Highlights:

- Crypto whale invests over $100 million in Bitcoin and Ethereum.

- The anonymous investor spent $54 million on 30,000 ETH and $56.7 million on 600 BTC.

- Ethereum and Bitcoin record slight prices amid the crypto market resurgence.

On-chain crypto transactions monitor Lookonchain reported a massive accumulation of Bitcoin (BTC) and Ethereum (ETH), sparking widespread reactions among crypto enthusiasts. According to the report, the anonymous whale invested $110.7 million in 30,000 ETH and 600 BTC.

It seems that a whale bought 30K $ETH($54M) and 600 $BTC($56.7M) through OTC today.

This whale transferred 54.9M $USDC and 56.94M $USDC to the Wintermute OTC wallet today, then received 30K $ETH($54M) and 600 $BTC($56.7M) from Wintermute.https://t.co/D9cJIXZcbS… pic.twitter.com/NUZUE0gjM0

— Lookonchain (@lookonchain) April 27, 2025

Unlike most acquisitions, which occur on exchanges, this whale chose over-the-counter trading (ITC) for the massive purchase.

Lookonchain stated:

“This whale transferred 54.9 million USDC and 56.9 million USDC to the Wintermute OTC wallet today, then received 30K ETH ($54 million) and 600 BTC ($56.7 million) from Wintermute.”

Previous Accumulations and Possible Implications

Arkham Intelligence data showed that beyond the recent acquisitions, this whale has been accumulating Bitcoin in the past. Two months ago, the large investor bought 1,000 BTC via four transactions involving 250 BTC each. The four acquisitions cost the whale $22.46 million, $21.87 million, $21.82 million, and $22.69 million, summing up to about $88.84 million. In March, the same whale bought 500 BTC, valued at roughly $41.18 million.

In summary, this unknown investor spent about $186.72 million to acquire 2,100 BTC within two months. The acquisitions amid Bitcoin and Ethereum price volatility concerns signify strong faith in crypto potential as a sustainable store of value. In addition, it could inspire other traders, including retail investors, to accumulate these tokens.

