The crypto market faced sharp swings last week as Bitcoin dropped below $75K and regulatory developments intensified. From Trump’s Fed pick stirring Bitcoin optimism to Tether’s rising gold dominance and major shifts in SEC policy, the week delivered high-stakes headlines shaping the future of digital assets. In this article, we will discuss the crypto weekly market wrap of February 2nd in deeper detail.

Trump’s Fed Choice Spurs Bitcoin Buzz

President Donald Trump confirmed that he would nominate Kevin Warsh as his next Fed chair. Warsh is a former Federal Reserve governor and a G20 representative. His opinions have been inclined towards nontraditional monetary policy tools.

Crypto circles noted the openness of Warsh to alternatives such as Bitcoin. Although the Fed does not directly control crypto, the chair plays a significant role in financial policy. A shift in tone may affect the perception of markets regarding inflation and hedges of assets. Bitcoin enthusiasts view this as a potentially positive macro environment.

SEC Tightens View on Tokenized Assets

The SEC clarified the regulatory position regarding tokenized securities. It currently identifies two different types: issuer-led and third-party-led tokens. Traditional security rules apply to the issuer-led tokens, which are issued by the originating entity despite the use of the blockchain.

🚨NEW: @SECGov staff just put out guidance on tokenized securities, laying out how federal securities laws apply and distinguishing between issuer-led and third-party tokenization models. pic.twitter.com/KWZTtwgmoe

— Eleanor Terrett (@EleanorTerrett) January 28, 2026

Third-party tokens are, however, categorized under custodial or synthetic. These are riskier and can be swapped as security-based swaps. This categorization places them under stricter supervision. The main concerns in this model are counterparty risks and bankruptcy exposure.

CLARITY Act Moves Forward in Congress

The CLARITY Act was passed by a close margin of 12-11 in the Senate Agriculture Committee. This act seeks to shed more light on crypto regulation by enabling the CFTC in the digital commodity spot markets. Meanwhile, the SEC still has control over investment contracts. The fate of the bill is, however, uncertain. A swipe-fee amendment was removed by Senator Roger Marshall to prevent the bill from collapsing. This move further revealed the weakness of crypto laws in terms of financial policy struggles.

Binance Converts SAFU to Bitcoin Reserves

Binance announced plans to swap its $1 billion SAFU fund from stablecoins into Bitcoin. The move follows the pressure of users demanding more transparent support in the crypto sector. Conversion will take place within 30 days. Binance also guarantees the reimbursement of reserves in case the value of Bitcoin drops below $800 million. SAFU serves as an important reserve buffer in case of emergencies. The company will now review its composition more actively in relation to price shifts.

Tether Tops Private Gold Holdings

Tether is the largest non-state or banking entity of gold globally. The company holds a total reserve of over 140 tons, worth approximately $24 billion. These reserves back Tether Gold (XAUT) and serve as a surplus for USDT.

According to Bloomberg, Tether has become the largest gold reserve holder outside of sovereign nations and banks, currently holding over 140 tons of gold valued at approximately $24 billion. Its reserve size exceeds the official reserves of many countries, including Australia and…

— Wu Blockchain (@WuBlockchain) January 28, 2026

The chief executive officer, Paolo Ardoino, disclosed that the majority of the gold is secured in Swiss vaults. The approach adopted by Tether indicates a preference towards tangible assets. This further provides additional collateral to its stablecoins amid increased market scrutiny.

SEC Backs Crypto in Retirement Plans

Paul Atkins, the SEC Chair, expressed his support for crypto in retirement plans such as 401(k)s. He emphasized the necessity of clearly defined rules, alongside CFTC’s Mike Selig. They plan to establish a secure and transparent atmosphere for digital assets.

They also highlighted that crypto is a legitimate asset class, provided that it is protected with the necessary measures. Broader access to alternative assets would be beneficial to investors. Well-established rules are likely to attract more mainstream capital.

Tether Launches Compliant USA₮ Stablecoin

Tether introduced a new U.S.-compliant stablecoin, USA₮. The stablecoin aligns with the GENIUS Act and is issued by Anchorage Digital Bank. Cantor Fitzgerald is in charge of custody and is the preferred choice of prime broker. This made-in-America stablecoin is targeted at an institutional-grade infrastructure. Some of the early listings include Kraken, OKX, Bybit, and Crypto.com. The product indicates a move towards regulation-friendly digital dollars.

