Highlights:

- Delaware Life and BlackRock have teamed up to expand Bitcoin exposure through a new index product.

- The new Index is already listed on three of Delaware Life’s products as available options for investors.

- The product targets investors who prioritize investment protection as well as growth opportunities.

Delaware Life Insurance Company, part of Group 1001, has added a new index that includes Bitcoin to its fixed index annuity products. The company announced the strategic move in a press release on January 20, as it became the first insurance firm to offer a crypto-linked index inside an FIA.

Termed the BlackRock US Equity Bitcoin Balanced Risk 12% Index, it allows investors to gain exposure to Bitcoin while protecting the funds they put into the annuity. With this new option, the main amount invested by users remains safe, even if markets suffer declines. Moreover, the Index is already available as an option on three Delaware Life products, including Momentum Growth, Momentum Growth Plus, and DualTrack Income.

Delaware Life Insurance Company, a Group 1001 insurance subsidiary, announced the addition of the BlackRock U.S. Equity Bitcoin Balanced Risk 12% Index to its fixed indexed annuity (FIA) product lineup, making it the first U.S. insurer to introduce bitcoin exposure within this…

— Wu Blockchain (@WuBlockchain) January 20, 2026

Delaware Life’s New Move Targets Retired Employees

The investment firm’s latest move is aimed at offering investors more options as their investment habits evolve with age. For context, FIAs are often used for long-term planning, especially for retirement. This is because of their strong ability to balance growth and safety. By integrating Bitcoin in a controlled manner, Delaware Life plans to meet rising demand for crypto exposure without extra risk.

Colin Lake, President and Chief Executive Officer (CEO) of Delaware Life Marketing, expressed satisfaction with the partnership between his company and BlackRock. He noted that Delaware Life remains committed to meeting the demands of financial professionals and their clients. “Our fixed index annuities deliver what today’s investors want and need: opportunity for growth with protection,” the CEO added.

BlackRock and Delaware Life just launched a “Bitcoin retirement annuity”—yes, your uncle's pension is getting crypto exposure, but with volatility caps and insurance training wheels. Is Bitcoin finally too safe for degens? Or is this just TradFi cosplaying as innovators? Either… pic.twitter.com/DVhVJ0fHf7

— Fama Crypto (@Famacrypt) January 21, 2026

How the New Index Protects Investors

The index mixes US stocks with Bitcoin to spread risk. It also aims to keep price swings under control, specifically around a 12% volatility level. Whenever volatility sets in, portions of the index can move into cash to cushion sudden price drops.

Instead of buying Bitcoin directly, the index gets its crypto exposure through the iShares Bitcoin Trust ETF (IBIT). With this, investors gain exposure to the flagship crypto without managing wallets, keys, or cryptocurrency exchanges. Robert Mitchnick, BlackRock’s Global Head of Digital Assets, noted that IBIT demand has surged significantly and that the new index offers insurance customers a new approach to include Bitcoin as part of a wider annuity strategy.

Mitchnick stated:

“The BlackRock US Equity Bitcoin Balanced Risk 12% Index offers a measured approach, allowing policyholders to participate in digital assets while maintaining the downside protection they expect from annuity products.”

