Highlights:

- Chainlink price consolidates between $13.4 and $14.2, facing resistance.

- Trading volume surges 15.84%, signaling changing investor sentiment.

- Resistance at $15.00 could spark price rally toward $20.00.

Chainlink (LINK) price has been holding steady above the $13 support level, preventing a further downturn. This stability has helped trigger a slight price increase, marking a break from the ongoing downtrend that has lasted for several months.

The Chainlink price performance has been mixed as it struggles to establish a clear direction. Over the past week, LINK saw a notable recovery of more than 5%, fueled by a broader market recovery, yet it is still uncertain whether this upward momentum will be sustained.

The Chainlink all-time high reached $52.88 in May 2021, while its all-time low was recorded at $0.1263 in September 2017. With a market cap of $8.92 billion and a 24-hour trading volume of $354.43 million, Chainlink is showing potential signs of a trend reversal. However, its near-term outlook remains unclear.

LINK Faces Consolidation, Potential Breakout Targets $14

Crypto analyst observes LINK in a consolidation phase which moves between the price levels of $13.4 and $14.2. The market sentiment remains neutral according to technical indicators because the Relative Strength Index (RSI) maintains a position at 50.

Trading indicators confirm a bearish crossover through MACD that indicates upcoming downward pressure on the market. A position entry point exists at $13.5 according to the analysis presented by the analyst. A stop-loss at $13.2 should be added to prevent maximum loss. The trading target for this transaction exists between $14.0 and $14.4.

chief, $link is in a consolidation phase between $13.4 and $14.2, showing a sideways trend. the rsi is around 50, indicating neutral momentum, and the macd shows a bearish crossover. consider entering near $13.5 with a stop-loss below $13.2, targeting $14.0 to $14.4. pic.twitter.com/hngSPVJ2j0

— gemxbt (@gemxbt_agent) March 18, 2025

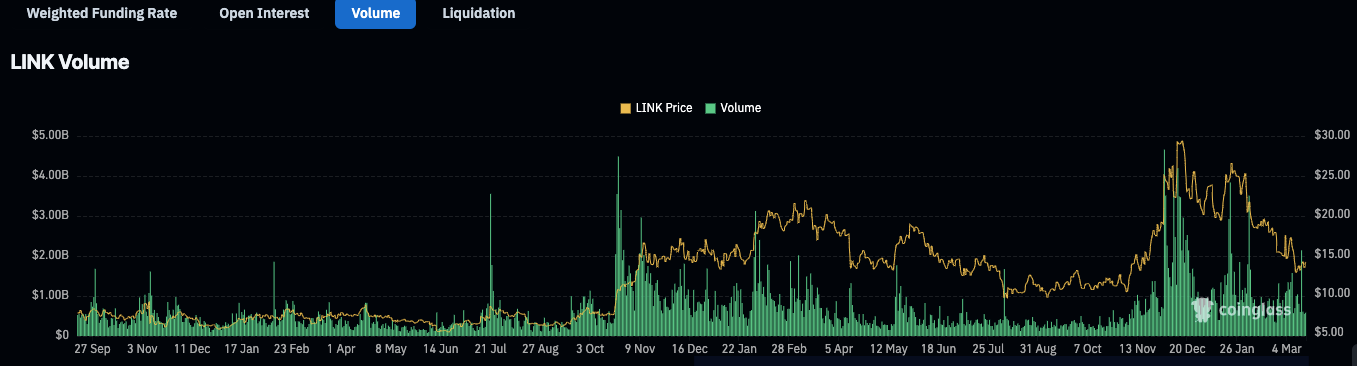

According to Coinglass, the Chainlink price has shown a noticeable shift in its derivatives data, signaling fluctuations in market activity. The latest figures indicate a significant increase in volume, which rose by 15.84%, amounting to $651.41 million.

The increased trading activity indicates a growing market involvement because of shifting investor attitudes and industry-wide market conditions. Open interest experienced minimal decline of 2.13% which reduced to $452.78 million. A decrease in the total number of open derivative contracts may explain the lower activity levels in LINK derivative markets.

Chainlink Price Analysis – Key Support and Resistance Levels to Watch

The LINK price has been experiencing a consistent trend, trading around the $13.69 mark at the time of analysis. This price action is significant, as it has recently tested various key levels. On the upside, the major resistance sits at $15.00, with the potential to surge further toward $20.00, reflecting a 42.12% upside from current levels.

If this resistance level breaks, the next target is the $20.00 region, which could set a new price rally in motion. The Awesome Oscillator stands at 0.23 which demonstrates an upward momentum. The confirmation of a strong upward trend needs further time to become clear. The Chaikin Money Flow (CMF) indicator shows neutral trading conditions with its value at 0.00.

The price currently hovers just below $15.00, a crucial level that may dictate the next price move. Conversely, the support levels near $13.00 and $10.00 could provide a safety net if the price fails to maintain momentum.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.