Highlights:

- The price of Chainlink has surged 4% to $14.24 with a 41% increase in daily trading volume, signaling strong market interest.

- KPMG recognizes Chainlink’s CCIP as a core technology bridging traditional finance and DeFi with real-world applications.

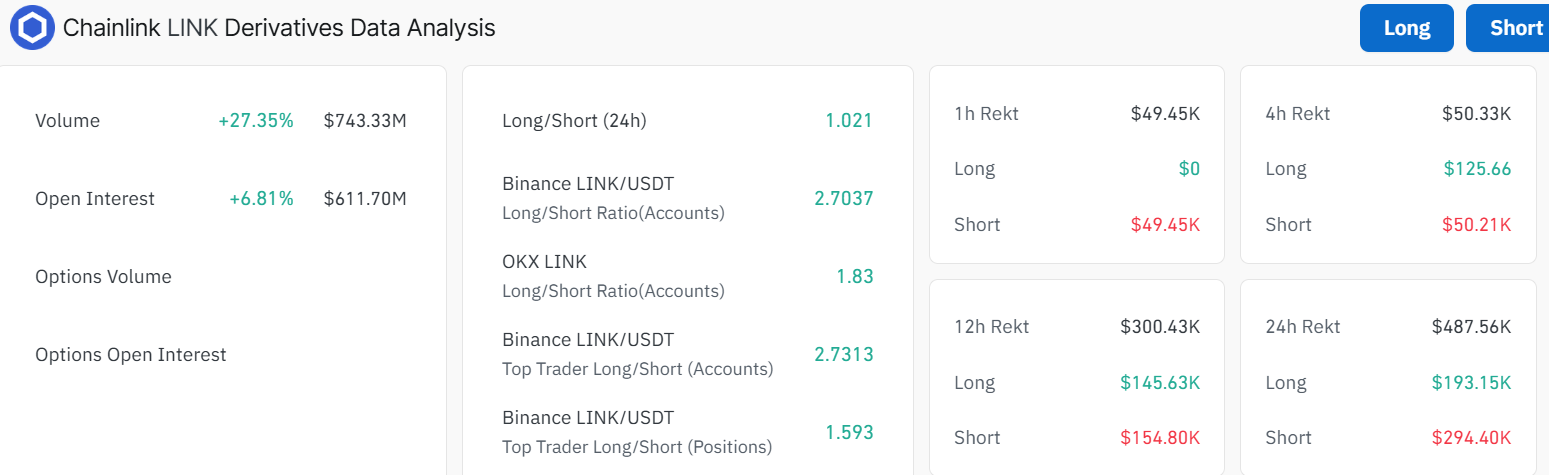

- Derivatives data reveals a 27.35% volume increase and a bullish long-to-short ratio of 2.70, indicating trader optimism.

The Chainlink price is among the top altcoins that have regained strength, jumping 4% to $14 in the past 24 hours. Accompanying the positive outlook is its daily reading volume, which has soared about 41%, indicating heightened market activity. Meanwhile, KPMG has acknowledged Chainlink as a main technology that helps connect the world of traditional finance to DeFi.

KPMG highlights that Chainlink’s CCIP helps securely and efficiently link conventional financial processes to blockchain networks. With this addition, settlements happen more smoothly and quickly, reflecting the increasing support and trust institutions are placing in Chainlink technology.

$Link The KPMG recognizing Chainlink as a "CORE" technology in connecting traditional finance with defi.

Also saying these aren't just pilots and or concepts….. its coming.P.s.- thanks Anon kekhttps://t.co/ZjeFQYH7gk pic.twitter.com/lz2OMgf8K8

— Bubbafox (@bob4punk) June 3, 2025

It pointed out that Chainlink’s products are working well in the real world now and are not just prototypes. The award indicates that decentralized oracles and interoperable blockchains are increasingly valuable in the financial world, which is helping Chainlink gain importance.

Chainlink Price Technical Market Analysis Shows Mixed Momentum

From the Chainlink price chart, it is possible to see that Chainlink remains near important moving averages, showing a “consolidation” phase. LINK is currently trading at $14.24, slightly below the $14.88 and $17.97 key resistance levels. This signals that the beras are dominating the market.

With a Relative Strength Index (RSI) of 42.01, the market is seeing a neutral to slightly bearish trend. This means the token is neither oversold nor overbought. Although the MACD just went slightly lower, the lines being very close to each other hints at a better chance for the trend to reverse.

Derivatives and Trading Data Indicate Increased Activity and Slight Bullish Bias

The volume of trades on Chainlink’s derivatives market has increased by 27.35%, totaling more than $743 million. Further, the open interest has risen by 6.81% to $611.7 million. More people are investing in LINK, causing its markets to have higher liquidity.

At Binance, the ratio of long-to-short trades among accounts is 2.70, and top traders are leaning strongly towards buying, showing that the Chainlink price may surge. Data from liquidations suggest that short positions are undergoing more forced liquidation than longs, which matches the upward trend. Even still, the indicators on the chart are telling traders to be cautious, but some indications point to an increase in LINK price.

Chainlink Price Outlook

Chainlink price is showing strong momentum, with the support of KPMG and stronger interest from traders. Although the technical indicators mark a period of holding and breaking through resistance, the large number of traders buying makes it likely that markets will rise if positive momentum grows.

If the bulls capitalize on the buying spree markets by the derivatives data, the Chainlink price could soar. A flip above the $14.87 mark will rekindle a short-term rally. This will see LINK rally towards $16, $17, and $19 in the near term. On the flip side, if the bears keep dominating and capitalize on the sell signal from the MACD, Chainlink’s price could fall. In such a scenario, LINK will retest the $13 and $12 support zones.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.