Highlights:

- Ki Young Ju predicts Bitcoin’s bull cycle is over, expecting a bear market for 6-12 months.

- On-chain metrics like MVRV and SOPR indicate Bitcoin may stay in a downtrend.

- Other Analysts predict Bitcoin could fall drastically, with targets as low as $10,000.

Ki Young Ju, the founder and CEO of CryptoQuant, shared in a post on March 17 that Bitcoin’s bull cycle has concluded. He warned that the market could experience a period of stagnation or decline for the next 6 to 12 months.

Every on-chain metric signals a bear market. With fresh liquidity drying up, new whales are selling Bitcoin at lower prices.@cryptoquant_com users who subscribed to my alerts received this signal a few days ago. I assume they've already adjusted their positions, so I'm posting… pic.twitter.com/0EIrpTCPVi

— Ki Young Ju (@ki_young_ju) March 17, 2025

Ju pointed to on-chain data showing a trend shift. According to him, all on-chain metrics are indicating a bear market, with liquidity dropping and new whales selling Bitcoin at lower prices.

He explained that certain on-chain indicators, like Market Value to Realized Value (MVRV), Spent Output Profit Ratio (SOPR), and Net Unrealized Profit/Loss (NUPL), help analyze market trends, investor profits, and market sentiment. These indicators are now showing important changes when looking at their 365-day moving average.

The data indicates that Bitcoin’s one-year moving average is now in a downward phase, a pattern typically seen during prolonged bear markets. If historical trends continue, BTC may stay down for months.

Ju’s current claim contrasts sharply with his March 4 post, where he mentioned that the Bitcoin bull cycle would remain slow but “is still intact,” citing neutral indicators. “Fundamentals remain strong, with more mining rigs coming online,” he said.

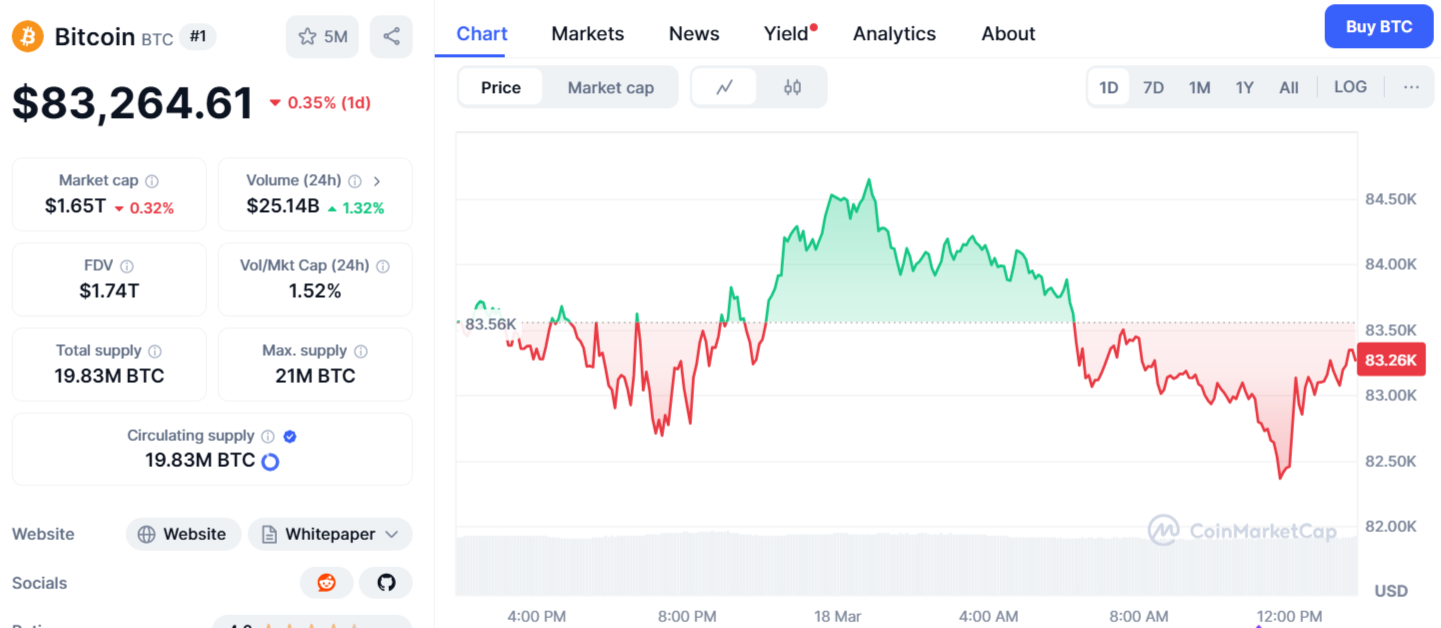

Bitcoin’s price dropped by 0.35% in the last 24 hours. After briefly surpassing $84,500 on Monday, it settled around $83,000, showing continued market uncertainty. Over the past week, Bitcoin saw a 3% increase, though it has dropped 14.3% in the last month.

Bitcoin Faces Potential Decline, Warn Analysts

Economist Peter Schiff recently warned that Bitcoin (BTC) could lose value if the market keeps falling. He believes Bitcoin is linked to the NASDAQ, making it vulnerable. The NASDAQ has dropped 12% recently, and Bitcoin tends to follow its movements. Schiff says a 12% drop in the NASDAQ could lead to a 24% drop in Bitcoin, possibly bringing it to $65,000. If the NASDAQ falls 20%, BTC could drop further to $55,000.

Schiff pointed out that the NASDAQ has seen bigger declines in past bear markets. Historically, bear markets lead to a 55% drop in Bitcoin. If the NASDAQ falls 40%, Schiff predicts Bitcoin could drop to $20,000, triggering a deeper collapse.

The NASDAQ is down 12%. If this correction turns out to be a bear market, and the correlation where a 12% decline in the NASDAQ equates to a 24% decline in Bitcoin holds, when the NASDAQ is down 20%, Bitcoin will be about $65K.

But if the NASDAQ goes into a bear market, history…

— Peter Schiff (@PeterSchiff) March 16, 2025

Last week, Bloomberg analyst Mike McGlone also warned that BTC could fall to $10,000. He believes the market is already in a bearish trend, with risk markets overheating while gold rises. Gold has gained 15% this year, while Bitcoin has dropped by a similar amount.

Moreover, Bitcoin miners have been actively cashing out, with over $27 million in profits, according to analyst Ali Martinez. CryptoQuant data shows a notable rise in early miners converting their profits into USD this month. This trend signals increased selling pressure from miners, which could contribute to Bitcoin’s market instability.

#Bitcoin $BTC miners cashed in over $27 million in profits! pic.twitter.com/TY3pSZIic7

— Ali (@ali_charts) March 17, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.