Highlights:

- The price of Chainlink is showing an upward trend, as it has risen 1% to $15.36 in the past 24 hours.

- Chainlink’s recent CCIP update now supports Astar Network’s token, enabling efficient asset bridging for DeFi applications.

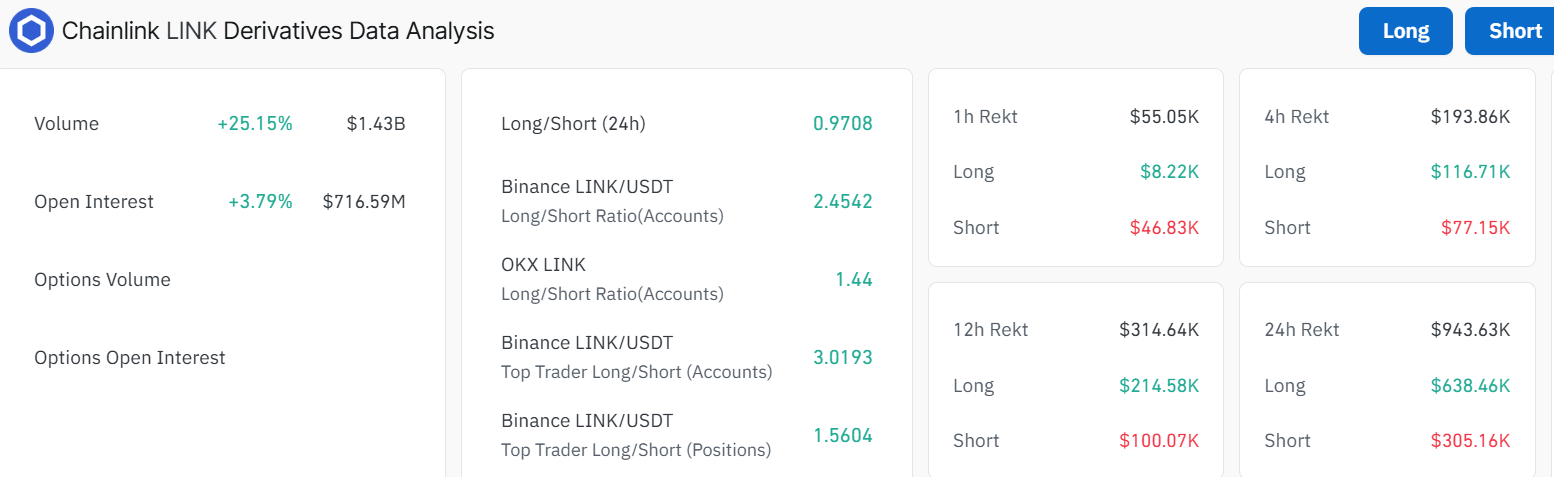

- Chainlink’s derivatives market sees increased investor interest, with a 25.15% rise in volume and a 3.79% increase in open interest.

The Chainlink price has soared 1.34% to $15.36, as the bulls show strength in the past 24 hours. On June 11, 2025, Chainlink announced a major improvement in its Cross-Chain Interoperability Protocol (CCIP) by integrating the token of Astar Network (ASTR). With the update, there is improved functionality in linking Ethereum Virtual Machine (EVM) ecosystems to non-EVM chains.

This has seen the inclusion of Optimism SuperchainERC20. Chainlink CCIP compatibility with Astar Network provides the decentralized finance (DeFi) community with new opportunities to operate within the multi-chain environment. This bridges assets across chains without facing the limitations of the past.

Chainlink CCIP’s Cross-Chain Token (CCT) standard is now compatible with @Optimism’s SuperchainERC20, with its first deployment on @soneium via @AstarNetwork's token, ASTR.

This upgrade of Astar Network's infrastructure shows how the CCT standard can seamlessly connect… pic.twitter.com/oF26WfwMWg

— Chainlink (@chainlink) June 11, 2025

Chainlink will further simplify the process of deploying decentralized applications (dApps) and smart contracts. This is achieved by incorporating the cross-chain token standards, enabling the efficient transfer of tokens between blockchains.

ChainLink Price Outlook

The Chainlink (LINK/USD) price chart demonstrates the existence of a positive trend. Recently, Chainlink price has been trading well within the confines of a rising parallel channel, as the bulls target the $17 resistance mark. It is currently trading at around $15.37 and has managed to impress with a gain of 1.03%, as bulls show strength in the market.

The Relative Strength Index (RSI) of 56.20 also shows that the token is not overbought or oversold. This means that there is potential for the upside until LINK is considered overbought. Moreover, the Moving Average Convergence Divergence (MACD) indicator also confirms the bullish sentiment as it indicates that the market is in a positive trend since it is above the orange signal line. This technical analysis proposes that Chainlink could be primed to experience a prolonged increase.

Meanwhile, if the bulls capitalize on the bullish outlook in the market and break above the $17 resistance, further upside could be imminent. In such a the $19, $21, and $23 resistance could be the next target. On the downside, if the $17 resistance proves too strong, the Chainlink price could drop towards $15, $13, and $12 support zones.

Chainlink Expanding Derivatives Market

The expansion of Chainlink into the derivatives market indicates a rise in the confidence of institutional and retail traders. LINK derivatives market has also been busy, with a 25.15% increase in volume, totaling $1.43 billion. Additionally, the open interest is up by 3.79% to $716.59 million. Such figures indicate that the number of investors who wager on the future performance of Chainlink is increasing both in the short and long term.

The Long/Short ratio of LINK indicates a positive sentiment with 0.97, indicating that traders are showing a preference for long positions. This momentum is a positive sign regarding the further price development of Chainlink. This is due to the increasing number of applications in cross-chain communication and interoperability. Chainlink has a strong chance of growing its utility within the decentralized finance environment. This comes as it scales its ecosystem and connects various blockchain technologies.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.