Highlights:

- Renowned asset manager CoinShares reported that digital asset investment products saw $47.2 billion in net inflows last year.

- The United States led the inflows, followed by Germany, Canada, and Switzerland.

- Ethereum had the best performance with $12.7 billion in net inflows last year, a 138% increase from 2024.

Latest research from CoinShares, a leading crypto asset management firm, has revealed that digital asset investment products concluded 2025 with massive capital inflows from global investors. According to the published work, last year’s net inflows were roughly $47.2 billion, $1.5 billion below the all-time record of $48.7 billion set in 2024. Digital assets were able to attract these massive capital inflows despite the market declines in the last quarter of 2025.

This year also started on a positive note as investment products attracted $671 million on January 2 alone. Despite recording a few outflows earlier in the week, net inflows still stood at $582 million. As expected, the United States dominated the inflows in 2025, accounting for $47.2 billion, a 12% decline from the value recorded in 2024.

Aside from the US, a few other countries recorded huge inflows from digital assets. Germany accounted for $2.5 billion in inflows last year, a big turnaround from the $43 million outflows in 2024. Similarly, Canada saw $1.1 billion in inflows after recording $603 million in outflows in 2024. Switzerland saw steady growth, with $775 million in inflows. “Appetite in Switzerland rose modestly with inflows of US$775m in 2025, up 11.5% year-on-year,” the asset management firm stated.

📊 NEW: Global digital asset investment products closed 2025 with $47.2B in inflows, just below 2024’s $48.7B record. pic.twitter.com/di2NltiZLS

— CW (@CW8900) January 5, 2026

Individual Digital Asset Product Performances in 2025

Compared to other assets, Bitcoin (BTC) had a weaker year, with inflows dropping 35% to $26.9 billion in 2025. Declining BTC prices forced many investors to consider other investment products. “A combination of price falls led to inflows of US$105m into short-Bitcoin products over 2025, although they remain niche with total AuM of US$139m,” CoinShares stated.

Ethereum (ETH) was one of the best performers last year, with net inflows of approximately $12.7 billion, marking a 138% increase from the value recorded in 2024. This highlights growing investors’ interest in Ethereum-based products. XRP attracted $3.7 billion last year, representing a 500% increase from 2024. Solana (SOL) also experienced significant growth, attracting $3.6 billion in net inflows, marking a 1,000% increase over the year. Not all altcoins recorded massive inflows. Smaller altcoins experienced weaker demand, which negatively impacted their net inflows.

The asset management firm explained:

“The remaining altcoins saw a decline in sentiment with a fall in inflows YoY of 30% (US$318m).”

Global digital asset inflows reached US$47.2bn in 2025, just shy of the 2024 record. Bitcoin saw a 35% decline in flows, with inflows of US$26.9bn in 2025. Ethereum saw the most substantive gains, with inflows of US$12.7bn, up 138% YoY. XRP and Solana saw a rise of 500%…

— Wu Blockchain (@WuBlockchain) January 5, 2026

Bitcoin and Ethereum Reclaim Key Price Levels

At the time of writing, the crypto market is 1.1% up in the past 24 hours with a market cap of $3.248 trillion and a trading volume of approximately $101.645 billion. Bitcoin’s dominance sits at 57.2%, while Ethereum’s dominance is at 11.8%. Like the broader crypto market, BTC is priced at $93,056 following a slight 1.5% upswing. It has a market cap of $1.86 trillion and a trading volume of $37.29 billion. Volatility remains low at 1.74% with a bearish sentiment.

