Highlights:

- The price of Dogecoin has dropped 8.75% to $0.23 despite a 74% surge in trading volume.

- Whales have accumulated more than 310 million Dogecoin in the past 48 hours.

- DOGE technical indicators suggest the latest dip is worth buying, as bulls eye $0.43.

The Dogecoin price has dropped 8.75% to $0.23, as the crypto market swims in the red. Despite the drop, the daily trading volume has increased by 74.44% to $5.41 billion, indicating an increase in investor confidence. The recent market slip has prompted popular analyst Ali Martinez to call for traders and investors to “buy the dip.”

Buy the dip!

— Ali (@ali_charts) July 24, 2025

The dog-themed meme coin is now boasting an 8% rise over the past week and a 43% spike over the past month. Moreover, over the last 48 hours, the DOGE market has witnessed significant whale activity. The whales have acquired more than 310 million Dogecoin, indicating high interest in the market despite the dip.

Over 310 million Dogecoin $DOGE have been swallowed up by whales in the past 48 hours, signaling major accumulation after a brief profit-taking dip. pic.twitter.com/ftWYPPhzCL

— Ali (@ali_charts) July 23, 2025

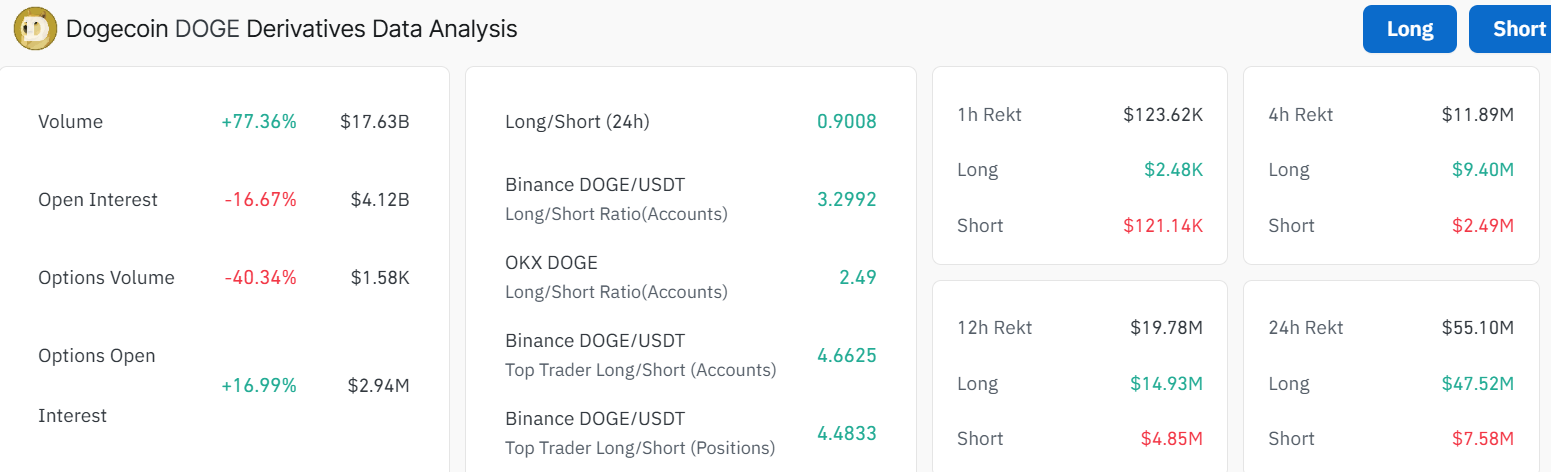

On the other hand, the Dogecoin derivatives market, according to Coinglass data, shows some mixed signals. The dog-themed volume has increased by about 77.36% to $17.63 billion, while the open interest has decreased by 16.67% to $4.12 billion.

The Dogecoin options market has also shown a significant decline in volume by 40.34%, which is the opposite of the overall trade volume. This implies that although traders are already actively building in Dogecoin, they are not willing to assume large leveraged positions within the derivatives market. The long-to-short ratio sits below 1 at 0.9008, indicating some bearish sentiment is building in the market.

