Highlights:

- Chainlink partners with FTSE Russell to launch the world’s first on-chain global indices on-chain.

- DataLink, Chainlink’s delivery service, will be used to publish the indices.

- FTSE Russell will benefit from Chainlink’s over 2,000 blockchain projects and major financial institutions.

Oracle Network Platform, Chainlink, has partnered with FTSE Russell to launch the world’s first global indices on-chain. Chainlink announced the partnership in a press release dated November 3. DataLink, a new data delivery service built on the Chainlink standard, will publish the indices.

With DataLink, data providers like FTSE Russell can publish information on-chain without developing their own systems. The data delivery service is backed by Chainlink’s proven technology, which has processed over $25 trillion in on-chain transactions and has secured almost $100 billion worth of Decentralized Finance (DeFi) assets.

We’re excited to announce that @FTSERussell, a leading global index provider with $18T+ in AUM benchmarked, is collaborating with Chainlink to publish its world-leading global indices onchain for the first time via DataLink.https://t.co/hCSHCvweNy

With this integration, the… pic.twitter.com/MIIhP6kTrl

— Chainlink (@chainlink) November 3, 2025

This announcement comes just days after Chainlink integrated with Stellar, an open-source blockchain network. On November 1, Crypto2Community reported that Stellar will leverage Chainlink’s tools, including its Data Feeds, Data Streams, and Cross-Chain Interoperability Protocol (CCIP), to expand into the DeFi space.

FTSE Russell Joins Chainlink’s Growing Institutional Network

FTSE Russell is one of the leading global index providers with over $18 trillion in assets under management. By joining the Oracle Network, FTSE Russell will leverage Chainlink’s over 2,000 blockchain projects and major financial institutions to become one of the first index providers to move their data on-chain. This will boost the utilization of tokenized assets by financial institutions, making it easier to develop new regulated financial products backed by trustworthy on-chain data, connecting traditional finance and blockchain technology.

Fiona Bassett, FTSE Russell’s Chief Executive Officer (CEO), welcomed the move. She said it will support innovation around tokenized assets, exchange-traded funds (ETFs), and other related products. Similarly, Sergey Nazarov, Chainlink Co-Founder, described the collaboration as a landmark moment for the industry.

Nazarov added:

“This integration demonstrates how DataLink securely and reliably enables globally-leading benchmark providers to deliver institutional-grade financial data directly into blockchain markets.”

Chainlink Supports First Cross-Border Blockchain Trade

On October 31, Banco Inter and Chainlink, in collaboration with the Central Bank of Brazil (BCB) and the Hong Kong Monetary Authority (HKMA), reportedly completed the first blockchain-based international trade finance test. This aims to enhance international commodity sales among small and medium-sized businesses.

The experiment conducted under Phase 2 of Brazil’s Drex Central Bank Digital Currency (CBDC) project tested a new trade finance system that used programmable Delivery-versus-Payment (DvP) and Payment-versus-Payment (PvP) features. These features allow for conditional and installment payments, which enable automatic release of payments after meeting certain conditions.

Notably, Chainlink linked Brazil’s Drex and Hong Kong’s Ensemble networks during the test. Meanwhile, the Global Shipping Business Network (GSBN) handled electronic Bill of Lading (eBL) transfers, marking the first time a blockchain-based title registry and a cross-chain payment system collaborated through a single automated process.

Bruno Grossi, Banco Inter’s Head of Digital Assets, said the move will positively impact customers’ financial lives. “By leveraging Chainlink to connect the BCB, the HKMA, and trade finance platforms, we’re building a more connected financial ecosystem that can underpin the future of global trade,” he added.

