Highlights:

- The Dusk price has rallied by over 50% to $0.08, as trading volume has spiked by 511%.

- The Dusk on-chain activities show a spike in active addresses and network growth, signaling strong momentum.

- The technical outlook shows overbought conditions, which may cause a slight pullback before a strong leg up.

The Dusk price has spiked out in a strong rally, up 55% to $0.0848 mark today. However, the token has hit an intraday high of $0.10 before retracing to its current levels. Its daily trading volume has skyrocketed 511% indicating heightened market activity.

Meanwhile, Hedger Alpha Dusk Network has gone live for public testing. This will be a new feature that allows users to conduct confidential transactions while maintaining privacy. It is a combination of both compliance and regulatory requirements, providing transparency to regulators and also protecting user confidentiality.

Hedger Alpha is now live for public testing.

Dusk brings compliant privacy to EVM, enabling you to send confidential transactions and keep your balance private.

Private to everyone, yet auditable by regulators.

Here's how to get access 👇 pic.twitter.com/hLxBDHvHv0

— Dusk (@DuskFoundation) November 6, 2025

DUSK On-Chain and Derivatives Market Outlook

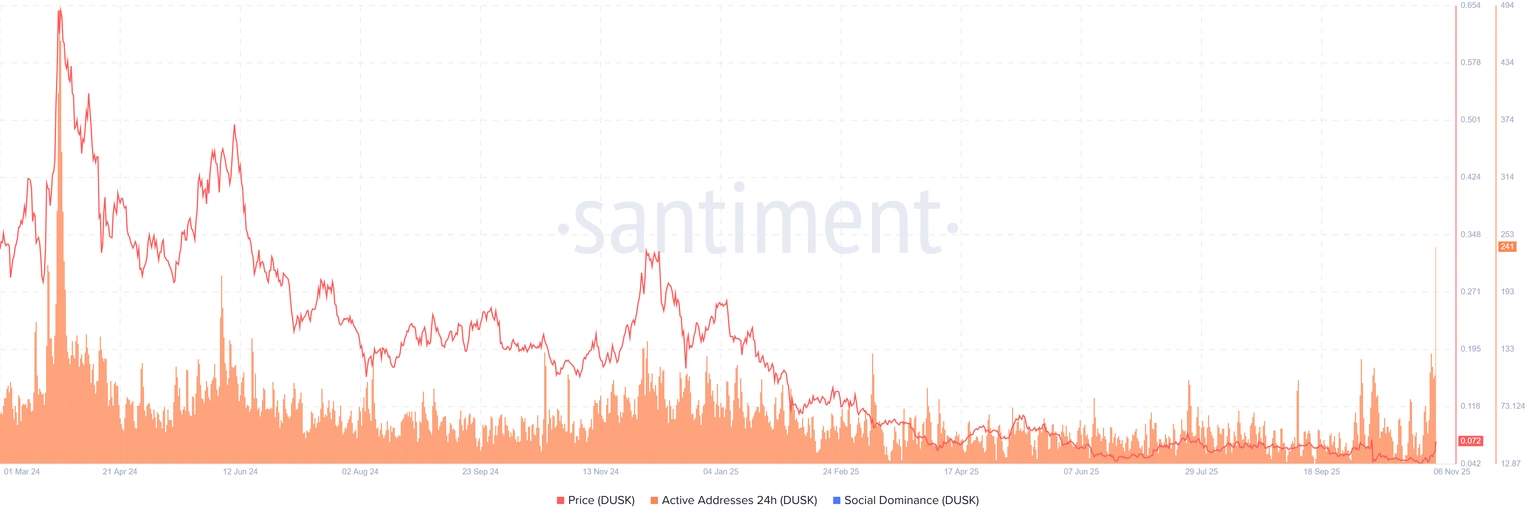

The Daily Active Addresses index from Santiment, which measures network activity by day, is showing a bullish signal for DUSK. The increase in the metric indicates increased blockchain usage, whereas the decrease in addresses indicates reduced network demands.

