Highlights:

- Dogecoin price has dropped 10% over the past week to $0.22.

- A crypto analyst foresees a potential comeback towards the $0.24-$0.25 range.

- Technical indicators are sending mixed signals, as the derivatives market has seen a 95% decline in options volume.

The Dogecoin price is down about 1% to $0.22, as the entire crypto market attempts to find stability while awaiting the Fed’s Rate cut. DOGE’s daily trading volume has decreased by over 10%, indicating a decline in market activity. Currently, DOGE is down 10% over the past week; however, it has shown remarkable strength with a 35% spike in the past month.

A well-known analyst, Bitgu-ru, has noted an imminent price bounce off a healthy support level. Various traders and analysts also speculate that the price could rally by an estimated 28%, targeting the $0.240 and 0.250 range.

$DOGE Pullback Reversal Forming#Dogecoin is bouncing from the 0.213 support zone, showing signs of a bullish pullback.

A breakout could lead to a 28% move toward the 0.240–0.250 range. pic.twitter.com/xB1jDV7HxC

— BitGuru 🔶 (@bitgu_ru) July 30, 2025

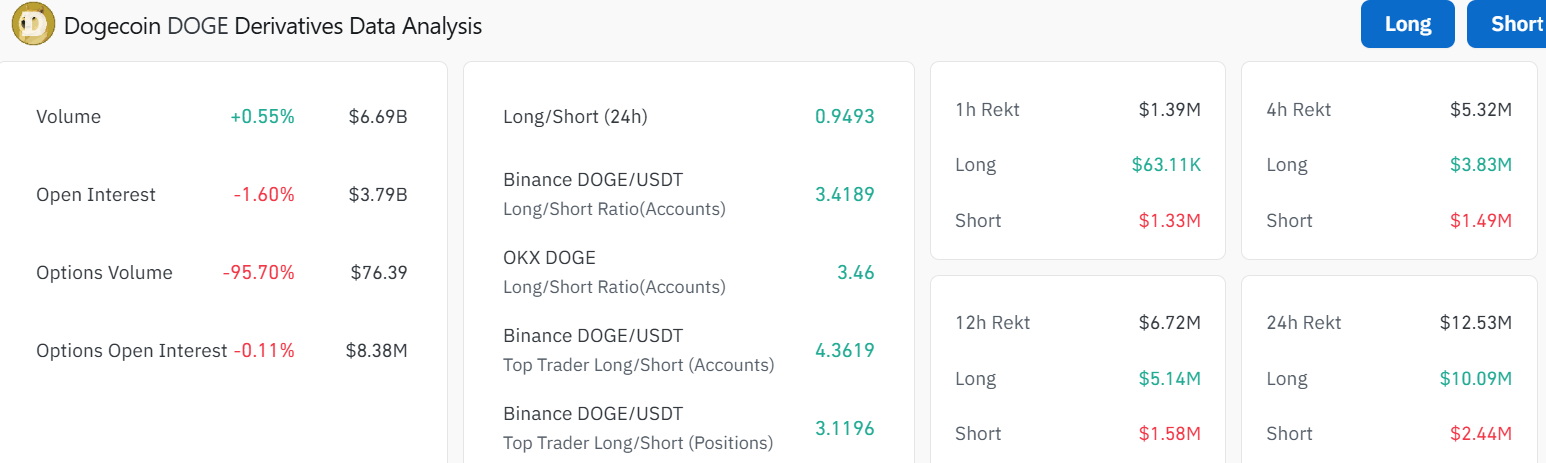

On the other hand, the derivatives data show that the market has a bullish outlook. It can be seen that the Dogecoin futures market has been quite interesting in terms of buy-side activity. The exchanges that trade derivatives of cryptocurrencies show that the long/short ratio of Dogecoin is quite high. On Binance, the ratio stands at 3.4, and on OKX, it is 3.46, indicating that long positions are highly preferred over short positions. This suggests that traders are betting on a short-term rise in Dogecoin prices.

Additionally, the open interest in Dogecoin options stands at around $8.38 million, with options volume down 95.7%. This may indicate an instance of institutional players positioning themselves for a possible breakout. The drop in open interest might also signal that general market uncertainty is diminishing. In that, traders are gaining confidence regarding the direction the price is expected to take, as the volume soars by 0.55%.

Dogecoin Price Poised for 28% Gains

A quick look at the daily chart reveals that the Dogecoin price is exhibiting a healthy pullback from its recent highs of $0.27, currently trading around $0.22. Meanwhile, the support zone at $0.21, aligning with the 200-day SMA, has been an essential point for DOGE. As described in a chart by BitGu-ru, the break of this level of support may act as a bullish pullback. The DOGE price may rise to 0.240-0.250, which would translate to a significant 28% increase.

The Relative Strength Index (RSI) stands at 51.46, indicating that the asset is neither overbought nor oversold. This suggests that it can even gain more upward movement if the bulls show strength. Moreover, the MACD (Moving Average Convergence Divergence) indicator reveals a bearish crossover. This is evident in the market, as the blue MACD has crossed below the orange signal line.

DOGE Bulls Aim for a Bullish Reversal Towards $0.25

In the short term, Dogecoin price could test support around $0.19, aligning with the 50-day SMA, if this dip continues. A break below that might send it toward $0.17, triggering panic sell-offs and driving it to lower levels.

On the other hand, if the DOGE bulls gain strength, they could push towards the $0.24-$0.25 range. However, the 10% weekly drop is a red flag for caution. For now, it’s a wait-and-see game. Investors may want to keep an eye on volume and the RSI, as a dip below 50 may signal it’s time to brace for further downside.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.