Enterprises Drive Crypto Payment Adoption

According to a recent PayPal survey, large enterprises are at the forefront of crypto payment adoption. Approximately 40% of merchants already back it. Adoption exceeds 50% among companies with annual incomes above $500 million.

A new PayPal survey shows that almost 4 out of 10 shops in the US already accept crypto payments.

Even more telling, 8 out of 10 business owners believe paying with crypto will be normal within the next five years. pic.twitter.com/JvJdBahqm0

— MANDO CT 🇮🇪 🇦🇪 🇬🇧 (@XMaximist) January 28, 2026

Moreover, almost 75% of these companies have increased crypto-related sales in the previous year. The majority of them believe that in a five-year time period, digital payments will be mainstream. The findings point to a shift from niche to norm.

Hong Kong Expands Digital Asset Rules

New stablecoin and digital asset regulations were fast-tracked in Hong Kong. The Stablecoin Ordinance is now in effect, and license applications are in progress. The HKMA is evaluating fiat-backed issuers of stablecoins. There are also plans to expand the regulation of custody service, trading, and advisory services. By 2028, a crypto asset tax-reporting framework, aligning with OECD standards, will be introduced. The government is still establishing itself as a digital finance hub.

Russia Advances Crypto Regulation Bill

Russia’s parliament aims to vote on a sweeping crypto bill by June. Should it be passed, it would become a law on July 1, 2027. The bill limits unregistered exchanges and requires qualification tests for retail investors. Retail users are also limited to purchasing up to $4000 per year. An approved list of cryptocurrencies will be published by the Central Bank. In addition, stablecoins can be employed in foreign trade through licensed brokers only.

Kazakhstan to Build National Crypto Reserve

The central bank of Kazakhstan plans to boost its crypto holdings using confiscated assets. National Investment Corporation will allocate $350 million in crypto through hedge funds. Gold and foreign currency are also part of the strategy.

According to DLNews, Kazakhstan's central bank investment subsidiary NIC announced plans to bolster national crypto reserves using cryptocurrencies seized by law enforcement, gold, and foreign currency, allocating $350 million. Director Timur Suleimenov stated that purchases will…

— Wu Blockchain (@WuBlockchain) January 30, 2026

Recently, police shut down more than 130 illegal exchanges in the country, confiscating over $5 million in assets. Moreover, the strategy is endorsed by President Tokayev in national financial innovation.

Japan Reviews Crypto Rules Publicly

Japan’s Financial Services Agency introduced a consultation on the crypto regulations update. The review is based on recent changes in the Payment Services Act. It concludes on February 27 and seeks community feedback. The draft clarifies the naming of bonds, the electronic payment structure, and intermediate oversight. It further streamlines the financial institution regulations regarding digital financial assets. Japan is in the process of enhancing its crypto policy by involving public input.

India Leaves Crypto Taxation Unchanged

The 30% capital gains tax on crypto was retained in India’s 2026 budget. It maintained the 1% transaction TDS as well. There were no modifications in terms of classification and licensing. The absence of clarity has, however, left the crypto community disappointed. Developers and exchanges fear that stagnation could push the talent offshore. A regulatory overhaul is still being sought by many.

Corporate Crypto Holdings Continue Growing

Strategy bought 2,932 BTC valued at $264 million, bringing its total holdings to 712,647 Bitcoin. This indicates that there is still institutional interest in Bitcoin as a treasury reserve, despite the volatility in the market.

Strategy has acquired 2,932 BTC for ~$264.1 million at ~$90,061 per bitcoin. As of 1/25/2026, we hodl 712,647 $BTC acquired for ~$54.19 billion at ~$76,037 per bitcoin. $MSTR $STRC https://t.co/RooLfEvniX

— Michael Saylor (@saylor) January 26, 2026

Meanwhile, Bitmine expanded its Ethereum reserves to 4.2 million ETH. The total value now exceeds $12 billion. Both companies consider crypto as a strategic long-term balance sheet asset.

Ethereum Readies ERC-8004 Upgrade

Ethernet developers confirmed that ERC-8004 would be activated on the mainnet soon. The standard allows smart contracts to interact with artificial intelligence agents. These agents are able to handle on-chain assets autonomously. The rollout is still in early stages, but is expected to enhance automation of the decentralized apps. Ethereum continues to advance towards a more programmable and intelligent blockchain layer.

