Highlights:

- Celestia’s price has surged 9% in a week as bulls aim to propel the price high.

- Volume and Open interest have elevated, indicating growing investor confidence in the token.

- Analyst predicts TIA could rally to $8 in the short term.

The Celestia price has surged 2% today, with the TIA/USD trading at $5.90. The noticeable price movement is accompanied by an increase in its 24-hour trading volume of 51% to $167.99 million. TIA is now up 9% in a week, 13% in a month, and a whopping 182% in a year, gaining a spot among the fastest-growing tokens in the crypto sphere.

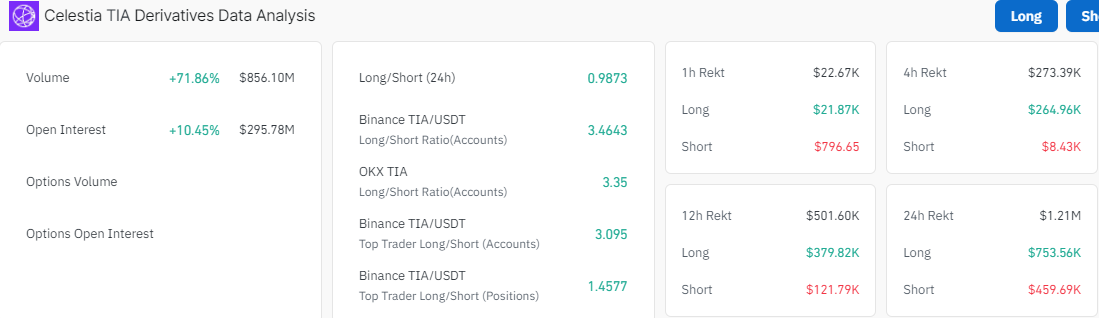

Moreover, Coinglass data upholds a bullish outlook in the Celestia market as the volume and open interest surge. The Open Interest (OI) in TIA is up 10% to $295.78M, while the volume has surged 71.86% to $856.10M. This indicates renewed interest in the token as investors’ confidence bolsters.

On the other hand, traders and investors are optimistic about the token, as the analyst aims for a movement between $8 and $10 soon.

$TIA A Strong coin, the blue box will be an ideal Entry if the Market Allows it (EMA200 4H). Looking for a Swing trade in this coin, aiming for $8 – $10 #TIA #btc #celestia #Altseason pic.twitter.com/vHTcEEZAai

— ROBZ (@RKattura) October 18, 2024

Celestia Statistical Data

Based on CoinmarketCap data:

- TIA price now – $5.90

- Trading volume (24h) – $167.99 Million

- Market cap – $1.29 billion

- Total supply – 1.08 billion

- Circulating supply – 218.19 million

- TIA ranking – #57

On September 30, the TIA price dwindled mercilessly like a dead weight in the air as the bulls established strong support at $4.77, cushioning against further losses. This led to the bulls building momentum in the market, causing a rally.

However, recently, the asset encountered resistance at $6.25, leading to a decline. This has resulted in the formation of a rounding bottom pattern in the Celestia market. This bearish momentum raises concerns about a further drop, potentially targeting the support level of $5.62.

Meanwhile, the TIA price trades well above key moving averages, including the 50-day Simple Moving average and 200-day SMA. The bulls have established immediate support at $5.51 and 5.62, tilting the odds in favor of the buyers.

Moreover, the Relative Strength Index (RSI) sits at the 55.25 level, suggesting increased buying pressure. In this case, if the bulls increase their buying appetite, the RSI could jump to the 70-overbought zone in the short term. However, if the bears step into the market as the momentum indicator (RSI) is pointing downwards, the RSI could drop below the 50-mean level, invalidating the bullish thesis.

On the other side of the fence, the Moving Average Convergence Divergence (MACD) introduces a new bearish outlook on the four-hour chart. A sell signal manifested when the blue MACD line flipped below the orange signal line, revealing that declines should be expected in the Celestia market.

Celestia Price Prediction: Which Direction Is TIA Heading?

The Celestia price is showing some mixed reactions in the 4-hour chart timeframe as both the bulls and bears struggle to take control. However, if the bulls capitalize on the RSI, which shows intense buying pressure, the TIA price could surge. Moreover, if the support levels stay intact, the TIA price could soar, targeting the next technical barrier at $6.80.

On the flip side, with the MACD indicator upholding a sell signal, the TIA price could drop. In such a case, the $5.62 support level would be in line to absorb the selling pressure. A breach and break below the support zone will cause the price to dwindle to $5.51, coinciding with the 50-day SMA.