Highlights:

- The Pancakeswap price is up by 2% to trade at $1.95 today.

- The funding rate has turned positive, as the long-to-short ratio reinforces the bullish momentum.

- The technical outlook shows mixed signals, as the CAKE price eyes a break above the $2.01 barrier.

PanckeSwap (CAKE) is trading above the recovery trading of $1.95 at the time of writing on Thursday. The derivatives indicators support the recovery of CAKE, as the funding rate is becoming positive, and increasing the long-term investment. Moreover, the technical analysis hints to the even higher rise in case CAKE maintains the position above the major support at $1.84.

PancakeSwap Derivatives Market Outlook

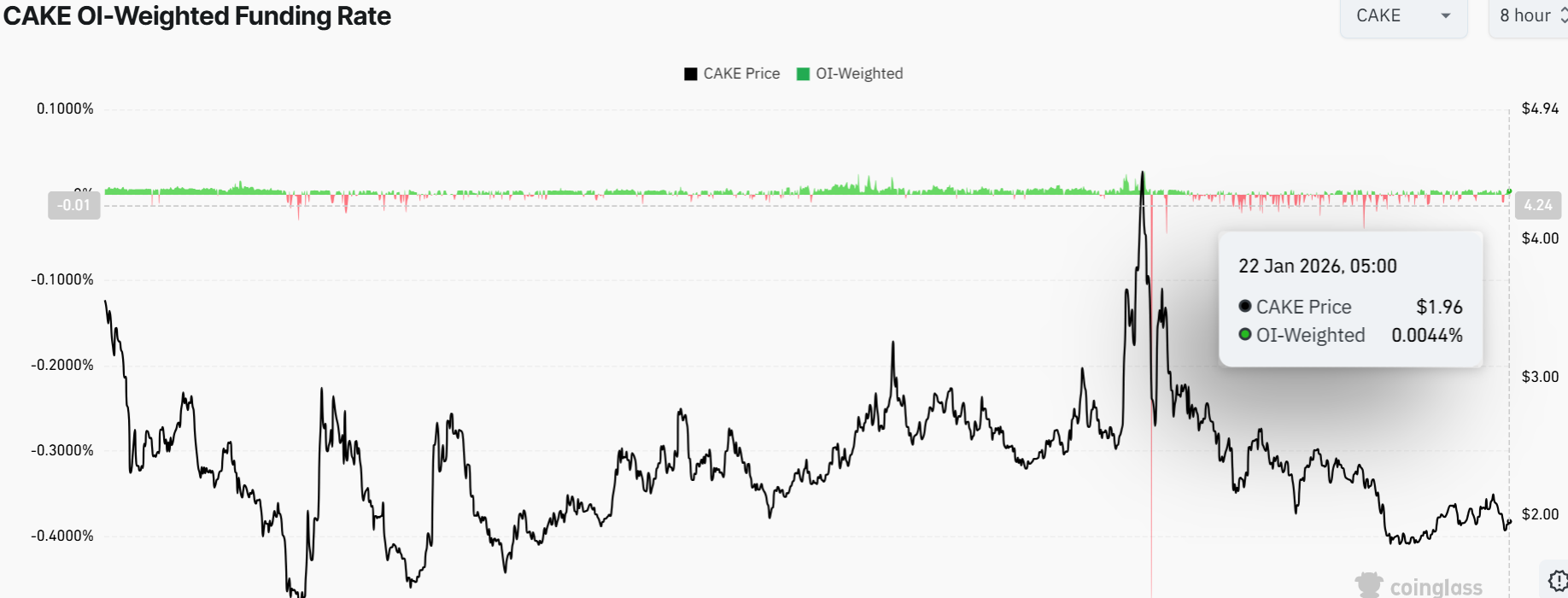

The data of OI-Weighted Funding rate of Coinglass reveals that the traders who bet that the price of CAKE would continue to fall are fewer in comparison to traders who predict that the price will increase. A positive number (longs pay shorts) shows generally that the market is bullish. On the other hand, a negative number (shorts pay longs) shows that the market is bearish.

The metric has turned a positive rate on Thursday and now stands at 0.0044%, which means that longs are paying shorts. In the past, in every instance where the funding rates have changed from negative to positive, as depicted on the chart, CAKE has witnessed a sharp rise in its price.

