, while total net assets reflected $6.53 billion. The total net assets value represented 2.28% of Ethereum’s $280.1 billion market capitalization.

Bitcoin ETFs Rebounds Strongly

In its September 9 statistics, Bitcoin EFTs staged a potential recovery with a positive netflow rate, which many market participants deemed below par. For context, the Bitcoin ETFs registered net inflows of about $26 million in yesterday’s news coverage.

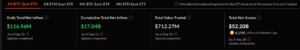

With over $100 million in its most recent data, it becomes apparent that recovering the $1.2 billion shed in eight days is taking gradual shape. Meanwhile, like Ethereum, none of the eleven Bitcoin ETFs witnessed outflows, as only three registered inflows.

Notedly, Fidelity Bitcoin ETF (FBTC) led the inflows pack with about $63.2 million. Grayscale Mini Bitcoin ETF (BTC) and ARK 21Shares Bitcoin ETF (ARKB) followed closely in the second and third place, respectively. Both ETFs saw approximately $ 41.1 million and $12.7 million in inflows.

Considering the recent inflows, Bitcoin ETF cumulative flow has surged above $16 billion and is now worth about $17.04 billion. The total value traded reflected $712.27 million, while total net assets were about $52.2 billion, representing 4.59% of Bitcoin’s $1.1 trillion market capitalization.

Ethereum Remains Steady Around the $2,300 Price Region

At the time of press, Ethereum is changing hands at about $2,320, reflecting a slight 0.8% decline from the previous day. In its 24-hour-to-date price change variable, ETH saw minimum and maximum prices ranging between $2,319.62 – $2,396.42. Therefore, it underscores its price stability claims.

Meanwhile, other specific periods’ price change variables reflected losses for Ethereum. For context, its 7-day-to-date, 14-day-to-date, and month-to-date variables displayed losses of about 1.9%, 6%, and 8.5%, respectively.

Bitcoin Sheds Off Accumulated Gains from Yesterday

While Ethereum appeared relatively stable, Bitcoin seemed to shed off gains from yesterday’s slight upswing, which saw retailers dump their BTC holdings in exchanges. The flagship cryptocurrency is worth approximately $56,250, mirroring a 0.9% decline in the past 24 hours.

Notably, BTC’s minimum and maximum prices within 24 hours reflected $56,147.00 and $58,042.60, respectively. Hence, it corroborates assertions that the coin might have lost earlier perceived positive momentum. Meanwhile, Bitcoin’s 24-hour trading volume is also down by about 7.32%, with a $30.96 billion valuation.