Highlights:

- Chainlink price has surged 3% to $25, despite the trading volume dropping 21%.

- Crypto analyst says the spikes in positive sentiment towards Chainlink often mark local tops, and steep corrections follow.

- LINK bullish indicators show a potential rally towards $35 in the coming weeks.

The Chainlink price has 3.47% to $25, despite the crypto market roaming in the red zone, led by BTC, which is down 1% to $113,838. Despite the surge, the daily trading volume has plummeted 21% showing reduced market activity. Meanwhile, LINK is still boasting a 6% rise over the past week and a 27% surge over the past month, showing intense hype.

Meanwhile, Chainlink (LINK) has demonstrated a strong positive sentiment on social media and big price movements as sentiment suddenly rises. According to Ali Martinez, the recent rallies of sentiment have been followed by local tops in price and sharp corrections. It is demonstrated as -57%, -37% and -49% dropped off, showing meaningful increases in positive sentiment before the falls. These dramatic drops depict the cyclical behavior of the cryptocurrency market with sentences trading that is highly emotionally-based.

Spikes in positive sentiment across social media towards Chainlink $LINK often mark local tops and steep corrections follow! pic.twitter.com/BNsqvpErSp

— Ali (@ali_charts) August 19, 2025

On-Chain Metrics Data Show a Spiking OI

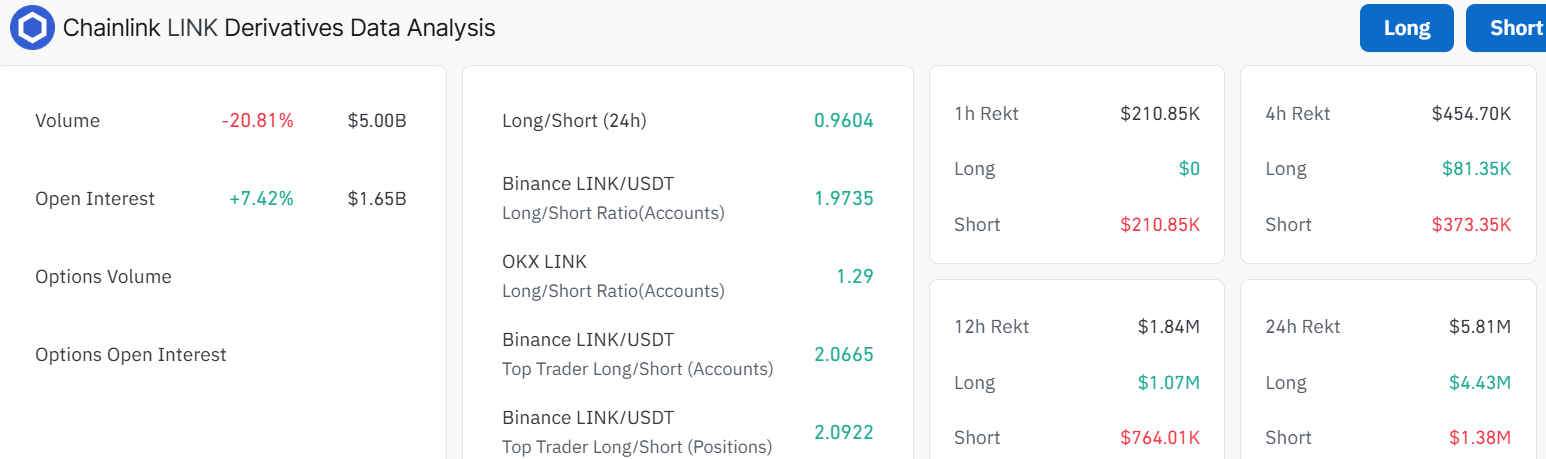

Current Chainlink derivatives data can give a further picture of market sentiment. When we have a snap at the open interest along with long/short ratios, there is a balanced but mild bullish attitude of the market. Now, the long/short ratio in the last 24 hours is trading at 0.96, indicating that traders are essentially evenly divided between long and short futures contracts. However, the mood is more bullish at other platforms such as Binance LINK/USDT, where the long/short ratio stands at 1.97, meaning more traders are betting on the price going up.

The derivatives information further illustrates an increase in open interest in the LINK contracts by 7.42% to $1.65 billion. This indicates a rise in activities in the market. However, the volume has dropped 20.81% to $5.00 billion, showing a drop in market activity in the Chainlink market.

Chainlink Price Breaks Above a Rising Channel

A quick look at Chainlink’s daily chart analysis, the bulls have broken out of a rising channel, implying further upside. Moreover, the evidence of a Golden cross in the market suggests a long-term uptrend in play. The bulls have flipped the 50-day(18.16) and 200-day(15.66) SMAs into immediate support zones. This further paints a bullish picture in the market, implying further upside.

The Relative Strength Index (RSI) at 64.22 shows that Chainlink price is not yet overbought. The intense buying pressure, however, is evident, so traders will want to keep an eye out for a potential pullback if it hits the 70-overbought region. Meanwhile, the Moving Average Convergence Divergence (MACD) shows bullish momentum as the MACD line (blue) soars above the signal line (orange).

LINK Bulls Gears Up for a Rally Ahead

Chainlink price now eyes the next target, which lies around $30. However, this is only possible if the bulls keep exerting pressure on the crypto’s price, and the volume bounces back. If this happens, the LINK price could reach $35-$40 in the next few weeks. Conversely, if Chainlink price faces rejection at the $26-$30 resistance, there could be a dip back to $23-$21. Below that, LINK may target $18 (50 SMA), where the next major support lies.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.