Bitcoin and Ethereum Record Slight Drops

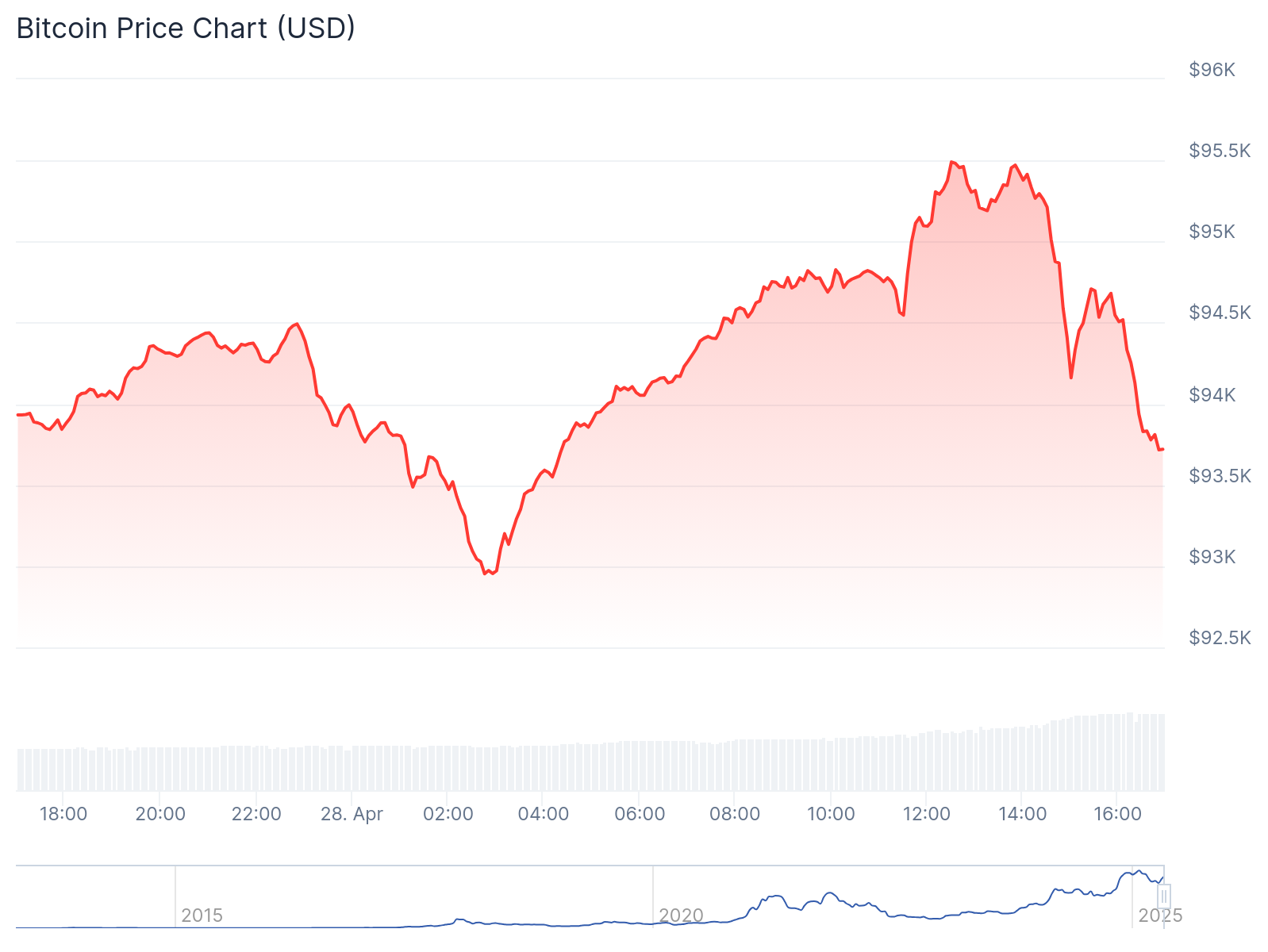

At the time of press, Bitcoin is changing hands at approximately $93,700 reflecting a 0.2% drop in the past 24 hours. In the past week, BTC surged 9.7%, fluctuating between $86,872.88 and $95,501.31. Other extended period data showed that Bitcoin spiked 12.1% 14-day-to-date, 15.8% 30-day-to-date, and 50% year-to-date.

