Highlights:

- Dogecoin price has the potential to rally to $2 based on historical correction patterns.

- Whale accumulation suggests an increasing confidence in the Dogecoin market despite bearish trends.

- Technical indicators point to a bullish reversal with resistance levels at $0.2949 and $0.35.

The crypto market has continued its sluggish trend, as the global market cap declined by 270% to $3.12 trillion. However, the 24-hour trading volume has surged by 2% to $103 billion, indicating increased market activity. Despite the broad price volatility, the fear and greed index lies at 35, indicating a fear sentiment.

Dogecoin Price Action

The largest memecoin, Dogecoin, has displayed a remarkable rally recently, with the price rallying to new highs. The memecoin started its rally in November when the price climbed above the $4 mark, a level not seen in 2021. The bullish momentum continued further, pushing the price to $0.47 in December when stiff resistance led to a pullback.

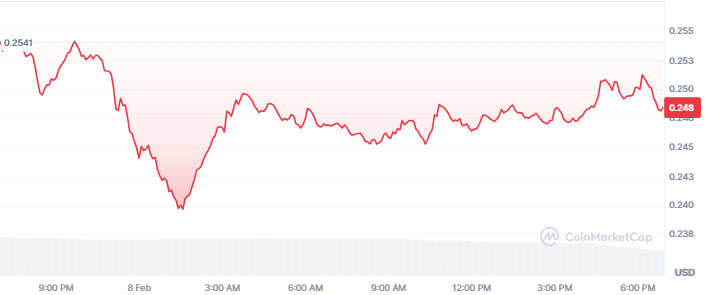

Despite the price swings, DOGE recovered above the $0.40 mark again before facing a correction in mid-January. The correction dropped the price below the $0.35 level, and the recent broad market pullback further dropped it below $0.30. After the crash, the market tried to stabilize, and DOGE managed to rise back to $0.30 on Tuesday. But it has been rejected and pulled back below $0.25 recording a 25% loss on the weekly chart.

At press time, DOGE is trading at $0.248, down by 2.28% in the past 24 hours. The memecoin is down 23% on the monthly chart despite the 200% surge in the past year. Moreover, the market cap and trading volume have declined to $36 billion and $1.36 billion, respectively.

Analyst Forecasts Dogecoin’s Potential Rally to $2

Based on the technical analysis by Trader Tardigrade, Dogecoin still has potential in the future. Previous similar declines demonstrated that sharp recoveries followed significant declines. In prior cycles in 2017 and then in 2020, Dogecoin embarked on corrections of 59.76% and 56.2% consecutively before climbing to new peaks. These shifts are evident, and the 58.25% pullback in 2024 also shows such trends, indicating a potential upward surge.

#Dogecoin: The down percentages in the final pullbacks are very close 🔥

Before each strong rebound, $DOGE tends to pull back more than 50%.

The first pullback noted a -59.76% decline, while the second revealed -56.2%.

The current (third) pullback recorded -58.25%, qualifying it… pic.twitter.com/abOyjsdLxQ— Trader Tardigrade (@TATrader_Alan) February 7, 2025

The depth of the retracements between 56% and 60% proves that structured market movement is probably brought about by phases, accumulation, and liquidity. Such patterns indicate that Dogecoin is set to enter another bullish phase. If such a trend is maintained, the memecoin might be approaching a $2 price target.

At the moment, there are clear similarities in the market trends to previous cycles for Dogecoin. If this trend continues and higher trading volumes follow suit, the memecoin can follow its past performance and propel its value higher.

Whale Buying Spree Signals Optimism Despite Dogecoin Price Drop

Dogecoin whales have been consistently accumulating during the price correction. Analyst Ali Martinez noted that the whales have recently bought 100 million tokens within a single day indicating a range of confidence and demand.

Whales have accumulated another 100 million #Dogecoin $DOGE in the last 24 hours, signaling growing confidence and demand! pic.twitter.com/HKuseWubtN

— Ali (@ali_charts) February 7, 2025

Earlier on February 6, Martinez had stated that these investors bought 750 million DOGE, worth nearly $200 million. Such significant accumulations tend to pull in traders, which often leads to an increase in price. As the supply increases, Dogecoin price may see an upward trend.

Technical Analysis – DOGE Eyes Bullish Reversal in Short-term

Technical indicators on the 4-hour chart suggest a reversal in the Dogecoin price movement. A series of green candlesticks are forming, usually indicating a reversal from the continuous downtrend.

Indicators such as the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) support the bullish reversal. The RSI has climbed from the oversold region at 42 indexes, suggesting further room for growth. In addition, the MACD line is above the signal line, and green histograms rule the chart.

The support at $0.2017 has proven strong recently as the price bounced back strongly. Should the current trend hold, DOGE could challenge the immediate resistance at the $0.2948 level. A break above this mark could lead to a retest at the $0.35 region.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.