Highlights:

- Carv price has increased by 7% to trade at $0.38 in the past 24 hours, as the market paints a bullish grip.

- The Carv team has revealed its plan to build an AI chain ecosystem, enabling large-scale data ownership.

- Carv derivatives data show new money is flowing into the market, hinting at a price surge towards $0.40.

The Carv price market outlook flaunts a bullish grip, as the token rallies about 14% in a week and 7% in a month. The Carv team has notably revealed that “it is building an AI chain ecosystem focused on secure, large-scale data ownership and sharing.” This has fueled the recent price movement in the Carv market, as analysts and investors foresee a potential surge towards higher levels.

We never stop working, never stop building, never stop expanding. We are now available on @coinsph. https://t.co/Xgmejnzyrd

— CARV (@carv_official) April 29, 2025

Carv Price Outlook

The Carv price has formed a rounding bottom pattern in the 4-hour chart outlook, as the bulls gear up for further upside. As of writing, the CARV price has increased by about 7% to trade at $0.38, painting the bigger picture bullish. Moreover, the bulls have established a strong support area at $0.33, aligning with the 50-day MA.

Intense buying appetite could cause more upside toward the $0.40 mark. However, a quick zoomed outlook at the Relative Strength Index at 71 calls for caution among traders and investors. Its position above the 70-mean level suggests that the CARV token is overbought and may need a slight correction. This allows the bulls to sweep through liquidity before spiking another leg up. Meanwhile, traders must be very cautious to avoid the bull trap in the CARV market.

Conversely, the Moving Average Convergence Divergence upholds a bullish picture, as it sits in the positive region. This indicates that the buyers can still add more CARV tokens to their portfolios, unless the MACD changes. In the meantime, the odds lean towards the bulls, calling for more buying activities in the market.

With the token portraying overbought conditions, a slight retracement towards $0.37 support could be imminent. However, if the investors and traders keep booking their profits, the Carv price could decrease to $0.35.

Carv Derivatives Data Analysis

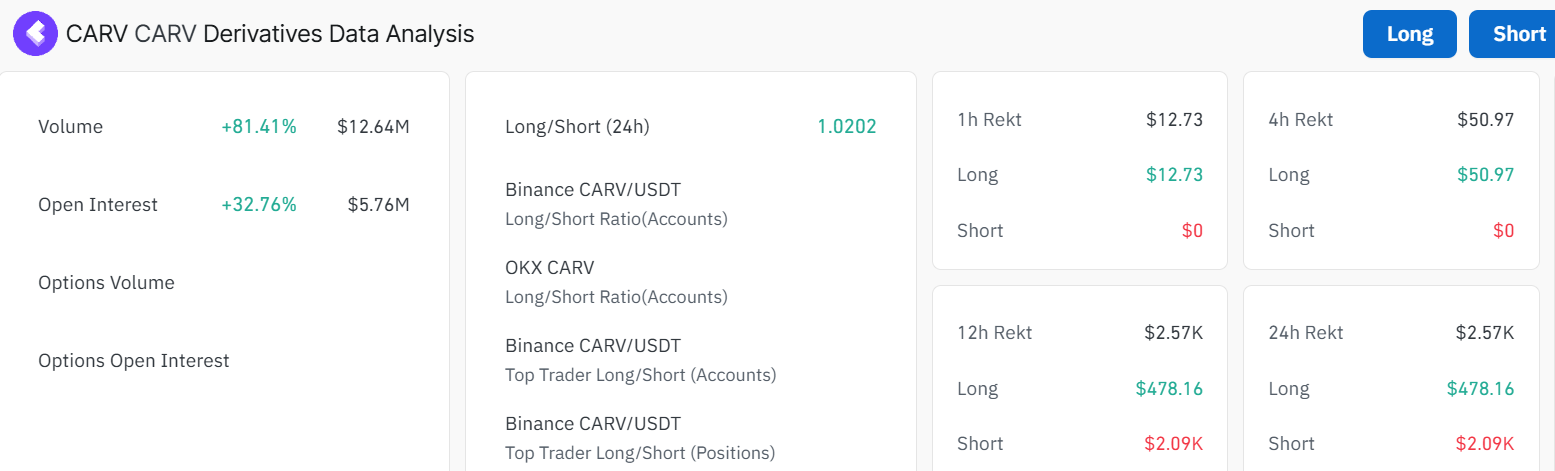

According to the Carv derivatives data analysis, the token signals a positive outlook based on on-chain metrics and Coinglass data. This is manifested as the open interest and volume have increased by about 32% and 81% to $5.76M and $12.64M, respectively. This increase indicates a rise in trading activities and that new money flows into the CARV market, potentially causing a price increase soon.

The total liquidations in the Carv market have hit $2.57K in the past 24 hours. In the same period, the long liquidations have garnered the lion’s share of about $478.16 while the short liquidations take the rest of about $2.09K. As the long liquidations surpass the short ones, it indicates that the bullish traders are facing intense pressure from the bears, forcing them to close their trading positions.

Moreover, this may lead to a potential reversal in the Carv price towards immediate support keys. With that said, it is prudent to watch out for the overbought RSI and other technical indicators, to avoid the bull trap in the Carv market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.