Highlights:

- Australia is now the third-largest market for crypto ATMs.

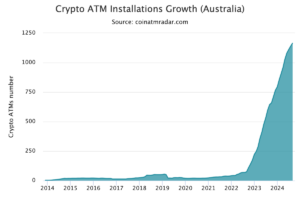

- The country is seeing a surge, making it the fastest-growing crypto ATM market.

- This rapid expansion has raised concerns about potential money laundering risks.

Australia has experienced a 17-fold rise in cryptocurrency automated teller machines (ATMs) over the last two years. With 1,162 machines, the country is now the world’s third-largest market for crypto ATMs, a significant increase from just 67 in August 2022, according to the latest data from Coin ATM Radar. This means that 160 ATMs have been added since the end of April, when Australia surpassed the milestone of 1,000 active machines. The surge has sparked debate about the demand for these services and their potential risks.

Bloomberg: Australia leads crypto ATM market

The number of Bitcoin automatic teller machines (ATMs) is growing rapidly in Australia, leading the global market, Bloomberg reported. Specifically, the number of Bitcoin ATMs in Australia has grown from just 73 two years ago to 1,200…

— CoinNess Global (@CoinnessGL) August 30, 2024

Crypto ATMs enable users to deposit cash in exchange for digital assets in their wallets or withdraw physical currency from the sale of tokens. Australia has rapidly reached third place in the crypto ATM market but only commands a 3% global share. The United States dominates with over 82% of the market, with 31,877 ATMs. Canada is second with 3,004 machines, representing 7.8% of the market.

Concerns Rise Over Crypto ATMs in Australia Amid Growing Adoption

While the increase in crypto ATMs reflects greater cryptocurrency adoption in Australia, it has also raised concerns among regulatory bodies about potential misuse. These concerns include risks of money laundering, facilitating scams, and difficulties in tracing the source of funds. Angela Ang, senior policy adviser at blockchain intelligence firm TRM Labs, highlights that Australian authorities have flagged crypto ATMs as a potential money laundering vulnerability.

According to TRM Labs, the cash-to-crypto industry has facilitated at least $160 million in illicit transactions worldwide since 2019. “Last year, illicit volumes in the cash-to-crypto industry stood at 1.2% of total volume, double the 0.63% for the overall crypto ecosystem,” it added. In contrast, Chainalysis Inc. estimates that Australia alone experienced approximately $223 million in illegal digital asset activity between 2022 and 2023.

Scams and fraud made up most of the illicit volumes in 2023. According to TRM Labs’ analysis, over $30 million, or nearly 80% of the total illicit volume, was directed to known scams and fraud-linked crypto wallets. The firm pointed out that some kiosks feature anti-scam warnings or checklists to help ensure users aren’t misusing them.

Australia Tightens Crypto Regulations

The Australian Transaction Reports and Analysis Centre (AUSTRAC) requires all crypto exchange providers to register and adhere to anti-money laundering regulations. Additionally, local banks have imposed restrictions on transactions linked to crypto exchanges. Notable banks enforcing these restrictions include National Australia Bank Ltd., Australia & New Zealand Banking Group Ltd., Commonwealth Bank of Australia, and Westpac Banking Corp.

This banking move has pushed crypto users to seek alternative methods for cashing out their cryptocurrencies. Meanwhile, regulators are closely monitoring these activities to prevent money laundering and other illicit transactions.

In March of last year, the Australian Federal Police established a multi-agency task force to combat money laundering, highlighting that some criminals were using crypto ATMs to launder their illicit gains. The United Kingdom’s Financial Conduct Authority shut down 26 unlicensed crypto ATMs. TRM Labs reported that this action led to a 90% reduction in the number of active machines in Britain.