Highlights:

- Santiment has revealed significant drops in BTC’s exchange supply.

- The declining exchange supply reflects growing individual and institutional interest in Bitcoin.

- The on-chain firm stated the shift could catalyze a Bitcoin price rally.

Analytical intelligence firm Santiment revealed that Bitcoin’s (BTC) exchange supply has dropped to a record low. In an X post, Santiment noted that Bitcoin’s supply ratio on exchanges plummeted to about 7.53%, marking its lowest point since February 20, 2018.

The analytical intelligence firm stated that this trend reflects growing investors’ interest in Bitcoin. It added that despite BTC’s short-term volatility, traders are comfortably holding it long-term.

Implications of BTC’s Exchange Supply Declines

According to Santiment, declining exchange supply suggests a decrease in short-term selloffs, especially from retail investors. The on-chain firm also noted that cryptocurrencies held outside exchanges are stored in cold wallets, reflecting traders’ reluctance to sell quickly.

Furthermore, Santiment mentioned that cold storage reduces the number of tokens available for spot trading. This will protect Bitcoin from sudden price declines in volatile market conditions. The on-chain tracker added that the persistent low exchange supply could trigger market spikes.

Beyond protecting BTC’s price from sudden declines, Santiment noted that the accumulation trend suggests behavioral shifts. The analytical intelligence firm claimed that increasing self-custody or secure institutional storage shows traders view Bitcoin as a store of value, not just a mere speculative asset. Santiment added that this helps to promote market maturity and stability.

💸 Bitcoin's ratio of supply on exchanges has officially dropped to as low as 7.53%, the lowest since February 20, 2018. The 7-year milestone reflects a continued trend of investors of crypto's top asset feeling comfortable 'hodling' for the long-term, regardless of short-term… pic.twitter.com/m7d6Yon5HR

— Santiment (@santimentfeed) March 26, 2025

BTC ETFs Record Consecutive Gains as Accumulation Trends Remain Strong

On March 26, Bitcoin ETFs attracted cash inflows worth $89.57 million to mark their ninth consecutive gain. Last month, the funds suffered massive selloffs, recording net inflows on just five days.

The selling pressure persisted into the first few days of March. Between March 3 and March 13, Bitcoin ETFs recorded gains on only one occasion. However, they bounced back after the last net outflow on March 13. This new trend corroborates Santiment’s claims of growing individual and institutional interest in Bitcoin.

On March 26, U.S. spot Bitcoin ETFs saw a total net inflow of $89.57 million, marking the ninth consecutive day of net inflows. In contrast, spot Ethereum ETFs recorded a total net outflow of $5.89 million, with none of the nine ETFs seeing any net inflow.https://t.co/Hj2Gs48E6C

— Wu Blockchain (@WuBlockchain) March 27, 2025

Meanwhile, institutions are not relenting in their quest to expand their Bitcoin holdings. Firms like Strategy, Metaplanet, and GameStop have shown marked interest in BTC with consistent purchases and fundraisers to finance their purchases.

On March 26, retail company GameStop announced plans to raise $1.3 billion from stock sales to buy more Bitcoin for its treasury. The announcement came a few days after the company disclosed interest in keeping Bitcoin as a treasury reserve holding.

On March 24, Metaplanet completed its fifth Bitcoin purchase this month. The company spent $12.6 million to add 150 BTC to its stack, increasing its coin holdings to about 3,350 tokens. The investment firm’s consistent purchase aligns with its target of increasing its Bitcoin stores to 10,000 by the end of this year and 21,000 by the end of 2026.

Strategy also announced that it expanded its Bitcoin holdings on the same date as Metaplanet. The American-based firm and largest corporate holder of Bitcoin said it acquired 6,911 BTC worth $584 million, increasing its Bitcoin stores to about 506,137 BTC.

