Highlights:

- The Dogecoin price has dropped 2% to $0.20, as trading volume has plummeted 16%.

- Whales purchase over 1 billion DOGE, indicating confidence in Dogecoin’s recovery.

- Technical indicators signal potential downside if the bulls don’t gain strength.

The Dogecoin price has dropped 2.05% to $1.99, as daily trading volume has slipped 16% to $1.47 billion. This drop indicates a slight decline in market activity. Meanwhile, Dogecoin ($DOGE) has experienced significant whale activity within the last 24 hours. Big holders have scooped up more than 1 billion DOGE, indicating a significant shift in the market. This buying spree occurs as the price of Dogecoin records a slight decrease.

Whales bought over one billion Dogecoin $DOGE in the last 24 hours! pic.twitter.com/qdGrIE6Gez

— Ali (@ali_charts) August 6, 2025

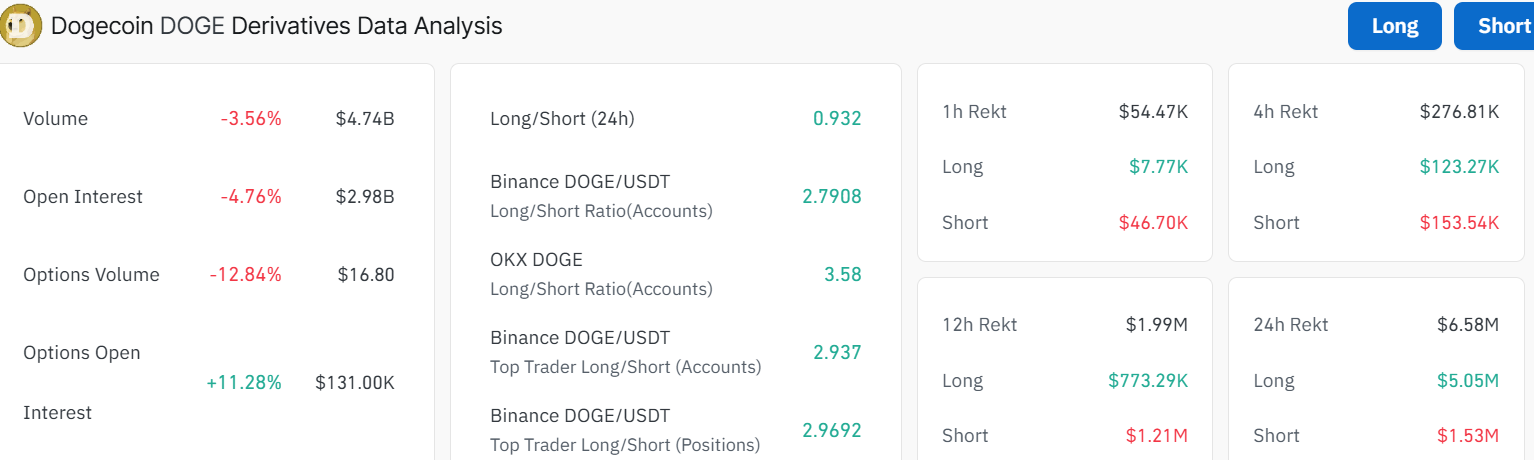

During the last 24 hours, a high amount of activity was observed on the Dogecoin derivatives market. DOGE volume slightly decreased by 3.56% to reach $4.74B. The open interest has been relatively healthy, despite a 4.76% decrease to $ 2.98 billion. The volume of options trading has decreased by 12.84%, which could be a sign of caution within the market. Interestingly, Dogecoin options open interest soared by 11.28%, indicating that traders are positioning themselves for possible price shifts in the future.

The long/short ratio also shows a small bias towards long, which over the past 24 hours was 0.93. This is a positive indicator regarding the coin’s potential in the near future, as traders have high expectations for its future prospects.

Meanwhile, in some derivative exchanges, such as Binance and OKX, the long/short ratio remains positive, indicating a bullish sentiment. In the case of Binance, the DOGE/USDT ratio is 2.79, and for OKX, it is even greater, at 3.58. This means that most traders are currently electing to trade long positions. Such indicators indicate that major players are still contributing to the market, further boosting the price recovery of Dogecoin.

Dogecoin Price Stuck Within Range

The technical analysis of DOGE’s price shows an encouraging trend for investors. The DOGE/USDT pair is currently stuck within range, trading at $0.20. The 1-day DOGE/USDT chart indicates that the price is currently hovering around $0.20, with a 50-day Simple Moving Average (SMA) at $0.1963 serving as immediate support. On the other hand, the 200-day SMA is at $0.2078 and acts as the immediate resistance, cushioning the bulls against further upside.

The RSI (Relative Strength Index) at 44.74 is positioned near the neutral zone, not yet overbought, which leaves room for further upside without an immediate pullback. However, its position below the 50-mean level is a threat, as traders should watch out for a possible downside. Meanwhile, the MACD is showing a negative divergence, as the blue MACD line is positioned below the orange signal line. This outlook reinforces the sell signal, suggesting a bearish outlook for DOGE.

What’s Next for DOGE?

The whale activity is a strong bullish indication. A 1 billion buy-in is a signal that these big investors believe in Dogecoin’s potential to rally. Combined with the chart’s sideways trend and current technical indicators, DOGE could see a push to $0.40 by the end of August if volume increases.

However, crypto is volatile, and currently, volatility is low (as volume has dropped 16% in a day). In other words, further downside isn’t off the table if profit-taking kicks in. This appears to be a golden opportunity for the DOGE army. In such a case, the DOGE price may plummet towards $0.16 if the $0.19 support level cracks.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.