Meanwhile, the Dusk Daily Active Addresses increased on Monday to 59 and on Friday to 312, the highest since March 2024. This means DUSK is increasingly using blockchain, which is a positive sign for the DUSK price.

On the other hand, according to Santiment data, the network growth index for DUSK jumped to 95 on Thursday, up from 13 on Monday, the highest since March 2024. Though stabilized since Friday, it stands at 32. These high levels still point to a very wide-ranging bullish outlook for DUSK.

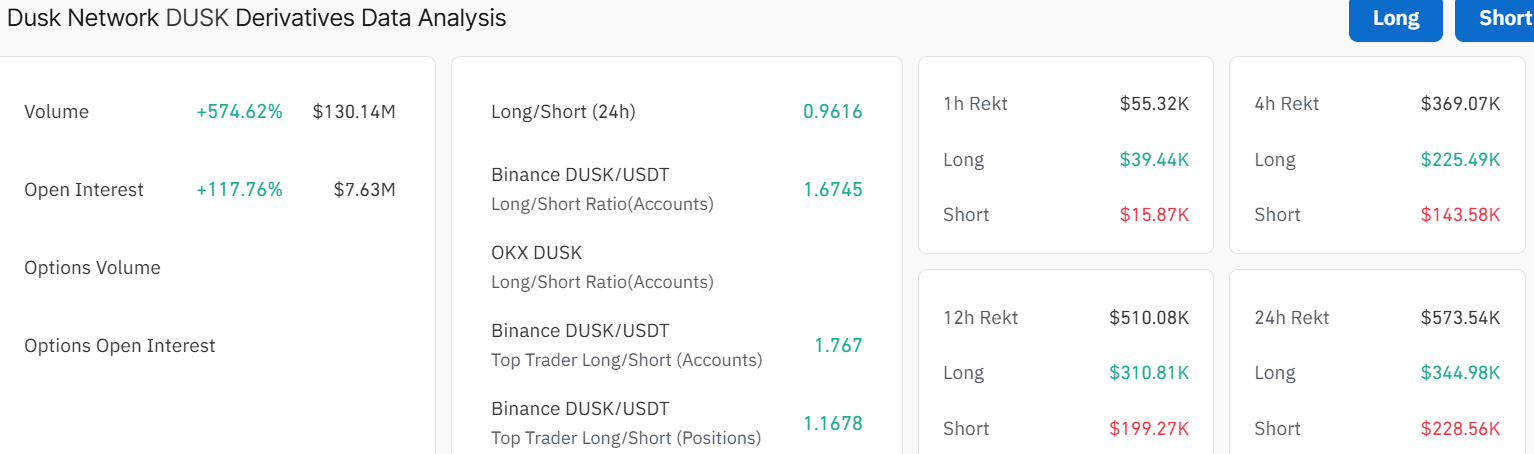

According to CoinGlass, DUSK futures OI on exchanges rose to $7.63 million, a 117% increase over the past 24 hours. The increased OI reflects new money entering the marketplace and new purchases, which might further fuel the ongoing DUSK price frenzy.

Dusk Price Risks a Pullback as Overbought Conditions Emerge

Looking at the DSUK/USDT chart, the 200-day Simple Moving Average (SMA) at $0.065 is acting like a solid launchpad from which the price bounced to a high of $0.10 before retracing to $0.08

The Dusk price has been riding above this both moving averages lately, signaling strong bullish momentum. If it breaks through the recent $0.10 mark, it could soon soar to $0.15. The chart displays a bullish parabolic curve from which the price broke out.

The Relative Strength Index (RSI) at 79.43 is signaling DUSK is overbought. This might lead to a pullback to $0.07 or even $0.06 if early profiteering commences. Notably, the MACD is bullish, suggesting the Dusk price is on an upward trajectory.

Looking ahead, the short-term forecast is bullish. If Dusk price holds above $0.10 and volume keeps pumping, the token could jump to $0.15. In the long term, if this momentum continues, $0.20 isn’t off the table by the end of November, especially with the community hype. But traders will want to watch out for the overbought RSI, and potential profit-taking could drag it back to $0.07 support.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.