Highlights:

- Crypto thefts surged to $1.38 billion in the first half of 2024, doubling from 2023.

- The top five hacks accounted for 70% of the total amount stolen in early 2024.

- DMM Bitcoin suffered the largest attack, losing over 4,500 BTC, valued at over $300 million.

Crypto thefts have surged in the first half of 2024, with hackers stealing nearly $1.38 billion, almost double the amount stolen in the same period last year. According to the latest report from blockchain intelligence firm TRM Labs, this figure represents almost double the amount stolen during the same period in 2023.

Surge in Crypto Thefts

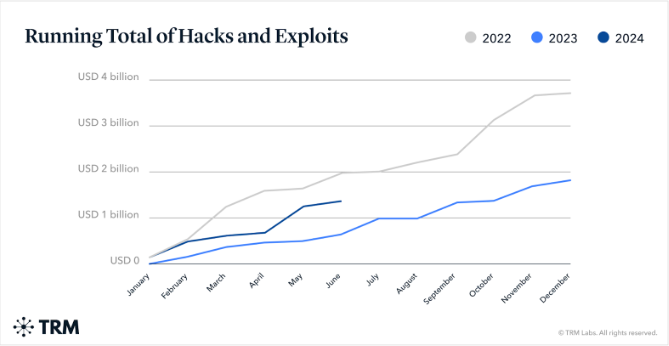

By June 24, 2024, the total amount stolen in crypto heists reached $1.38 billion, compared to $657 million in the first half of 2023. This sharp increase is attributed to a small number of large-scale attacks, with the top five incidents alone accounting for 70% of the stolen total. Private key and seed phrase compromises remain the primary attack vectors, along with smart contract exploits and flash loan attacks.

GLOBAL CRYPTO THEFTS EXCEED $1.38 BILLION IN 6 MONTHS

In the first half of 2024, hackers stole over $1.38 billion in crypto, doubling last year’s figures, TRM Labs revealed.

Ari Redbord stated, “We have seen a significant increase in the value of various tokens… motivating… pic.twitter.com/SBynvEylDQ

— Mario Nawfal’s Roundtable (@RoundtableSpace) July 5, 2024

In May 2024, DMM Bitcoin, a prominent Japanese cryptocurrency exchange, experienced the largest hack of the year, losing over 4,500 BTC, valued at more than $300 million at the time. While the exact cause of the attack remains unclear, potential vectors include stolen private keys or address poisoning. Address poisoning involves attackers sending small amounts of cryptocurrency to a victim’s wallet to create fake transaction histories, potentially misleading users into sending funds to the wrong address in future transactions.

According to CoinPost, DMMBitcoin, a cryptocurrency exchange under Japanese securities company DMM, was suspected of being hacked, and $300 million worth of Bitcoin may have been stolen. DMMBitcoin said it would purchase Bitcoin equivalent to the outflow amount and guarantee the…

— Wu Blockchain (@WuBlockchain) May 31, 2024

However, DMM Bitcoin revealed plans to raise 50 billion yen (approximately $321 million) to address the security breach. The company intended to source these funds from its group companies. To compensate customers who lost Bitcoin in the hack, the exchange is taking steps to resolve the issue and rebuild trust among its users.

Key Attack Vectors and Trends

The top attack methods in 2024 include private key and seed phrase compromises, smart contract exploits, and flash loan attacks. Despite the increase in theft, TRM Labs has not observed any fundamental changes in the security of the cryptocurrency ecosystem that might explain this surge. Additionally, the number of attacks has remained consistent with last year. However, higher average token prices in 2024 have likely contributed to the increased theft volumes.

Every month of 2024, more money was stolen than in the corresponding months of 2023, with the median hack size being 150% larger. Thefts from hacks and exploits are still a third below the same period in 2022. The year 2022 remains a record year for crypto theft.

Protective Measures for Crypto Projects

Crypto projects are advised to adopt a multi-layered defense strategy to safeguard against such attacks. Regular security audits, robust encryption, multi-signature wallets, and secure coding practices are crucial. Additionally, staying updated on the latest threats, educating employees, and fostering a security-aware culture is essential.

Having a comprehensive incident response strategy is also vital, potentially including bounties for the return of stolen funds. However, no single measure is foolproof. Therefore, adopting a defense-in-depth approach, where multiple redundant security measures are in place, provides the best protection against potential breaches.

The surge in cryptocurrency thefts in the first half of 2024 underscores the industry’s need for enhanced security measures. As hackers become more sophisticated, crypto projects must remain vigilant and proactive in protecting their assets and users.