DOJ Seizes $400 Million from Helix Mixer

The U.S. Department of Justice ended a 400 million seizure associated with the Helix darknet mixer. The court order was issued late in January, ending a case that began in 2017. In 2021, founder Larry Harmon pleaded guilty to money laundering. He was sentenced to 36 months in prison. Helix processed more than 350,000 BTC, aiding criminals in laundering money in darknet markets.

Bybit Launches Retail Bank with IBANs

Bybit announced “My Bank,” a retail banking product, which provides personal IBANs. Global payments can be sent and received by the users once they have been verified through KYC. USD transfers will be offered at launch. Additionally, the service will support up to 18 currencies. Qatar National Bank, DMZ Finance, and Pave Bank will collaborate on the implementation. Customers have the ability to use their accounts to pay salaries and bills as well as trade in cryptocurrencies.

UAE Registers First Dollar Stablecoin

Universal Digital International introduced USDU, approved by the UAE Central Bank. It is the first foreign stablecoin to be registered by the Payment Token Services Regulation. USDU is based on ERC-20 standards and is bank integrable. Moreover, reserves are at Emirates NBD and Mashreq. Meanwhile, monthly attestations promote transparency.

Universal launches USDU – the UAE’s first Central Bank-registered USD stablecoin.

Issued by an FSRA-regulated entity in @ADGlobalMarket, USDU is supported by banking partners @EmiratesNBD_AE , @MashreqTweets, and @almaryahbank with global distribution via @aquanow, and alignment… pic.twitter.com/LisFKmBMxd

— Universal (@Universal_USDU) January 29, 2026

Fidelity Reveals U.S. Digital Dollar

Fidelity is launching a stablecoin called the Fidelity Digital Dollar (FIDD). It operates on Ethereum and is supported by cash and U.S. Treasuries. Reserved backing will be displayed on the daily disclosures. Moreover, Fidelity platforms will have FIDD at redemption of $1. It also meets GENIUS Act reserve requirements.

Russia Bans WhiteBIT Crypto Exchange

WhiteBIT and W Group were designated by Russian authorities, halting all operations within the country. Officials attributed the move to the connection to Ukrainian projects, such as United24 and military support. WhiteBIT was reported to have transferred $11 million to Ukrainian efforts. The decision also bars any commercial presence. Collaboration with the listed organizations has become subject to criminal penalties.

U.S. Sanctions Two UK Exchanges

Zedcex and Zedxion were sanctioned by the U.S. Treasury for helping Iran evade sanctions. Both companies were alleged to facilitate billions of digital asset transactions associated with the IRGC. Blockchain analysis further revealed a high volume of illicit network-related Tron addresses. Meanwhile, the founder of Zedxion has a background of sanctions violations.

Ethereum Foundation Enters Austerity Mode

Ethereum co-founder Vitalik Buterin announced a five-year austerity program for the Ethereum Foundation. Vitalik allocated 16,384 ETH to project funding. The strategy is aimed at decentralization and sustainability.

In these five years, the Ethereum Foundation is entering a period of mild austerity, in order to be able to simultaneously meet two goals:

1. Deliver on an aggressive roadmap that ensures Ethereum's status as a performant and scalable world computer that does not compromise on…

— vitalik.eth (@VitalikButerin) January 30, 2026

Buterin also emphasized the support of open-source privacy tools. Some of the priorities include projects such as Vensa and uCritter. Moreover, a portion of ETH will be staked to generate sustainable income.

White House Hosts Stablecoin Talks

On February 2, the White House will hold a meeting with crypto firms, banks, and lobbyists. The idea is to find solutions to disagreements regarding the CLARITY Act. Key points are stablecoin rewards treatment. Delays in compromise would shift the date of the meeting. The administration currently views stablecoins as a key to crypto regulation. There is a high demand for settlement, as indicated in ongoing discussions.

OKX Introduces Stablecoin Card in the EU

OKX introduced a stablecoin Mastercard in Europe. The card accepts USDC and USDG, which convert crypto at the point of sale. Customers are able to spend at more than 150 million merchants worldwide. Apple Pay and Google Pay are compatible with the card. It also does not impose any transaction or FX fees. Moreover, the card is distributed by Monavate, a licensed EMI, based on MiCA regulations.

Steak ’n Shake Doubles Down on Bitcoin

Steak ’n Shake boosted its holdings in Bitcoin by adding $5 million to the treasury, building on the January purchase of $10 million. The restaurant chain converts any BTC payments received into reserve holdings.

Steak n Shake's Burger-to-Bitcoin transformation continues.

