China and Russia are accelerating the use of digital payments for cross-border settlements, completely abandoning traditional banking. Qifa, a China-based payment solution initially launched to facilitate imports between the two countries, affirmed the enhanced use of crypto payments. Qifa cited U.S. sanctions, which slowed down the cross-border payment processing on the platform and pushed the payment solution to process payments in digital assets.

Both countries strive to reduce global economic reliance on the US dollar, a struggle the BRICS alliance has consistently experienced since its inception. The economic cluster, which includes Brazil, Russia, India, China, and South Africa, aims to replace the US dollar with a new currency.

China and Russia Spark De-dollarization by Endorsing Digital Payments

China and Russia are exploring ways to enable efficient digital payments to boost remittances for bilateral trade. In this slew, Qifa, a digital platform headquartered in Beijing, has emerged as a key solution for seamless transactions using digital payments. Similarly, such payment gateways can reduce transaction completion time, further supporting the BRICS’ goal of de-dollarization.

The Chinese-owned platform Qifa was founded in 2013 to import consumer goods to Russia. The following year, the platform launched its bilateral trade, aiming to increase trade between the countries despite threats of secondary sanctions by US authorities on Chinese Banks.

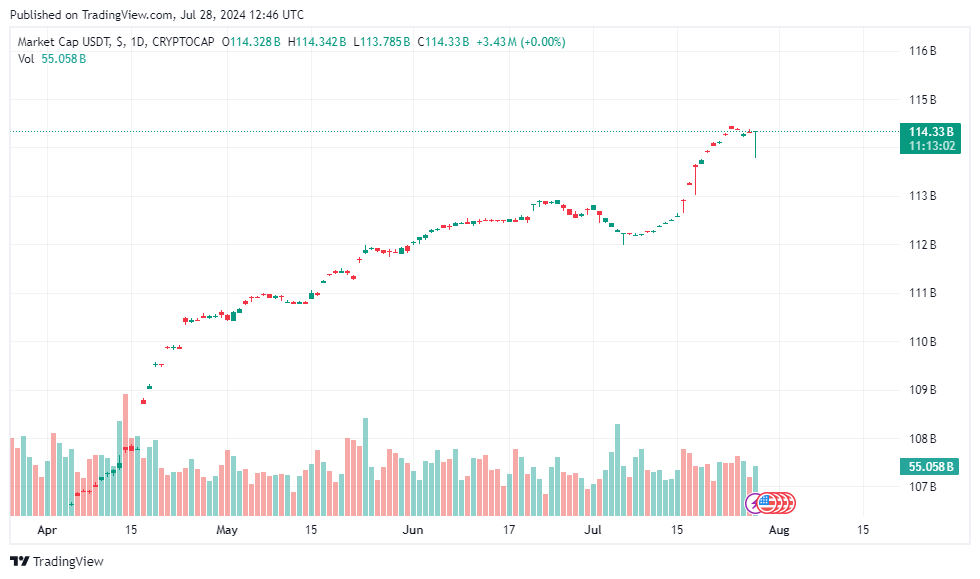

Qifa expanded its settlements into digital payments and cryptocurrencies to overcome these restrictions. Qifa clarified that legal authorities from both countries authorized the platform to execute crypto payments, and it facilitated the trades using USDT stablecoin. This enables payment firms to process hefty transactions quickly. Also, Qifa plans to list its shares or stocks on the Moscow exchange soon.

Likewise, Chinese banks exited the traditional economic system to include digital assets in their framework for cross-border transfers. Only a few banks are now limited to traditional financing since the majority have endorsed the digital ecosystem.

Russia Steps Aside from the US Dollar Permanently

Russia and its allies permanently abandoned the use of dollars. In 2023, Russia settled more than half of the payment in RMB (local currency) in trade with China. This step clarifies the intentions of both countries to move away from the US dollar. Russian President Vladimir Putin recently confirmed that 90% of the trade between China and Russia uses local currencies, including Yuans and Rubles.

Moreover, BRICS countries are also working to introduce a new system called BRICS Bridge that will aim to connect financial systems using digital currencies from central banks. This comes due to increased regulatory compliance, slow navigation of trade payments, multiple procedures, and security checks, resulting in payment delays.

In an interview, the Russia’s Chairman of the Deputy Board, Kyle Shostak, commented:

Payment delays are due to the fact that many Russian counterparties have faced increased compliance from Chinese banks for supplies to Russia. Many Russian counterparties are not completely used to such practices and don’t know how to respond to these requests.

In October 2024, Russia will host a summit at which de-dollarization will be the main topic of discussion. National leaders of both countries will disclose strategies to adopt alternative currencies, which will shape the future of digital assets in the international economic sector.