Dogecoin Price Upholds a Bullish Outlook Despite the Recent Dip

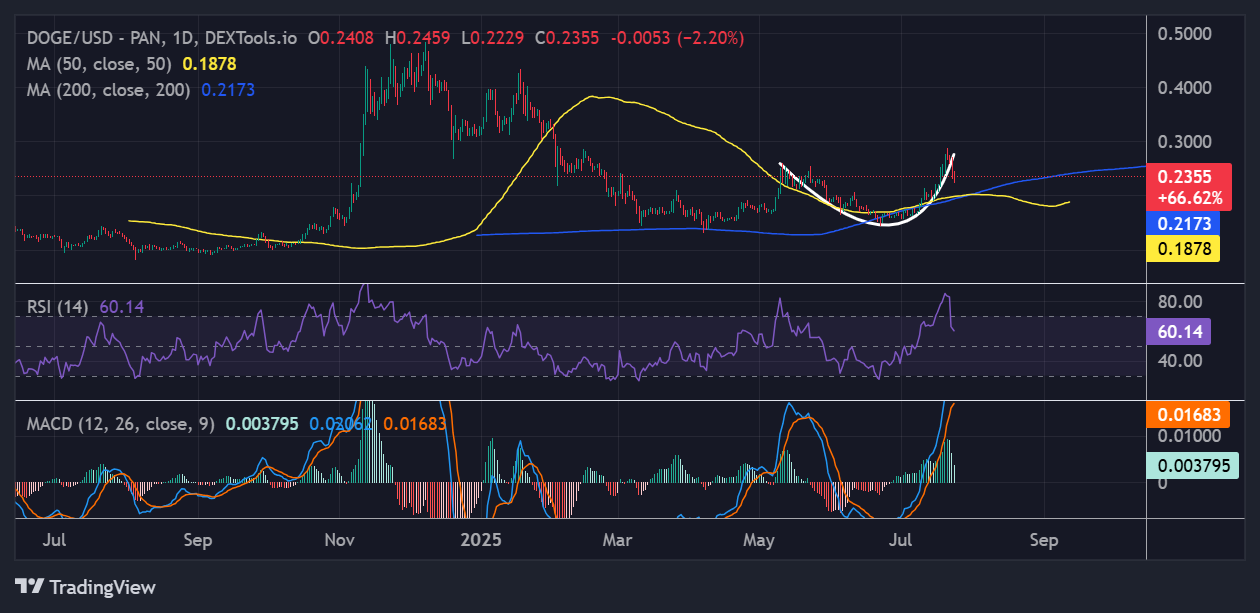

A closer look at the daily chart of the Dogecoin price reveals that the bulls still have the upper hand. The dog-themed meme coin has formed a well-defined rounding bottom, often signaling a potential shift to bullish. The DOGE price is still trading above the 50-day MA ($0.1878) and the 200-day MA ($0.2173). As long as the meme coin holds above these key levels, a potential upside towards $0.30 mark could be imminent.

Based on the relative strength index (RSI), it currently reads 60.14, having retraced from the 84.22 overbought region. The recent short-term pullback was crucial in allowing the bulls to sweep through liquidity and provide entry points for other traders.

Moreover, there is also bullish momentum based on the MACD (Moving Average Convergence Divergence), as the MACD line (0.0206) has crossed above the orange signal line (0.0168). Unless the MACD changes, traders are free to buy more DOGE tokens on the market. This is reinforced by the bullish crossover and the increasing size of the green histograms.

DOGE Eyes $0.43 If Key Levels Hold

Looking ahead, if Dogecoin price breaks and holds above $0.25 resistance, it could end up testing resistance near $0.34 in the short term. A break past $0.340 might then send it cruising toward $0.43, a moonshot comprising 82% gains from the current level.

However, traders will want to watch out for a pullback if the recent correction continues. In such a case, the immediate support lies at the 50-day and 200-day SMAs. Meanwhile, the crypto market’s volatility is unpredictable. Dogecoin’s current momentum and technical indicators suggest that the latest dip is a buying opportunity. For the next few weeks, the dog-themed meme coin may begin a steady climb if the support levels hold, potentially hitting $0.43 by August.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.