Highlights:

- Digital assets led by Bitcoin recorded $3.3 billion in last week’s inflows data.

- Ethereum also printed impressive statistics with an over $300 million inflow contribution.

- Digital assets have attracted over $10 billion after six weeks of recording only net inflows.

On May 26, crypto asset manager CoinShares published last week’s digital asset inflows report. The publication showed that digital assets drove $3.3 billion in inflows, extending their profitable streak to the sixth straight week. During these six consecutive weeks, digital assets attracted net inflows totaling roughly $10.5 billion.

Last week’s gains spiked digital assets’ year-to-date yield to a new all-time high worth approximately $10.8 billion. Similarly, total assets under management (AUM) also reached peak levels when it touched $18.75 billion at some point last week.

CoinShares attributed the remarkable trend to the US economy and investors’ actions. The asset manager stated, “We believe that growing concerns over the US economy, driven by Moody’s downgrade and the resulting spike in treasury yields, have prompted investors to seek diversification through digital assets.”

Digital asset investment products saw a net inflow of $3.3 billion last week, bringing year-to-date (YTD) inflows to $10.8 billion — a new all-time high. Bitcoin recorded $2.9 billion in inflows, while Ethereum saw $326 million. XRP experienced an outflow of $37.2 million, ending…

— Wu Blockchain (@WuBlockchain) May 26, 2025

Digital Assets’ Contribution to Last Week’s Inflows

As usual, Bitcoin had a dominating impact last week. CoinShares data showed that the flagship crypto contributed $2.9 billion in cash inflows, which accounted for a quarter of the asset’s total inflows in 2024. The asset manager also noted that many Bitcoin investors capitalized on BTC’s transient rally to short BTC, contributing about $12.7 million to the inflows. This figure became the highest-ever inflows recorded from shorting Bitcoin after the massive value recorded in December 2024.

Ethereum also had a stellar performance with about $326 million, marking its fifth consecutive profitable week and highest inflows in fifteen weeks. XRP had a negative flow, erasing $37.2 million and ending an 80-week profit streak.

US Dominates Digital Assets Inflows Trend

The asset manager reported that the US market added $3.2 billion in Inflows. Other countries that had inflows were Germany, Australia, and Hong Kong. These countries recorded inflows valued at about $41.5 million, $10.9 million, and $33.3 million, respectively. Unlike its European counterpart, Switzerland’s crypto market experienced net outflows. “Swiss investors used the recent price strength as an opportunity to lock in gains, resulting in US$16.6m of outflows,” the asset manager noted.

BTC and ETH ETFs Also Record Remarkable Weekly Statistics

Bitcoin and Ethereum ETFs also had one of their best combined weekly statistics. Bitcoin ETFs’ weekly net inflow reflected $2.75 billion, while Ethereum ETFs had about $248 million. BlackRock remains the main Bitcoin and Ethereum Exchange Traded Funds (ETFs) driver with combined inflows worth $52.38 billion. In addition, the net assets valuation from these ETFs has reached $74.86 billion, underscoring the funds’ significant contribution to driving BTC and ETH ETFs’ gains.

From May 19 to May 23 (ET), spot Bitcoin ETFs recorded a net weekly inflow of $2.75 billion, marking the third-highest weekly inflow in history. Spot Ethereum ETFs saw a net weekly inflow of $248 million, with all nine ETFs reporting no outflows.https://t.co/ueXcZjub6m