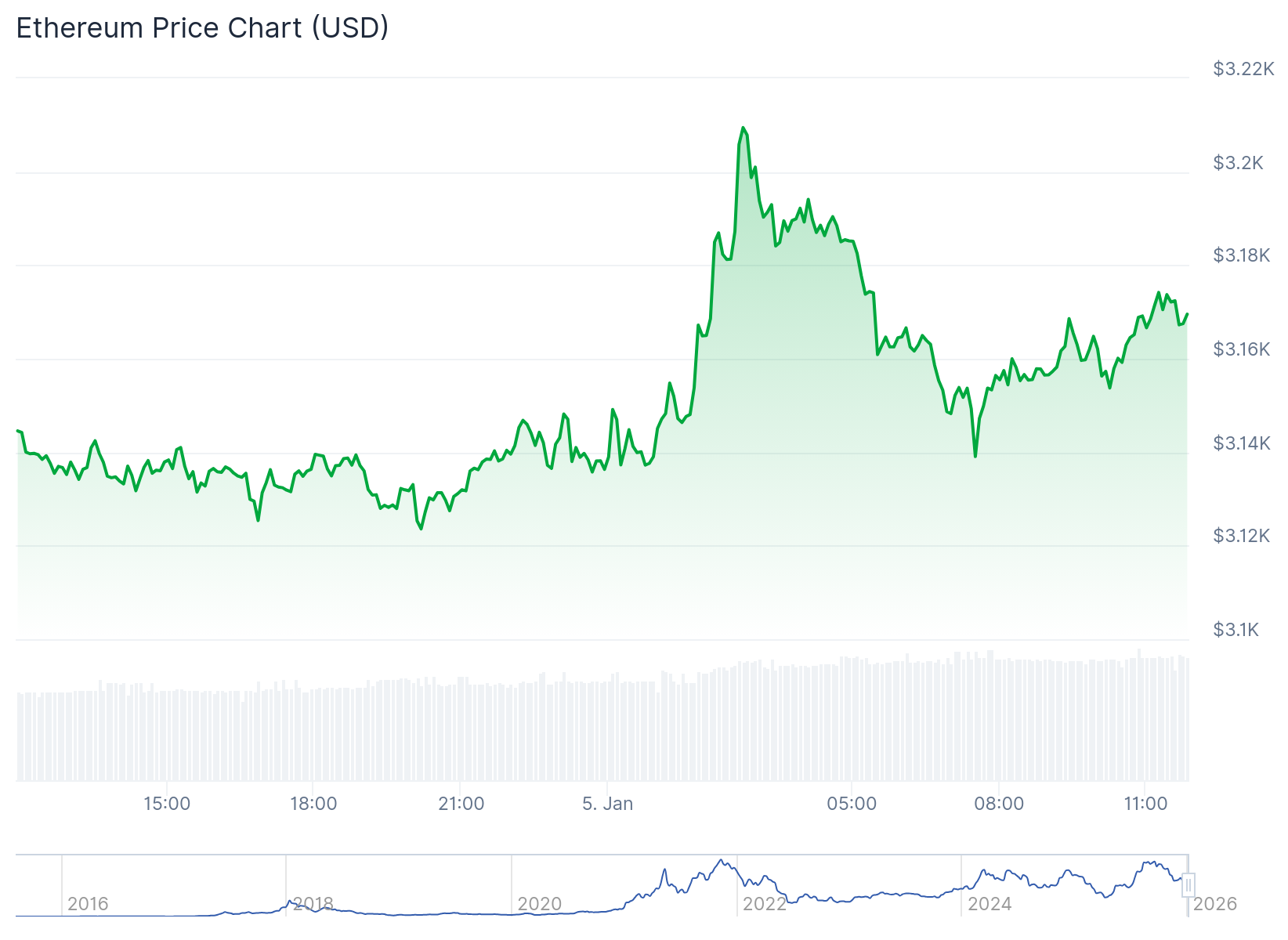

Similarly, Ethereum is changing hands at $3,172, following a slight 0.8% spike in the past 24 hours, with a market cap of $382.65 billion and a trading volume of $17.1 billion. ETH’s 7-day-to-date and month-to-date price change variables show spikes of about 5.3% and 4.6%, respectively. However, the asset dropped 12.4% year-to-date. Sentiment remains bearish, while the “Fear & Greed Index” points towards “Fear” at 26.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.