Highlights:

- Bitcoin price plunged below $57,000, sparking panic and triggering a widespread sell-off in the crypto market.

- Governments’ Bitcoin movements and macroeconomic factors have contributed to market volatility and investor panic.

- Over $300 million in cryptocurrency liquidations occurred within 24 hours as market sentiment shifted to fear.

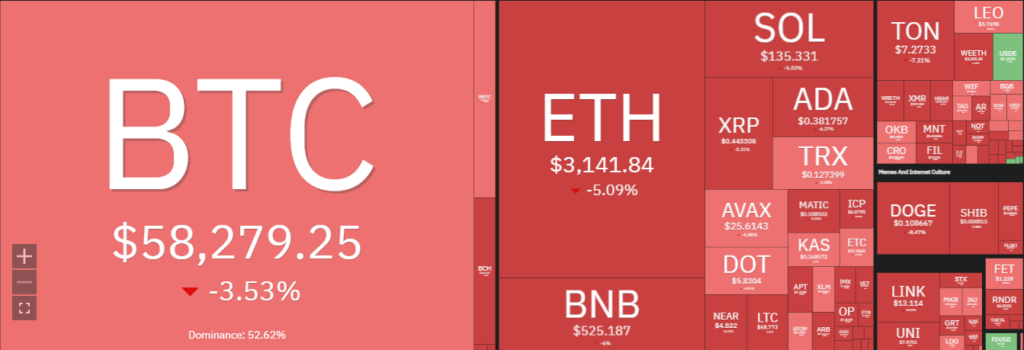

The crypto market has entered a state of panic, with Bitcoin and altcoins experiencing significant declines. Bitcoin’s price fell below the critical $57,000 mark, triggering widespread selling and a dramatic drop in the global crypto market cap to $2.14 trillion. This represents a more than 4% decrease in the past 24 hours.

Bitcoin and Altcoins Under Pressure

Bitcoin hit a 24-hour low of $56,700, nearing a key support level and risking further declines to $52,000. This drop has put significant pressure on altcoins, with major cryptocurrencies like Ethereum, BNB, Cardano, and XRP facing declines. Additionally, tokens within the Solana ecosystem, meme coins, and several AI coins experienced double-digit losses.

Ethereum’s price correction is particularly notable as the market anticipates the Securities and Exchange Commission’s (SEC) decision on the Spot ETH Exchange Traded Fund (ETF). Although experts predict a potential rally if the ETF is approved, Ethereum has corrected to $3,140 ahead of this decision. Applicants have submitted a revised S-1 draft to the SEC.

Panic Selling Intensifies

Investor sentiment has shifted to fear, driven by concerns over upcoming repayments from Mt. Gox’s $10 billion in BTC and BCH. JPMorgan and CoinShares have warned about potential market disruptions due to creditor selloffs.

According to Coinglass, over $300 million worth of cryptocurrencies were liquidated in the past 24 hours, affecting 133,127 traders. The largest single liquidation order occurred on the Binance crypto exchange, where an ETH to USDT swap valued at $18.48 million was executed. Of the total liquidations, $250 million were long positions, and $50 million were short positions, leading to significant losses for investors.

Government BTC Transfers Add to Panic

Government actions have exacerbated the market’s instability. Both the US and German governments have moved substantial amounts of Bitcoin. The US government transferred 237 BTC from the Potapenko/Turogin seized funds to a new address. Meanwhile, the German government offloaded 1,300 BTC on exchanges like Bitstamp, Coinbase, and Kraken and moved an additional 1,700 BTC worth $98.76 million to an unknown wallet.

UPDATE: German Government selling up to $175M BTC

In the past 2 hours the German Government has moved 1300 BTC ($76M) to exchange deposits at Kraken, Bitstamp and Coinbase.

They have also moved 1700 BTC ($99M) to address 139Po. These funds are likely moving to a deposit for an… pic.twitter.com/ZMTxoipo5d

— Arkham (@ArkhamIntel) July 4, 2024

These large transfers by government wallet addresses have triggered panic among investors, causing Bitcoin’s price to dip below $57,000. Data from Arkham Intelligence indicates that 1,300 BTC worth nearly $76 million was deposited into Kraken, Bitstamp, and Coinbase. Additionally, another $99 million in Bitcoin was moved to another address marked as 139Po.

Macro Factors Add to Pressure

Federal Reserve Chair Jerome Powell’s recent speech and the release of FOMC Minutes confirmed the hawkish stance on interest rate cuts this year. With Trump leading after the latest debate, the political climate has added to the market pressure. Fed officials are awaiting further data on US inflation and the labor market.

The CME FedWatch Tool indicates a 66.5% probability of a 25 basis point rate cut in September, up from 59% last week. Weak US economic data has strengthened bets on Fed rate cuts this year. The US dollar index (DXY) held around 105.3, and the US 10-year Treasury yield dropped to 4.35% following recent ISM and jobs data showing a slowing labor market.