Highlights:

- Chainlink Price surges 7% increase to $18 in 24 hours.

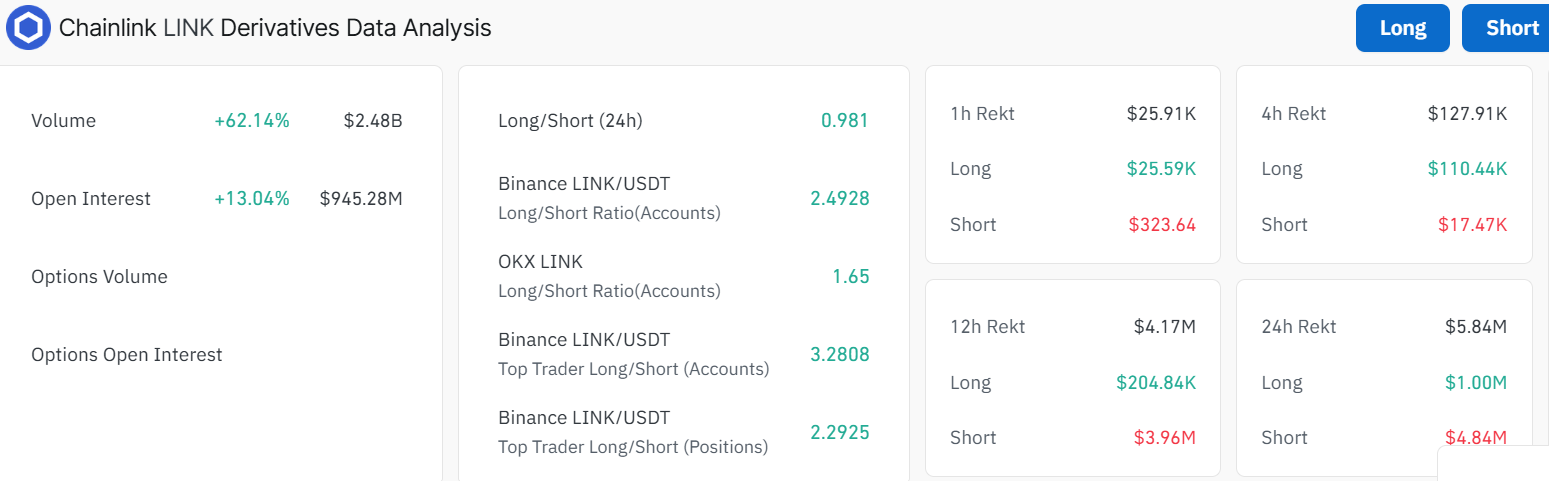

- LINK’s 66% surge in daily volume to $2.48B and OI by 13.04% indicates growing investor confidence.

- LINK could break $22 resistance, reaching $28 according to analyst Ali Martinez.

The Chainlink price has risen 7% to $18 over the past 24 hours, indicating a strong bullish momentum. Accompanying the price movement is a 66% increase in its daily trading volume. With the recent hype, the LINK token has boasted a 19% spike over the past week and a 43% increase over the past month. According to a popular analyst, Ali Martinez, the Chainlink price is also showing positive indicators of a potential price breakout. With the price approaching the critical price level of $22, it could possibly break out to $28, according to Ali.

Chainlink $LINK looks ready to break out, with eyes on $22 and possibly extending to $28! pic.twitter.com/FVreWNjGB9

— Ali (@ali_charts) July 18, 2025

Chainlink is a popular commodity, and its trading volume in the derivatives market has increased by 62.14% to $2.48 billion. This indicates the prevalent nature of the trading process. In addition, its open interest has increased by 13.04% to $ 945.28 million, indicating that more traders are preparing to take the next volley.

The recent volume surge and the open interest a signs of an increase in confidence towards the future of Chainlink. The traders are experiencing a bullish run, and most of them are looking for a breakout above the $22 resistance level.

According to the latest forecasts, when LINK crosses this threshold, it might reach a level of up to $28. The confidence has also increased due to higher optimism, as the long-to-short ratio on platforms such as Binance is 2.49. This further supports the prevalence of long positions in the contemporary market.

Chainlink Price Technical Indicators and the Future Direction

The technical outlook for the Chainlink price suggests the presence of a rounding bottom pattern in the daily chart. This implies the possibility of a significant rise, as the bulls show immense strength. Currently, the bulls have established immediate support at the 50-day moving average (MA) (13.94) and the 200-day MA ($16.20). If these support zones hold and the increasing volume sustains, Chainlink price could be poised for a breakout to higher levels.

The Relative Strength Index (RSI) is reading 80.05, indicating that Chainlink is in the overbought area. This may indicate some short-term consolidation or a downturn, although it also indicates the power of the ongoing rally. The bullish trend is confirmed by the MACD (Moving Average Convergence Divergence). This is manifested as the blue line crossing above the orange signal line, further reinforcing the buying call.

LINK Poised for Further Upside

According to the daily chart outlook, Chainlink bulls are showing immense strength, as the broader market is bullish. Looking ahead, if this 7% pump maintains its momentum, the Chainlink price could test the $21-$22 resistance level soon.

A break above that could push it toward $26 and beyond, especially with the bullish MACD and RSI backing it up. However, if the RSI enters too deep into the overbought region, it could trigger a dip due to profit-taking. A drop below $16 might see it slide back to $14-$13, where the 50 SMA could cushion the fall.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.