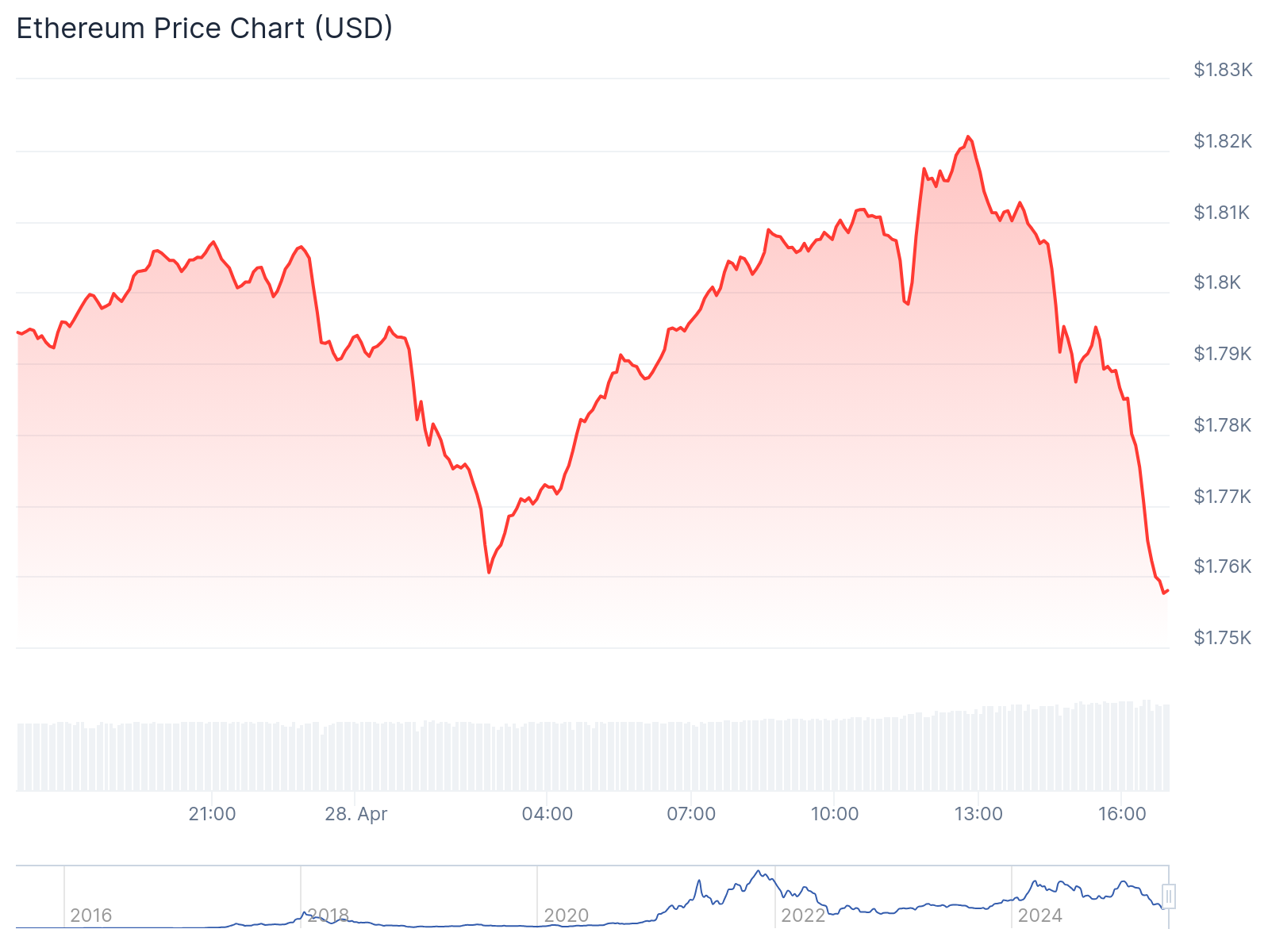

On its part, Ethereum depreciated 0.2% in the past 24 hours, trading at approximately $1,750. Within the same timeframe, the token oscillated between $1,760 and $1,821.94. The slight price appreciation increased ETH’s market to about $218.42 billion.

Next Bitcoin Top Could Reach $155,400

In a recent tweet, Ali Martinez shared a chart showing massive Bitcoin accumulations. The market chartist noted that the Bitcoin Accumulation Trend Score is nearing one, implying string holder conviction. In another tweet, Martinez forecasted that Bitcoin could hit $155,400. The expert based his prediction on the Pi Cycle Top Indicator. He added that the forecast will only hold if Bitcoin remains above $91,400.

The #Bitcoin $BTC Accumulation Trend Score is nearing 1, signaling intense accumulation and strong holder conviction. pic.twitter.com/Y8LaGiroXz

— Ali (@ali_charts) April 27, 2025

Bitcoin and Ethereum Record Soaring Adoption Among Institutional and ETF Investors

Last week, Bitcoin ETFs recorded only net inflows to conclude the week in profits. The funds attracted net inflows of about $3.06 billion, marking their second-highest weekly inflow in history. On November 22, Bitcoin ETFs saw weekly gains of about $3.38 billion, marking their highest-ever weekly profits to date.

During the last trading week (April 21 to April 25, ET), spot Bitcoin ETFs recorded a net inflow of $3.06 billion, marking the second-highest weekly inflow in history. Spot Ethereum ETFs ended an eight-week streak of net outflows, posting a net inflow of $157 million last week.…

— Wu Blockchain (@WuBlockchain) April 28, 2025

Ethereum ETFs also recorded weekly gains valued at approximately $157.09 million, marking its first weekly profit after eight consecutive losses. Unlike Bitcoin, Ethereum ETFs saw gains on only three occasions and recorded net outflows on two outings.

Meanwhile, Michael Saylor’s Strategy invested $1.42 billion in 15,355 BTC. This purchase increased MicroStrategy’s BTC holdings to about 553,555 BTC, valued at approximately $37.90 billion. While Bitcoin soars, the Swiss National Bank (SNB) recently rejected the proposal to include BTC in its foreign reserves. Citing reasons for the decision, Martin Schlegel noted that the nation needs assets that are more stable

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.