Highlights:

- Crypto funds see $1.9 billion in inflows, marking nine consecutive weeks of positive investment trends.

- Bitcoin rebounds with $1.3 billion inflows, while Ethereum adds $585 million in strong momentum.

- Investors stay confident even with global tensions, and the U.S. leads in inflows.

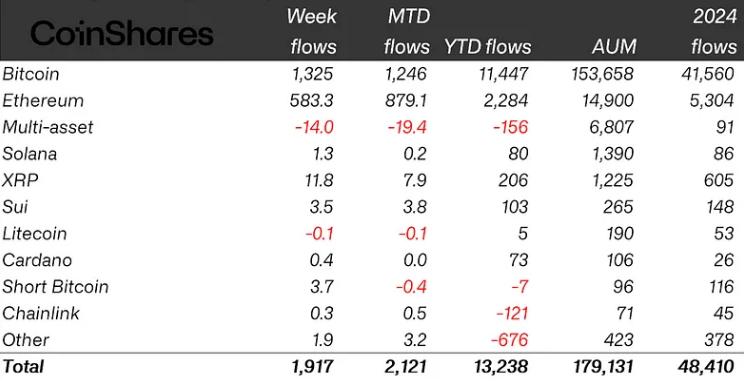

CoinShares’ James Butterfill shared in a report on Monday that even though global tensions made markets uneasy last week, digital assets still stayed strong and continued to attract investor money—just like gold. Global crypto exchange-traded products (ETPs) saw $1.9 billion in new inflows during the week ending Friday. This was the ninth straight week of positive inflows, bringing the total over that period to $12.9 billion. Butterfill said year-to-date inflows have now hit a record $13.2 billion, with total assets under management climbing to $179 billion.

Digital asset investment products saw US$1.9bn in inflows last week, marking the 9th consecutive week and a record YTD total of US$13.2bn. Bitcoin rebounded with US$1.3bn in inflows, while Ethereum saw US$583m inflows, its strongest since February. https://t.co/mz9A80gw4z

— Wu Blockchain (@WuBlockchain) June 16, 2025

Crypto Funds Rebound with Strong U.S. Inflows

Bitcoin investment funds bounced back last week, gaining $1.3 billion after two weeks of small outflows. Total assets under management (AUM) rose to $156.7 billion. Most of the inflows came from U.S. spot Bitcoin ETFs, which brought in $1.37 billion, while a few outflows were seen in other countries. Short Bitcoin funds recorded modest inflows of $3.7 million last week. Meanwhile, BlackRock’s iShares Bitcoin Trust (IBIT) set a new record as the fastest ETF to reach $70 billion in assets under management. It reached this milestone in just 341 days—five times quicker than the previous record set by SPDR Gold Shares (GLD).

Ethereum investment funds kept up their strong pace last week, bringing in $585 million in new inflows. Over recent weeks, total inflows have now reached $2 billion — about 14% of the $14.9 billion currently managed. U.S. spot Ethereum ETFs alone added $528.2 million to last week’s figure.

Meanwhile, XRP investment products recorded their first net inflows in three weeks, gaining $11.8 million. Sui-based funds also attracted $3.5 million. The U.S. led all regions with $1.9 billion in weekly inflows, reflecting strong investor confidence, according to Butterfill. Germany led among non-U.S. markets with $39.2 million in inflows, followed by Switzerland at $20.7 million and Canada at $12.1 million. However, sentiment turned negative in some areas — Hong Kong funds faced $56.8 million in outflows, while Brazil saw $8.5 million leave crypto products.

Crypto Holds Strong as Israel-Iran Tensions Push Gold

Butterfill said the growing Israel-Iran conflict added pressure to risk assets but did not shake investor interest in crypto. He also pointed out that the tensions sparked renewed demand for gold. Spot prices climbed sharply, reaching $3,448 — the highest since early May.

Bitcoin traded close to its recent peak of $110,000 last Monday but dropped sharply to $103,000 following Israel’s offensive targeting Iran’s nuclear sites on Thursday. By week’s end, it had rebounded to $106,000, according to CoinGecko. At the time of writing, Bitcoin was trading at $106,838, showing a 2% gain over the past 24 hours. Meanwhile, Ether showed ongoing strength, despite a brief fall from $2,869 on Wednesday to $2,473 on Thursday, before stabilizing again.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.