— Wu Blockchain (@WuBlockchain) May 26, 2025

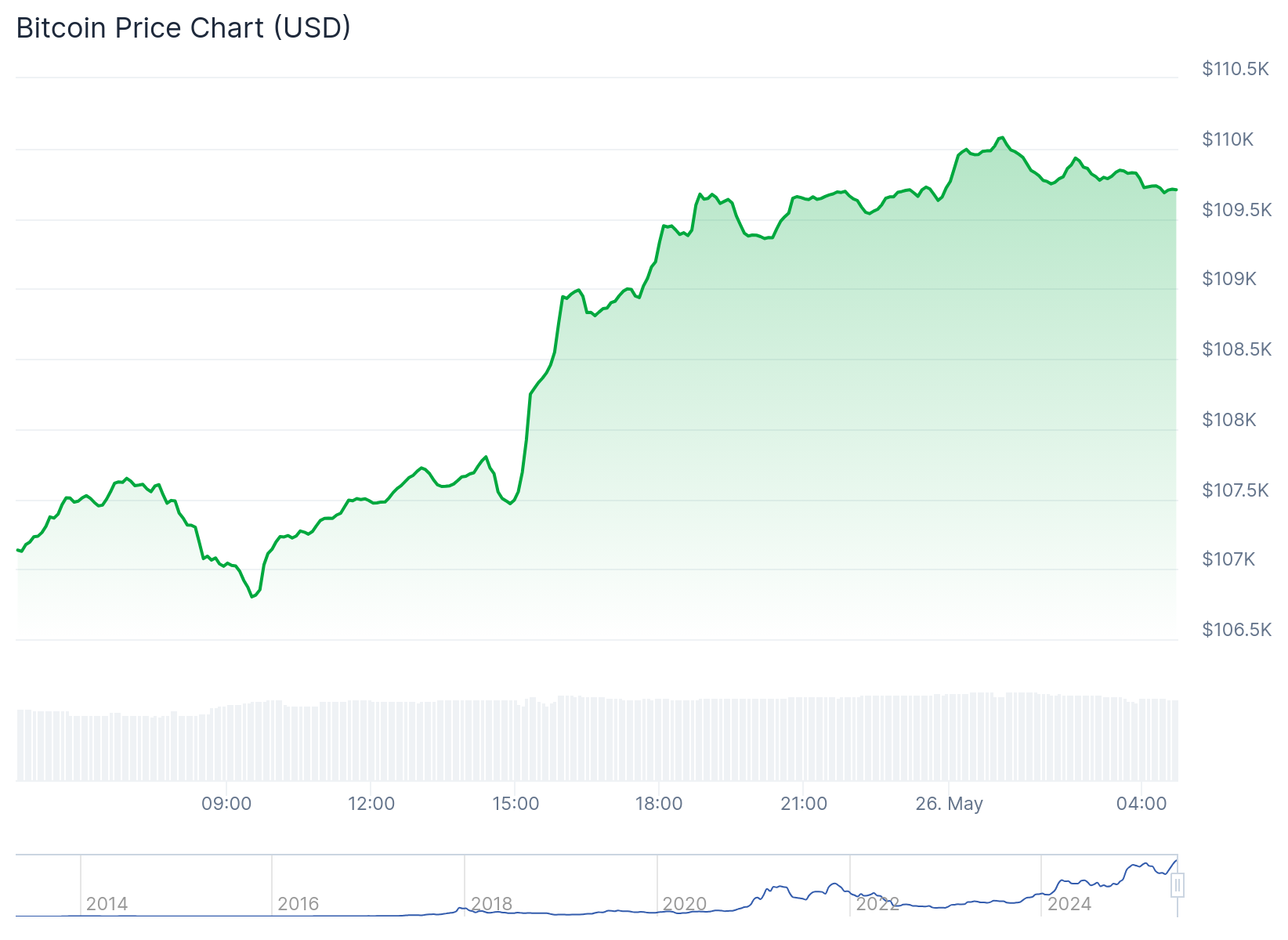

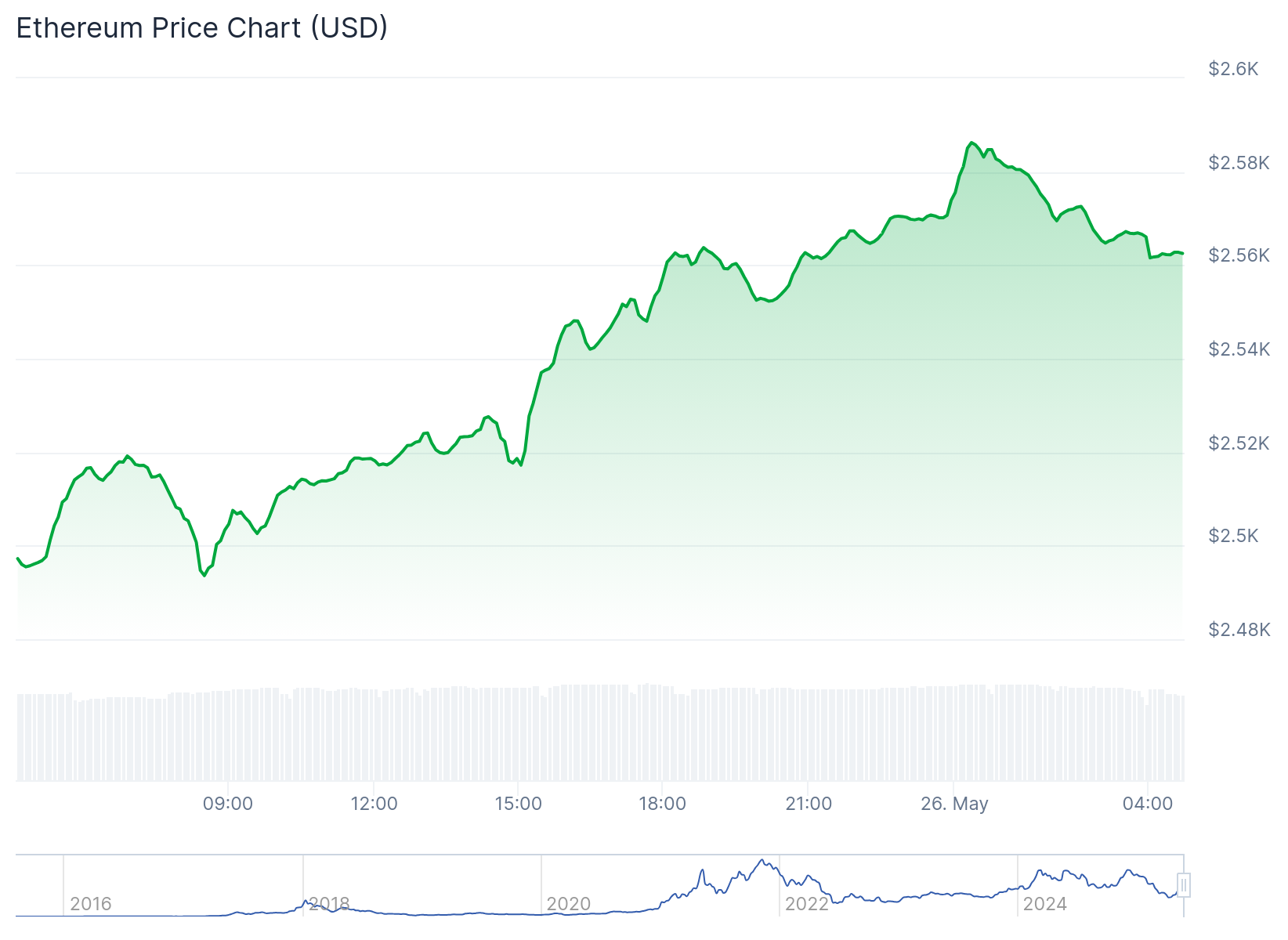

Bitcoin and Ethereum Rebound After Last Week’s Slight Dips

Bitcoin is changing hands at about $109,700, reflecting a 2.4% upswing in the past 24 hours and fluctuating between $106,802 and $110,078. The flagship crypto remains the most valuable cryptocurrency, with a market cap worth $2.17 trillion. BTC’s 24-hour trading volume is also up 3.96%, with a $46.66 billion.

On its part, ETH appreciated 2.8% in the past 24 hours, trading at approximately $2,560. In the past seven days, ETH printed a 6.2% upswing, fluctuating between $2,397.26 and $2,720.76. Meanwhile, Ethereum is the most valuable altcoin, with a $309.36 billion market cap.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.