Bitcoin Remains Below $90,000 Despite Rising Interest

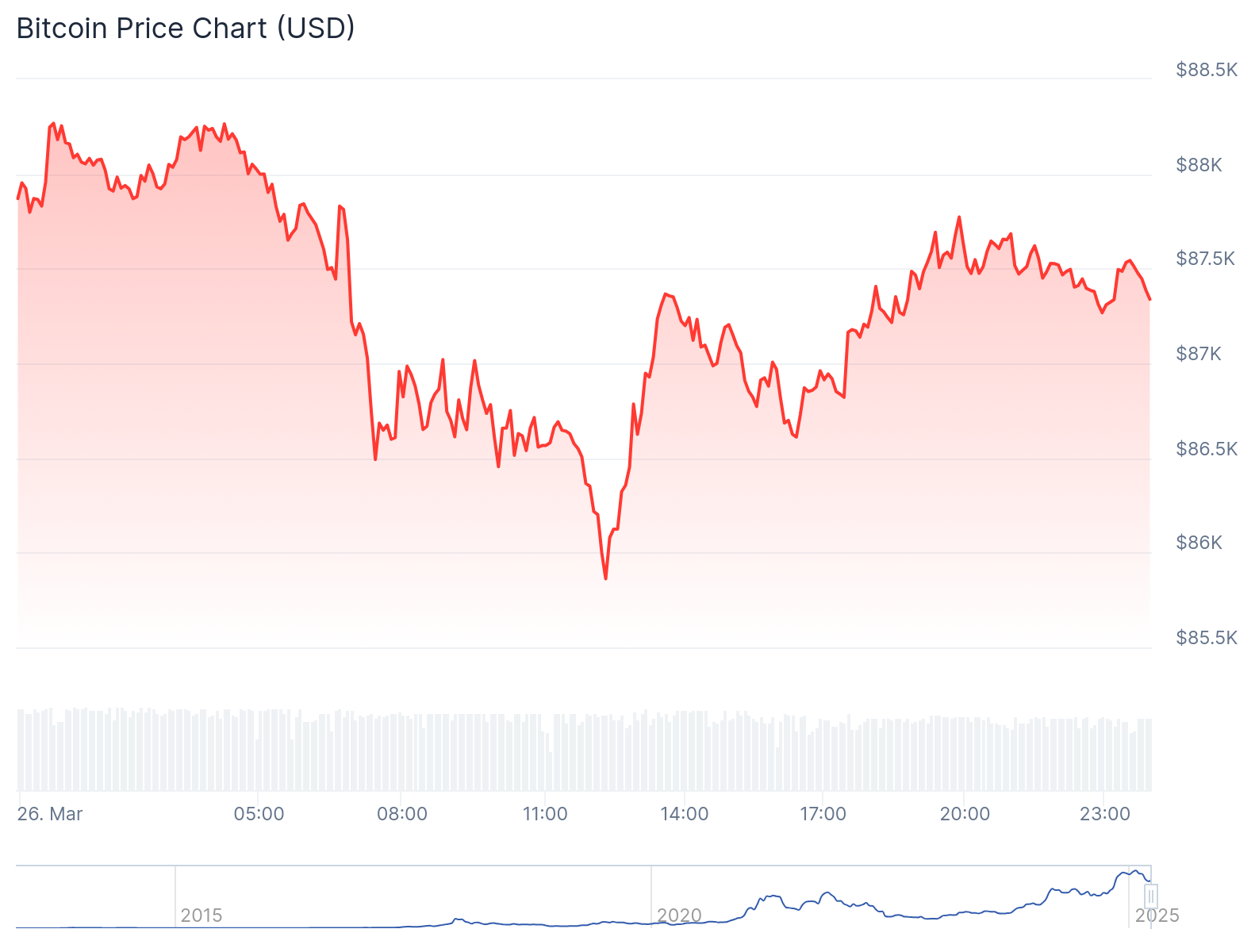

Bitcoin is down 0.3% in the past 24 hours, trading at about $87,300. Within the same timeframe, Bitcoin’s price extremes have oscillated between $85,862.55 and $88,267.90. This range highlights Bitcoin’s struggle to reclaim $90,000. Meanwhile, Bitcoin has a market capitalization of approximately $1.73 trillion. Its 24-hour trading volume has dropped 8.21% to about $26.52 billion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.