Highlights:

- DeFi Development has added 196K SOL, bringing its holdings above two million.

- The company reported that it now owns 2,027,817 SOL worth $427 million.

- DeFi Development now owns the largest SOL treasury.

On September 4, DeFi Development, a United States Nasdaq-listed firm and the first company to launch a Solana (SOL) treasury, announced that it has expanded its SOL holdings. According to the company’s press release, DeFi Development purchased 196,141 SOL at an average cost of $202.76, totalling roughly $39.77 million.

The acquisition increased the company’s SOL holdings to 2,027,817 SOL, worth $427 million, positioning it as the firm with the highest SOL treasury. DeFi Development noted that its present total SOL holdings represent an 11% increase from its previous purchase.

The company stated:

“The newly acquired SOL will be held long-term and staked to a variety of validators, including DeFi Dev Corp.’s own Solana validators to generate native yield.”

Aside from its latest purchase, DeFi Development has completed three other SOL acquisitions in the past thirty days. These include purchasing 4,523 SOL on August 12, 110,000 SOL on August 15, and 407,247 SOL on August 28, underscoring the company’s commitment to establishing a robust Solana treasury.

🚀BULLISH:

DEFI DEVELOPMENT CORP. (NASDAQ: DFDV) ACQUIRED 196,141 $SOL AT AN AVERAGE PRICE OF $202.76, BRINGING TOTAL HOLDINGS TO 2,027,817 #SOLANA (ABOUT $427M). pic.twitter.com/BgGRes3kqk

— Altcoin Alpha (@AltcoinAlphaOnX) September 5, 2025

DeFi Development Shares’ Information

DeFi Development’s press release also captured significant share statistics. As of September 4, 2025, the total number of issued and outstanding shares was 25,573,702. DeFi Development noted that the reported share count does not include pre-paid warrants from recent financing, which would push it to around 31.4 million.

The company stated:

“SPS will fully reflect this in future updates, alongside the deployment of the remaining cash proceeds from the equity financing into additional SOL purchases.”

Additionally, DeFi Development stated that it does not expect SPS to drop below the 0.0675 pre-financing level, even with full warrant impacts. Hence, highlighting SPS’s continuous growth.

DeFi Development Leads with the Highest SOL Treasury

CoinGecko data shows that six public companies, including four US firms, two Canadian companies, and one firm in Singapore, have adopted Solana treasuries. Together, they hold over four million SOL tokens, valued at over $900 million, which represents 0.82% of Solana’s total circulating supply.

DeFi Development now ranks as the company with the highest SOL holdings with 2,027,817 SOL, displacing Upexi, another US firm with 2,000,518 SOL. Canadian company, Sol Strategies, ranked third with 370,420 SOL. Other firms that made up CoinGecko’s list were Canada’s Torrent Capital, Exodus Movement in the US, and Singapore’s Lion Group Holding. These companies have accumulated 40,039 SOL, 34,578 SOL, and 6,629 SOL, respectively.

DeFi Development Corp. (Nasdaq: DFDV) announced it acquired 196,141 SOL at an average price of $202.76, bringing total holdings to 2,027,817 SOL (about $427M). With 25,573,702 shares outstanding, this equals 0.0793 SOL (≈$16.70) per share.https://t.co/YomxnxE9l5

— Wu Blockchain (@WuBlockchain) September 5, 2025

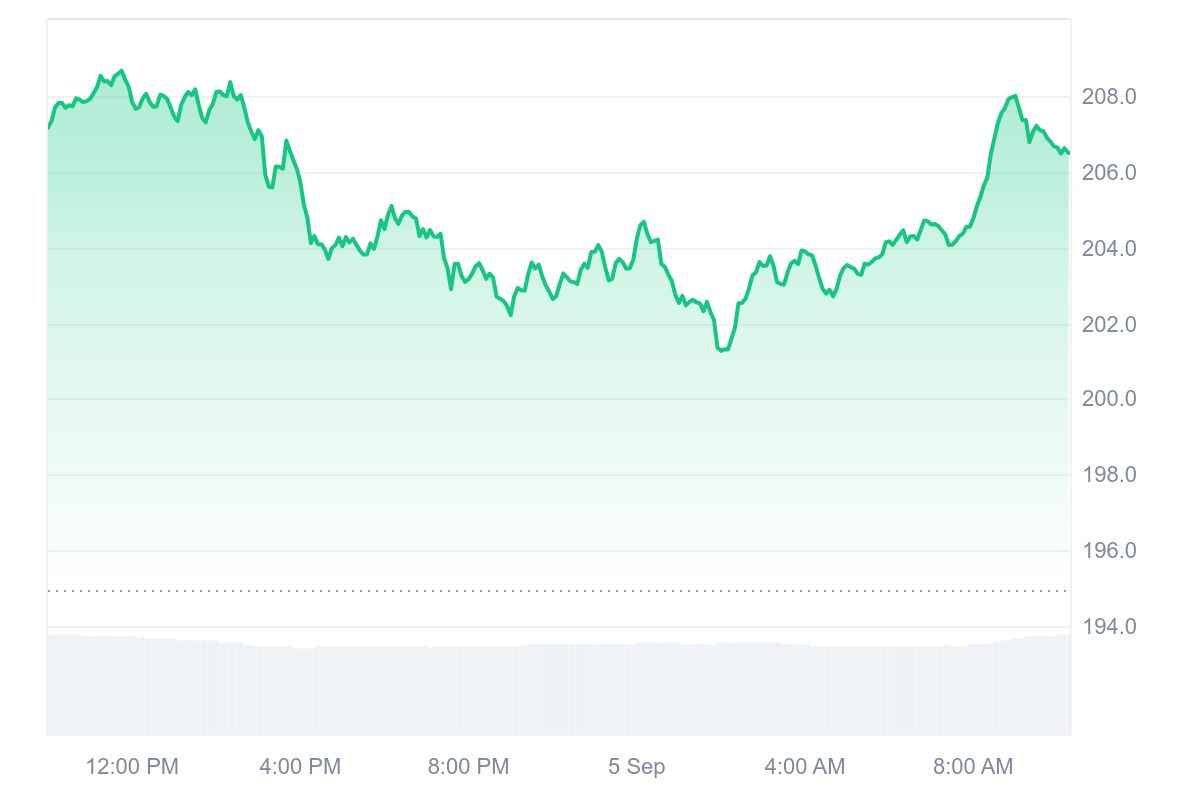

Price Reaction as DeFi Development Bags 196K Solana

At the time of press, SOL is up 0.1% in the past 24 hours, trading at $207.31. It is fluctuating between $201.33 and $208.67. Meanwhile, in the past seven days, Solana dropped 3.5% with price extremes oscillating between $194.83 and $214.03. This price range highlights Solana’s struggles in recent times. Solana’s current price is 29.1% below its all-time high (ATH) of $293.31 attained in January this year.

On Coincodex, Solana’s volume-to-market cap ratio was 0.1487 with a high supply inflation of 15.95%. Dominance was 2.88% while volatility was very high at 6.47%. For the risk assessment, SOL’s price has increased by 55% in the past year. The token has outperformed 85% of the top 100 most valuable cryptocurrencies, excluding Bitcoin (BTC) and Ethereum (ETH). It is trading above its 200-day Simple Moving Average (SMA) with a positive performance compared to the token sale price. Additionally, it has high liquidity on its market cap with a yearly 15.95% inflation rate.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.