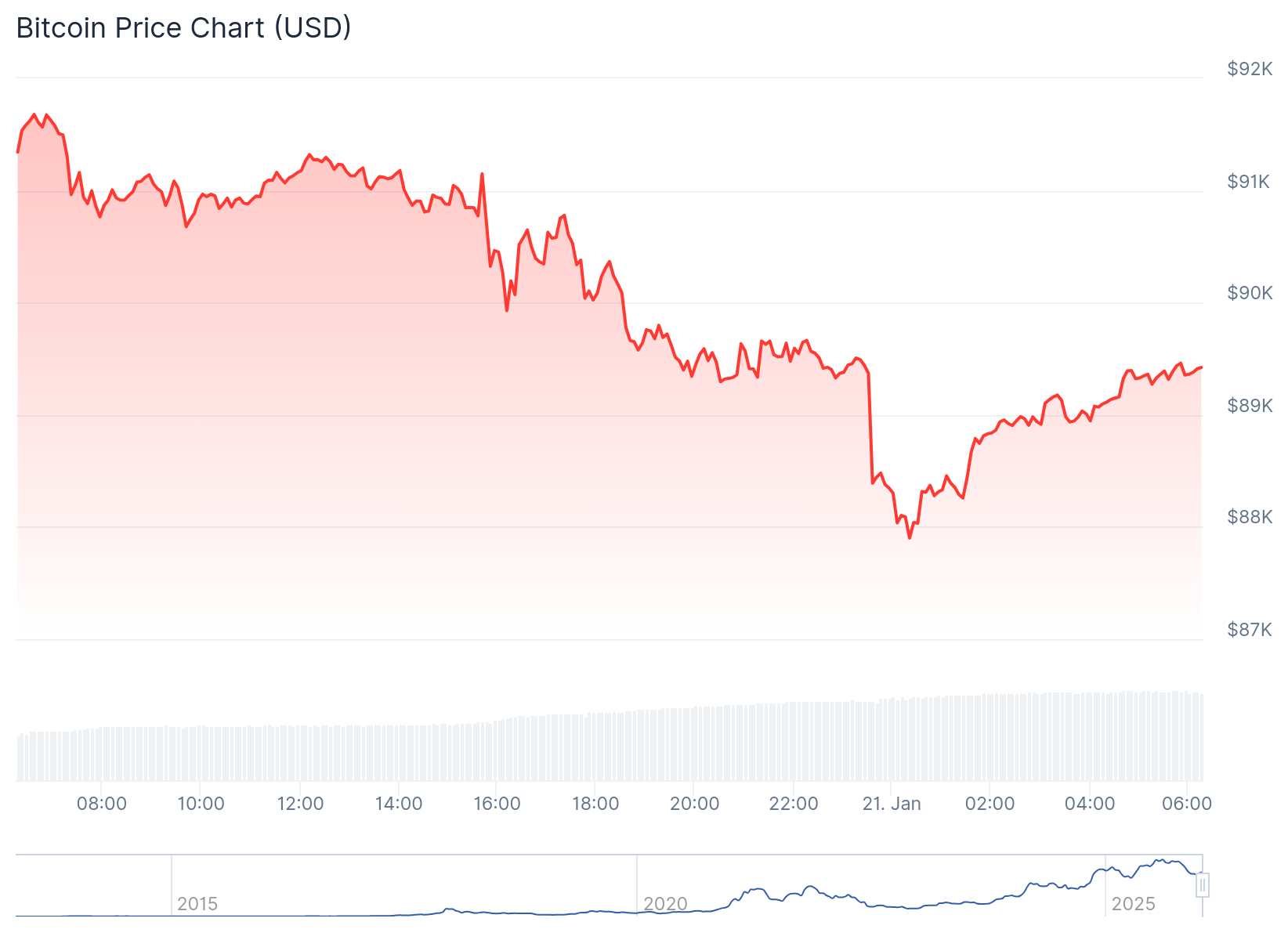

BTC’s Price Slips Below $90,000 as Delaware Life and BlackRock Partner

At the time of writing, the cryptocurrency market is 2.7% down in the past 24 hours, with a market cap of $3.12 trillion and a trading volume of $159.25 billion. Within the same timeframe, Bitcoin dropped 2.1%, trading at $89,464, with a market capitalization of $1.79 trillion and a trading volume of $61.9 billion. The asset is also down 6% 7-day-to-date, 3.6% 14-day-to-date, and 13.1% year to date.

Meanwhile, IBIT is currently the most traded Bitcoin ETF. SosoValue data showed that the fund recorded outflows worth $56.87 million, as the entire Bitcoin ETFs succumbed to $483.38 million in net outflows on January 20. Nevertheless, IBIT still has $63.38 billion in cumulative inflows and $70.18 billion in net asset valuation.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.