Highlights:

- CIMG announced that it purchased 500 BTC after raising $55 million from selling 220 million shares.

- The company is now the third-highest BTC holding company in Hong Kong.

- The CIMG CEO reiterated the company’s commitment to seeking collaboration in the crypto and AI industry.

CIMG Inc., a digital health and sales development services provider, has completed the sale of its 220 million shares of common stock as announced in a press release on September 2, 2025. Each share cost $0.25, totalling $55 million in gross proceeds. The capital realised was used to purchase 500 BTC, positioning CIMG as the third-largest public holder of BTC in Hong Kong. Notably, only Minang Shing Group and Boyaa Interactive International own more BTC than CIMG in Hong Kong. These companies have accumulated 833 BTC and 3,640 BTC, respectively.

Reacting to the company’s latest move, the CIMG Board of Directors stated:

“We are committed to a long-term Bitcoin holding strategy, building a robust Bitcoin reserve through a sound financial system to establish a solid value foundation for our investors.”

Wang Jianshuang, CIMG’s Chief Executive Officer (CEO), also spoke about the purchase. She said that Bitcoin has recorded soaring global adoption, creating new opportunities for businesses. Jianshuang also noted that traditional companies can now connect with blockchain technology through Bitcoin investments.

By embracing Bitcoin, CIMG aims to become a leading firm in the Bitcoin finance sector. She stated, “Moving forward, the Company intends to continue to increase its digital asset reserves and pursue collaborations across AI and crypto ecosystems, such as Merlin Chain.”

Nasdaq-listed CIMG Inc. announced the completion of the sale of 220 million common shares, raising a total of $55 million in exchange for 500 Bitcoin, as part of its long-term Bitcoin holding strategy to establish a Bitcoin reserve. https://t.co/Qqp5bFAV8m

— Wu Blockchain (@WuBlockchain) September 3, 2025

CIMG Joins Growing List of Bitcoin Holders

According to Bitcoin Treasuries.Net, 312 entities are holding Bitcoin. 179 out of these are public companies. The remaining group holding BTC includes governments, private companies, smart contracts, exchanges, and exchange-traded funds (ETFs).

Together, these entities hold 3.7 million BTC, with public companies accounting for 995,576 of the held tokens, while private firms hold 302,747 BTC. Notably, Government establishments own 526,361 BTC, ETFs and exchanges are holding 1,627,922 BTC, while smart contracts account for the remaining 242,864 tokens.

The United States has the highest number of establishments holding Bitcoin, with 107 firms. Canada followed closely with 43 companies that own BTC. Other regions in the top five include the United Kingdom, Japan, and Hong Kong. The number of companies holding BTC in these nations is 20, 12, and 11, respectively.