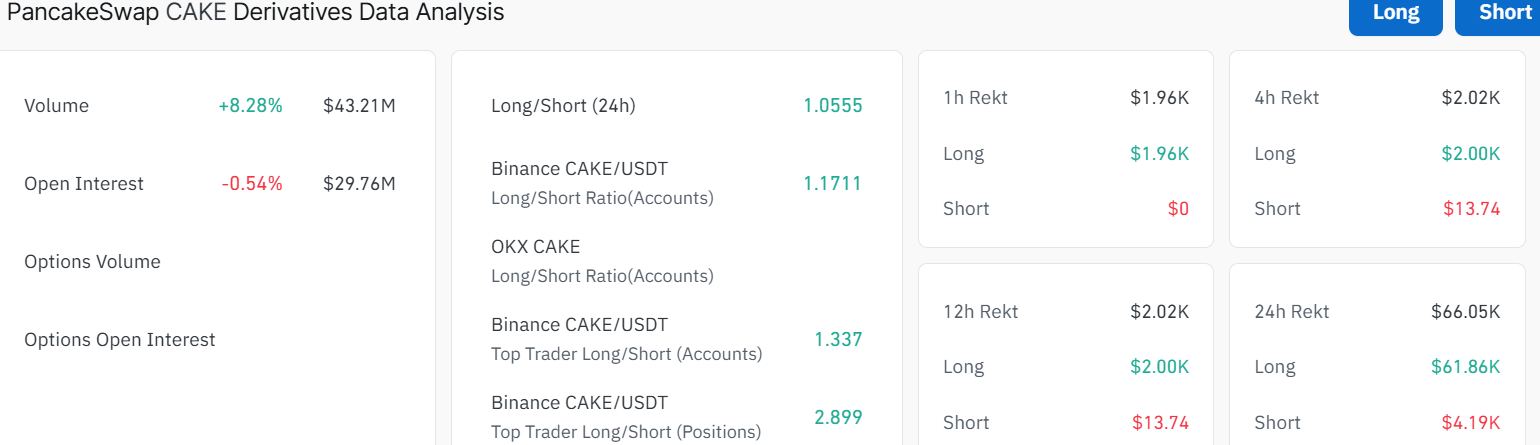

Besides the positive funding rates, the long-to-short ratio of Coinglass on CAKE sits at 1.05 on Thursday. The above ratio is above one, indicating that more traders bet that PancakeSwap is going to rally.

Besides bullish derivatives information, the max supply reduction proposal by CAKE was passed on Monday. Its max supply is being cut down to 400 million (that is lower than 450 million before), and the burns always exceed the emissions.

🗳️ The CAKE Max Supply Reduction Proposal has passed!

✅ Max supply has now been adjusted to 400M CAKE

🙏Thank you to our community for the thoughtful discussion and votes

With CAKE’s max supply reduced to 400M, we’re reinforcing long-term sustainability and a… https://t.co/9wzsGbcbOl

— PancakeSwap (@PancakeSwap) January 19, 2026

This is a positive long-term trend that will benefit CAKE. This is because a decreased maximum supply and constant token burns will narrow the circulating supply, which will trigger a scarcity and price increase.

CAKE Bulls Eye a Break Above $2.01 Barrier

Technical analysis of the CAKE price shows that the coin is trying to break above its 50-day simple moving average (SMA) of $2.01, as the long-term resistance lies around $2.49, aligning with the 200-day SMA. The relative strength index (RSI) sits at 45.95, signalling that PncakeSwap is neither overbought nor oversold. In other words, there’s room for more upside movement before any strong correction is likely.

CAKE has been largely range-bound between $1.84 support and $2.01 resistance. If the token can hold above the $2.01 level, the next resistance sits near $2.43 and then $2.49. A successful break could see CAKE push towards the psychological $2.87 level and perhaps even challenge the $3.50 level if momentum gathers pace.

On the downside, if sellers take control, the PancakeSwap price could slide back to $1.84 or fall further to $1.78, which would test investor patience and likely bring in new dip buyers. Looking ahead, CAKE price may see an increase once the bulls break above the $2.01 barrier, with typical target ranges moving towards $2.43 and possibly extending to $2.49 if bullish signals persist.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.