Highlights:

- BTC ETFs have witnessed yet another massive inflows worth over $300 million.

- On the other hand, ETH ETFs welcomed losses of over $10 million.

- Bitcoin price maintained its upward trajectory with considerable increments as Ethereum stabilized around the $2,600 region.

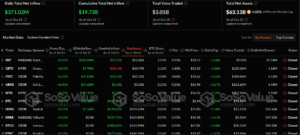

On October 15, Bitcoin (BTC) Exchange Traded Funds (ETFs) witnessed another massive net inflow surge, mirroring the general crypto market. According to SosoValue’s statistics, the commodities welcomed about $371.02 million in their most recent outing.

The latest recorded value marks the third consecutive day of registering inflows for Bitcoin ETFs. Interestingly, the entities never recorded values below $200 million within the three days, underscoring a booming ETF market. Unlike Bitcoin, its Ethereum (ETH) counterparts have not been impressive, with poor market readings. In their October 15 data, the ETH commodities witnessed $12.7 million in net outflows.

On October 15, the total net inflow of US Bitcoin spot ETFs was $371 million. The inflow of BlackRock ETF IBIT was $289 million. The outflow of Ethereum spot ETF was $12.7031 million. https://t.co/59u0BnEqLG

— Wu Blockchain (@WuBlockchain) October 16, 2024

IBIT Bounces Back with Over $200 Million in Inflows

Like yesterday’s ETF flow publication, the latest tabulated statistics saw heightened activeness from eight of eleven recognized commodities. Interestingly, all eight entities witnessed only gains, as none recorded losses. Meanwhile, the inactive entities include Valkyrie Bitcoin ETF (BRRR), Invesco Bitcoin ETF (BTCO), and Franklin Bitcoin ETF (EZBC).

After taking the front seat in inflows for two consecutive market outings, BlackRock Bitcoin ETF (IBIT) has finally outpaced Fidelity Bitcoin ETF (FBTC) by a massive margin. For context, IBIT witnessed $288.84 million gains, while FBTC welcomed $35.03 million. Aside from IBIT and FBTC, only two other entities saw profits above $10 million. They include ARK 21Shares Bitcoin ETF (ARKB) with $14.68 million and Grayscale Mini Bitcoin ETF (BTC) with $13.36 million.

Other commodities with less than $10 million in profits were Grayscale Bitcoin ETF (GBTC), VanEck Bitcoin ETF (HODL), WisdomTree Bitcoin ETF (BTCW), and Bitwise Bitcoin ETF (BITB). They registered gains of roughly $7.99 million, $7.56 million, $2.84 million, and $727.82k, respectively.

Consequently, the cumulative net inflow is edging closer to $20 billion. The current valuation is about $19.73 billion. Meanwhile, The total value traded and net assets saw significant increments, bringing their valuations to $3.05 billion and $63.13 billion, respectively. The total net assets represented 4.8% of BTC’s market capitalization.

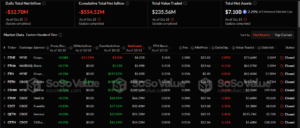

Ethereum ETFs Record Drastically Reduced Activeness

Unlike Bitcoin, Ethereum ETFs continued to thread poorly, with minimal commodities’ activeness. The most recent statistics revealed that only two entities were active, as one recorded gains while the other saw losses. The only outflows came from Grayscale Ethereum ETF (ETHE) with $15.29 million. On the other hand, Fidelity Ethereum ETF (FETH) contributed the only gains with $2.59 million.

Following the latest flow trend, the entities’ cumulative inflows depleted further in losses of about $554.52 million. Conversely, the total value traded and net assets soared considerably to about $235.56 million and $7.1 billion, respectively.

Bitcoin Clinches $67,000 as Ethereum Stabilizes Around $2,600

At the time of writing, Bitcoin is changing hands at about $67,150, reflecting a 2.3% upswing in the past 24 hours. Within the same timeframe, the flagship crypto has fluctuated between $64,885.69 and $67,803.50, underscoring a marked jump in a short time frame.

On the other hand, Ethereum displayed a $2,620 selling price, with a subtle 0.4% upswing in the past 24 hours. In its 24-hour-to-date minimum and maximum price limits, ETH displayed levels ranging between $2,543.48 – $2,677.39. ETH 24-hour price extremes underscore value stabilization around the $2,600 region.