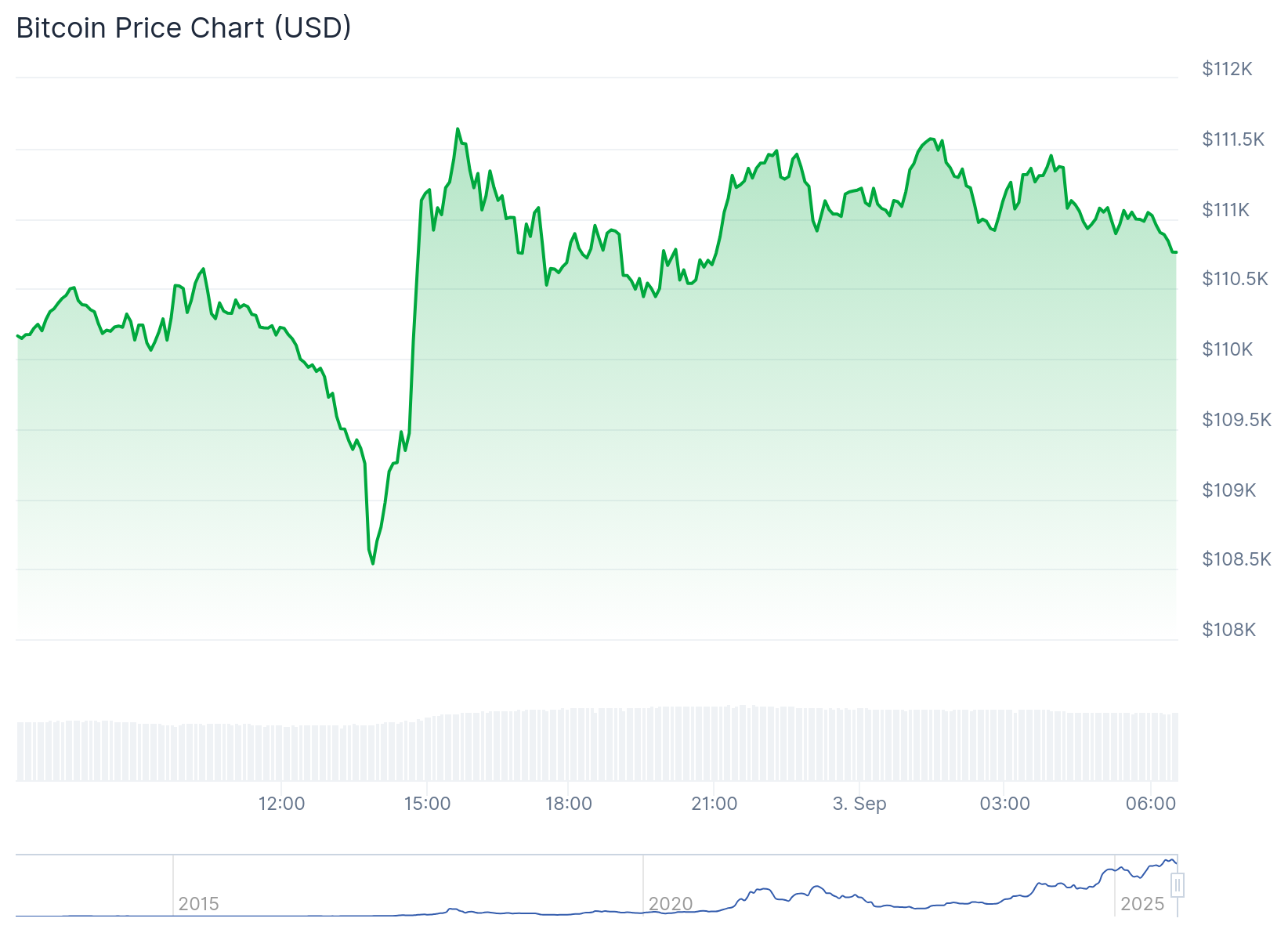

BTC Price Reaction as CIMG Sells 220M Shares to Buy Bitcoin

After days of remaining below $110,000, Bitcoin has finally reclaimed the level following a 0.5% upswing in the past 24 hours. At the time of press, BTC is changing hands at about $110,753 with a market capitalisation of $2.205 trillion. While its short-term variable indicated a slight increment, BTC’s longer-term metrics have remained negative.

For context, Bitcoin is down 0.8% 7-day-to-date, 2.5% 14-day-to-date, and 3.4% month-to-date. Bitcoin has the second-highest 24-hour trading volume, valued at about $74.5 billion, with a volume-to-market cap ratio of 0.0338. Supply inflation is low at 0.84% while volatility is medium at 3.09%.

Institutions Continue to Buy Bitcoin

While critics continue to dismiss Bitcoin’s potential as a sustainable store of value, institutions’ interest in the token has remained strong. On September 2, Michael Saylor, Strategy’s co-founder, announced that the company purchased an additional 4,048 BTC for $449 million. The purchase between August 26 and September 1, 2025, increased Strategy’s Bitcoin holdings to about 636,505 BTC, valued at approximately $46.95 billion.

On the same date, French semiconductor firm Sequans announced that it purchased 34 BTC for $3.8 million, increasing its holdings to 3,205 tokens worth $374 million. Sequans’ latest purchase comes a few days after the firm had announced an at-the-market (ATM) equity program to raise $200 million for its Bitcoin expansion project.

Sequans has purchased an additional 34 bitcoin for ~ $3.8 million at an average price of ~ $111,374 per bitcoin. As of 09/01/2025 we hodl ~ 3,205 bitcoin acquired for ~ $374 million at an average price of ~ $116,653 per bitcoin. $SQNS pic.twitter.com/TwhtDkuUfV

— Sequans (@Sequans) September 2, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.