We’re excited to announce that Chainlink is powering cross-border DvP settlement between the Central Bank of Brazil (@BancoCentralBR) & Hong Kong Monetary Authority (@hkmagovhk) alongside Banco Inter, Standard Chartered, GSBN, & 7COMm in the Drex program.https://t.co/pdodcDMkuC… pic.twitter.com/6cIIOjif1K

— Chainlink (@chainlink) November 3, 2025

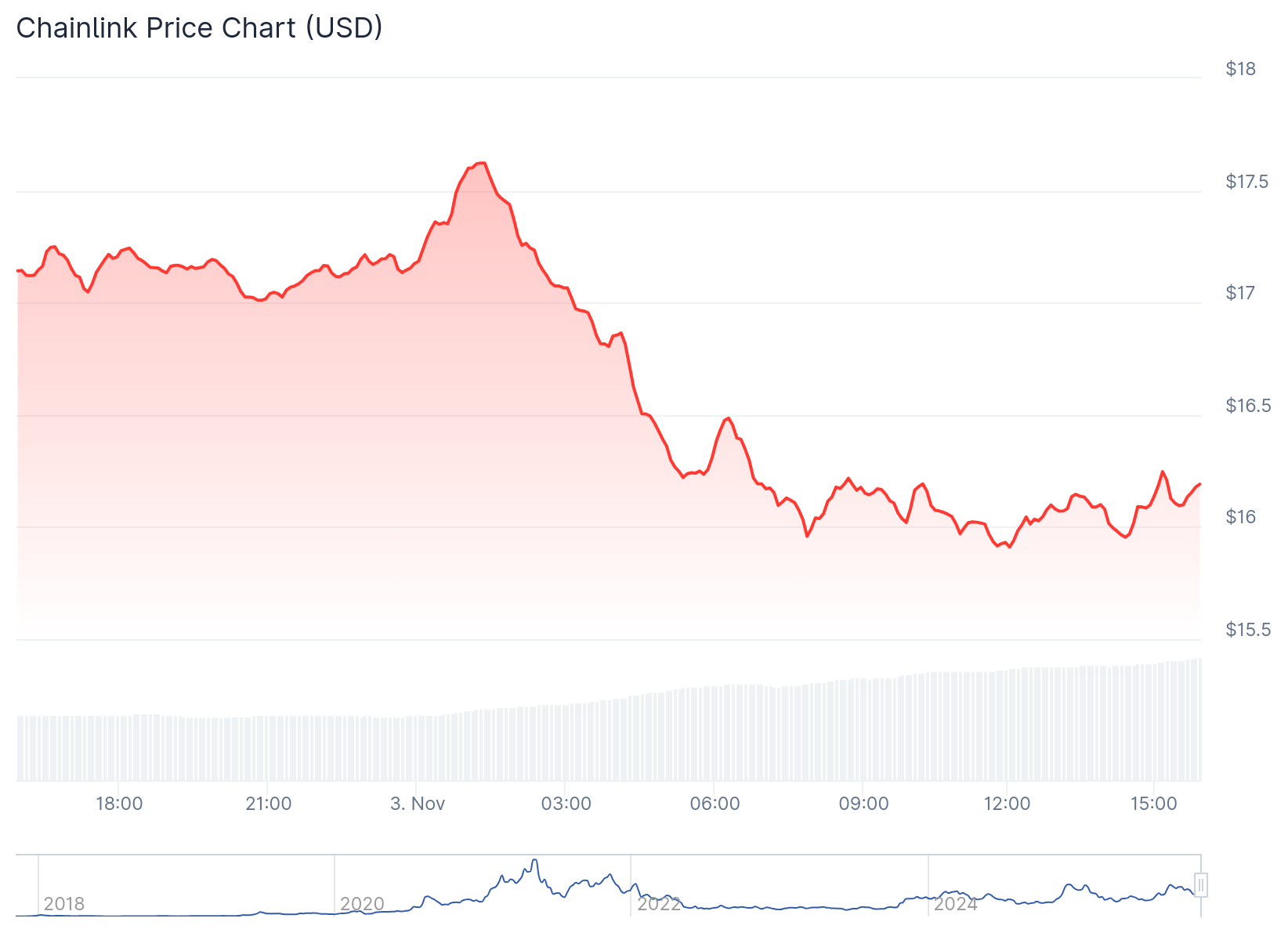

LINK’s Price Dips Despite Chainlink’s Partnership with FTSE RUSSELL

At the time of writing, LINK’s price is 5.6% down in the past 24 hours, trading at $16.22. In the past week and month, LINK dropped 11.8% and 26.1%, respectively, underscoring its current struggle. Meanwhile, on CoinGecko, it ranks as the sixteenth most valuable cryptocurrency with a market cap of $11.29 billion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.