The cryptocurrency market experienced a significant downturn, with the total market capitalization falling by over 4.30% to approximately $2.50 trillion as of June 18. This sharp drop has raised concerns among investors about the underlying factors driving the market’s instability.

Factors Contributing to Market Instability

The recent selloff in the cryptocurrency market was primarily triggered by Bitcoin’s loss of upward momentum, which was influenced by a combination of macroeconomic conditions, miner capitulation, and Bitcoin ETF outflows. A slow pace in new stablecoin issuance has also added to the bearish sentiment.

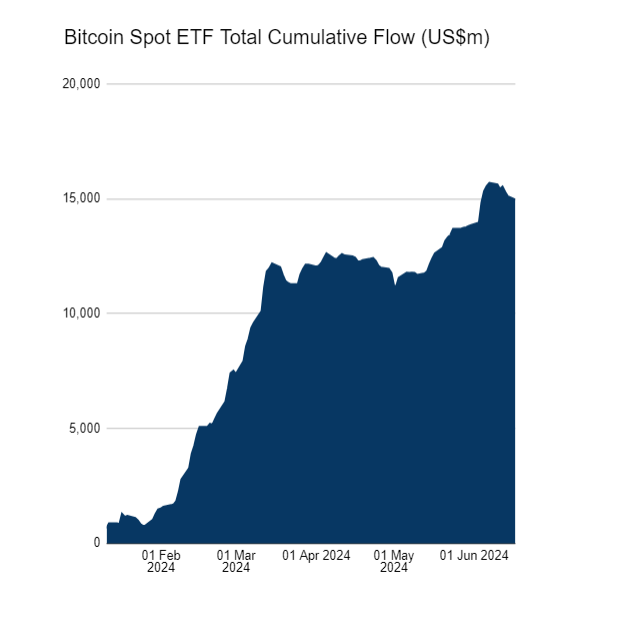

U.S.-based Bitcoin ETFs saw their holdings decrease, dropping by 3.65% to about $15.10 billion in the week ending June 14, and saw continued outflows, with an additional $145.90 million withdrawn on June 17, reducing the total ETF reserves to $14.956 billion.

According to data from Coinglass, around $500 million worth of popular cryptocurrencies were liquidated in the last 24 hours, affecting over 173,000 traders. Ethereum led these liquidations with the most significant single order on Binance, valued at $6.44 million.

The stablecoin market is also influencing the downturn in cryptocurrencies. With limited new issuances of major stablecoins like USDT and USDC, less fresh capital flows into the market. This liquidity shortage heightens price volatility, adding to the broader market’s decline.

Economic Indicators and Market Response

Despite recent cooler U.S. CPI and PPI inflation data, Federal Reserve officials remain cautious, adhering to the FOMC’s decision to limit rate cuts this year. Moreover, the hawkish stance from Bank of Japan’s Governor Kazuo Ueda regarding a potential rate hike in July has contributed to the uncertainty.

Bank of Japan Governor Kazuo Ueda reiterated that an interest rate hike at next month’s policy board meeting is possible https://t.co/ewLoAsjETs

— Bloomberg Markets (@markets) June 18, 2024

This environment has bolstered the U.S. Dollar Index (DXY), which climbed to 105.4, further influencing market trends. U.S. Treasury yields also increased to 4.298%, shifting investor preferences toward more stable assets amidst market volatility.

Market Outlook and Investor Sentiment

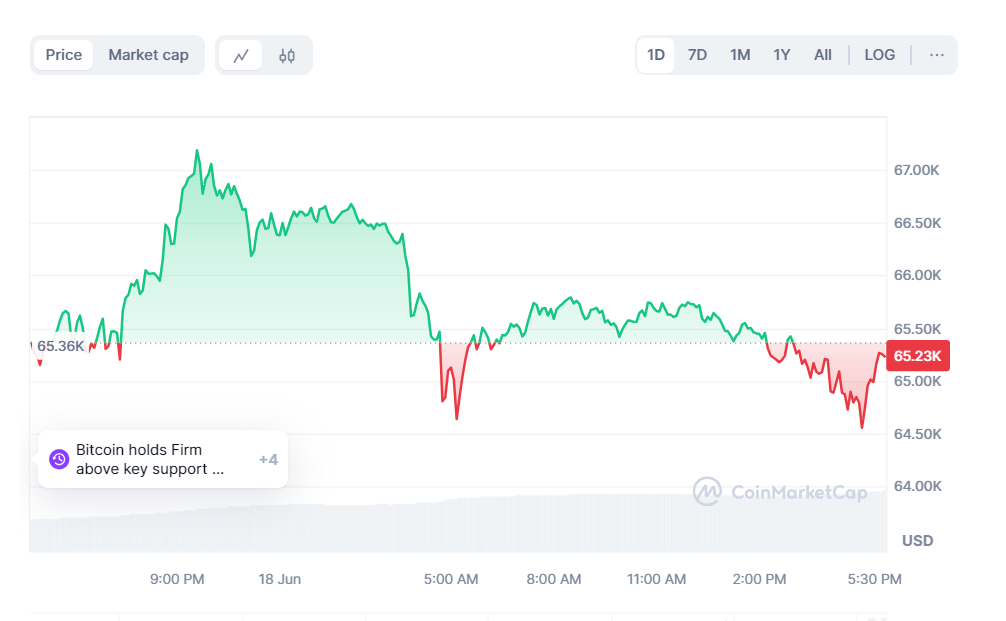

The downturn in the cryptocurrency market has worsened due to more long liquidations than short ones, leading to further downward pressure on prices. According to CoinMarketCap data, Bitcoin’s price has dropped to $64,980, marking a 1% decrease in the last 24 hours and 3% over the past week. This is despite a surge in trading volume that suggests increased trader activity

Spot Bitcoin ETFs have experienced a significant impact, with withdrawals occurring for three straight days. This resulted in a net outflow of $146 million on Monday. This trend reflects a changing investor sentiment, possibly steering towards a more cautious approach in the near term.

Navigating the Evolving Cryptocurrency Market

As the cryptocurrency market undergoes rapid changes, it becomes increasingly important for investors and traders to stay updated with the latest trends and developments. Adapting investment strategies in response to these dynamics is crucial for navigating the complexities of this volatile market. Staying updated with market trends, regulatory changes, and new technology helps investors make smart decisions and improve their investment strategies.

The ever-evolving nature of the cryptocurrency landscape demands a proactive approach from investors and traders. By staying informed and adjusting strategies accordingly, they can effectively manage risks and capitalize on opportunities presented by the market’s fluctuations and innovations.

Read More

- Billy Price Prediction As Billy Defies Market Trend, Surges 95% Amid Rising Investor Interest

- 20 Top Cryptocurrencies to Watch for 2024 – Detailed Reviews

- Next Cryptocurrency to Explode in 2024

Disclaimer: Cryptocurrency is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.