Highlights:

- BTC ETFs began the new week positively, amassing over $450 million in net inflows.

- The latest flow trend followed BTC’s incredible price surge that saw the token reclaim the $70,000 mark.

- Unlike Bitcoin, Ethereum ETFs registered another loss to mark a second consecutive day of accumulating net outflows.

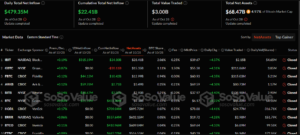

Exchange Traded Funds (ETFs) flow data for this week’s first trading day has emerged, with Bitcoin (BTC) ETFs maintaining stellar performance. According to SosoValue’s data, the Bitcoin commodities welcomed roughly $479.35 million in net gains on October 28. The latest flow data implies that the Bitcoin entities have welcomed net outflows on only one occasion since October 11.

💥BREAKING: Yesterday the Spot #Bitcoin ETF saw $479.35 MILLION inflow! pic.twitter.com/pewaO9u6aB

— Crypto Rover (@rovercrc) October 29, 2024

Meanwhile, the most recent flow statistics emerged amid Bitcoin’s incredible price actions. For context, Bitcoin finally broke above $70,000 after several attempts. At the time of press, the pioneer cryptocurrency is up by about 4.3% in the past 24 hours, with about $71,100 in selling price. Within the same timeframe, BTC recorded minimum and maximum prices, ranging between $68,145.74 – $71,540.92. In a 7-day-to-date interval, the price extremes reflected $65,441.77 – $71,268.18, following a 5.2% upswing.

The price extremes above underscore BTC’s resilience amid unfavorable conditions that kept it below $70,000 for months. Following its considerable price jump, Bitcoin’s market cap soared to about $1.4 trillion. Its 24-hour trading volume spiked by about 131.54% to approximately $47.19 billion.

BlackRock Remarkable Inflows Trend Continues

In the most recent ETF flow data, only five entities were active. All recorded profits, while the remaining six witnessed zero flows as no commodity registered outflows. In the over $450 net inflows, BlackRock’s Bitcoin ETF (IBIT) contribution was worth over 50% of the total profit. Notedly, the entity witnessed $315.19 million in gains.

Other profitable commodities welcomed inflows worth $10 million. They include ARK 21Shares Bitcoin ETF (ARKB) with $59.78 million, Fidelity Bitcoin ETF (FBTC) with $44.12 million, Bitwise Bitcoin ETF (BITB) with $38.67 million, and Grayscale Mini Bitcoin ETF (BTC) with $21.59 million.

The latest input from the five entities above saw Bitcoin ETFs’ cumulative net inflows skyrocket to $22.41 billion. The total value traded and net assets also spiked remarkably to about $3 billion and $68.47 billion, respectively. Meanwhile, the total net assets represent 4.97% of Bitcoin’s market capitalization.

Ethereum ETFs Bleed for Second Consecutive Day

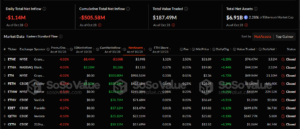

Unlike Bitcoin, Ethereum (ETH) ETFs have remained significantly poor, with unimpressive statistics. The commodities registered their second consecutive net outflows. Despite boasting two profitable entities, with one ETF that amassed losses, Ethereum ETFs October 28 data reflected $1.14 million in net outflows.

As usual, the only outflow contribution came from Grayscale Ethereum ETF (ETHE) at about $8.44 million. On the other hand, profitable inputs stemmed from Fidelity Ethereum ETF (FETH) and BlackRock Ethereum ETF (ETHA). Both commodities welcomed gains of about $5.02 million and $2.28 million, respectively.

Consequently, Ethereum ETF cumulative net inflows wallowed in losses of about $505.58 million. The total value traded was roughly $187.49 million, while total net assets reflected $6.91 billion. The net assets valuation now represents 2.28% of Ethereum’s market capitalization.

Ethereum Records Impressive Market Variables

Like Bitcoin, Ethereum is up by 4.4% in the past 24 hours, displaying about $2,600 in selling price. ETH’s 24-hour trading volume has spiked by approximately 74.66%, boasting a $21.49 billion valuation. While its short-term variables might seem impressive, Ethereum long-term state displayed otherwise.

For context, the world’s number one altcoin’s 7-day-to-date and month-to-date price change data reflected slight declines. They witnessed price drops of about 0.9% and 0.8%, respectively.