Today we increased our Bitcoin exposure by $5,000,000 in notional value.

All Bitcoin sales go into our Strategic Bitcoin Reserve.

Our self-sustaining system — improving food quality that grows same-store sales that…

— Steak 'n Shake (@SteaknShake) January 27, 2026

This system also connects operations with its Strategic Bitcoin Reserve. Same-store sales have increased by more than 18%. Transaction costs were reduced by almost 50% due to the use of Bitcoin payments.

VanEck Debuts Avalanche ETF

VanEck launched the first US-traded Avalanche Exchange Traded Fund (VAVX). Trading on Nasdaq commenced on January 26, providing investors with AVAX and staking rewards. Until February 28, early investors are at zero on the first $500 million of sponsor fees. VanEck also noted that Avalanche’s architecture allows bridging the traditional finance and on-chain economies.

Digital Asset Investment Products Market Overview

The latest report by CoinShares shows that investor confidence in digital assets weakened as weekly outflows hit $1.7 billion, reversing a previous annual gain. As a result, year-to-date flows now show a net outflow of $1 billion.

🚨JUST IN: Digital asset investment products recorded a second straight week of outflows, totaling $1.7B, reversing year-to-date inflows and pushing net YTD flows to a $1B global outflow.

Solana saw $31.7M in net outflows, its first weekly outflow in three weeks. pic.twitter.com/y8CGUWZ8nY

— SolanaFloor (@SolanaFloor) February 2, 2026

The US led the withdrawals regionally with $1.65 billion exiting products. Meanwhile, Canada and Sweden also experienced significant outflows. In contrast, Switzerland and Germany recorded small inflows, but these figures could not withstand global weakness. Overall, sentiment was negative across most major markets.

Bitcoin and Ethereum achieved the largest weekly outflows across assets. Additionally, XRP and Solana experienced decreased allocations. However, inflows were drawn into short Bitcoin products as defensive interest rose. On the other hand, Hype products were supported by an increase in activity in tokenized precious metals.

Bitcoin Price Performance

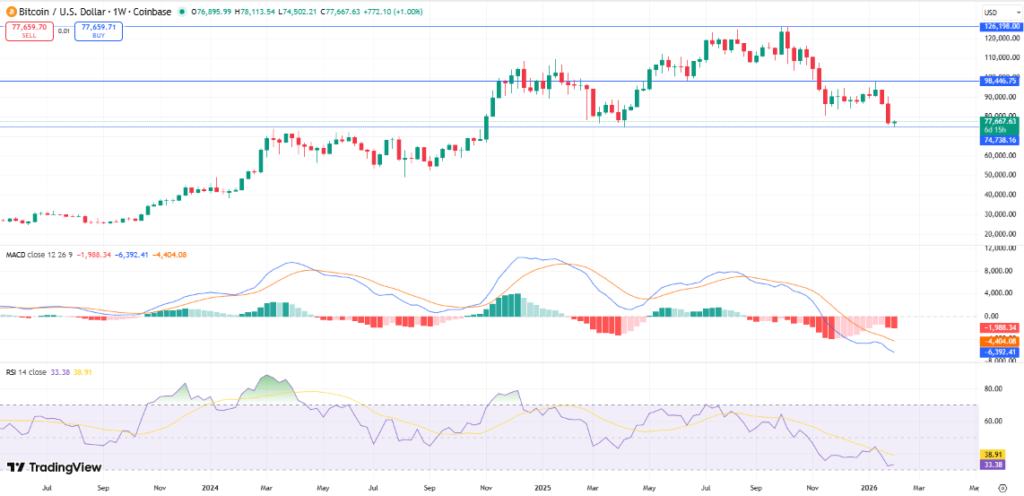

The crypto market witnessed a steady downturn last week, with Bitcoin declining from highs of $90K to $75K. During this period, BTC recorded a decrease of more than 12%. This drop has elevated the monthly decline to 15%. Meanwhile, BTC’s dominance stands at 59%.

Looking at the weekly chart, BTC continues trading in a descending channel. Support for the asset remains around the $74,968 region, while resistance is noted at the $98,446 and $126,198 regions.

Technical indicators such as the RSI and MACD display a bearish outlook as BTC continues its downtrend. The 14-day RSI is hovering at 32 levels, slightly above the oversold region, indicating a robust bearish momentum. Meanwhile, the MACD line has continued its journey below the signal line in the negative territory region, suggesting increased selling pressure.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.