Highlights:

- BTC ETFs recorded their second consecutive net outflows after forfeiting over $100 million.

- ETH ETFs sustained their impressive form with a third consecutive net inflow.

- Bitcoin price continues to struggle, and Ethereum shows subtle signs of recovery.

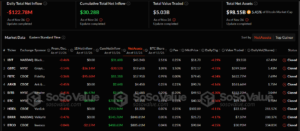

On November 26, Bitcoin (BTC) Exchange Traded Funds (ETFs) recorded another net outflow after losing over $400 million in their previous outing before their most recent one. According to the most recent ETF flow data, the Bitcoin commodities welcomed roughly $122.78 million in losses.

💥BREAKING: Yesterday the Spot #Bitcoin ETF saw $122.80 MILLION OUTFLOW! pic.twitter.com/qMyJEYmh4W

— Crypto Rover (@rovercrc) November 27, 2024

The net outflow above suggests that Bitcoin ETFs have never recorded any profitable outings since this week began. Contrary to Bitcoin ETFs’ newly established unimpressive trend, Ethereum (ETH) ETFs seem encouraging, with their third straight positive flow.

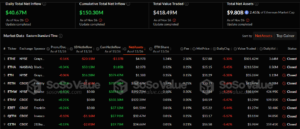

Per SosoValue’s ETF flow data, ETH ETFs attracted roughly $40.67 million in its November 26 market outing. The commodities’ newly attracted cash inflows might signify that they are gradually recovering from their previous six consecutive losses that ensued between November 14 and 21.

On November 26, the Bitcoin spot ETF had a total net outflow of $123 million, and the Ethereum spot ETF had a total net inflow of $40.6741 million yesterday. https://t.co/59u0BnEqLG

— Wu Blockchain (@WuBlockchain) November 27, 2024

BlackRock Could Not Save Bitcoin ETFs

Considering the value forfeited in yesterday’s market outing, one could assert that BlackRock Bitcoin ETFs (IBIT) would have averted the loss if the entity had not recorded zero flows. For context, over months of gracing the market, IBIT’s average profitable input reflected $142.3 million.

Aside from IBIT, five other commodities recorded zero flows. They include ARK 21Shares Bitcoin ETF (ARKB), VanEck Bitcoin ETF (HODL), Valkyrie Bitcoin ETF (BRRR), Franklin Bitcoin ETF (EZBC) and WisdomTree Bitcoin ETF (BTCW).

Nevertheless, five other entities were active. However, only two saw gainful outings, while the remaining three incurred losses. Fidelity Bitcoin ETF (FBTC) continued its poor trend with a second consecutive outflow. The entity experienced losses worth approximately $95.7 million.

Other commodities that saw net outflows include Grayscale Bitcoin ETF (GBTC), with $36.14 million, and Invesco Bitcoin ETF (BTCO), with $2.27 million. For gains, Bitwise Bitcoin ETF (BITB) recorded $6.47 million in inflows. Grayscale Mini Bitcoin ETF (BTC) experienced $4.84 million in profits.

With the back-to-back losses, Bitcoin ETF cumulative net inflow has dropped to about $30.28 billion. Similarly, the total value traded and net assets mirrored the same declining pattern. Their valuations plummeted to about $5.03 billion and $98.15 billion, respectively.

Ethereum ETFs Record Heightened Activities

Unlike Bitcoin, Ethereum ETFs recorded increased activeness. Six entities were active on November 26. Four recorded outflows, while only two were profitable. BlackRock Ethereum ETF (ETHA) witnessed $50.13 million in gains, while Grayscale Mini Ethereum ETF (ETH) attracted $16.28 million.

Grayscale Ethereum ETF (ETHE) topped the losses chart with about $20.11 million in outflows. Other entities that encountered losses include 21Shares Ethereum ETF (CETH) ($2.81 million), Fidelity Ethereum ETF (FETH) ($1.65 million), and Invesco Ethereum ETF (QETH) ($1.16 million).

With the most recent flow contributions, Ethereum ETF cumulative net inflow has spiked to about $150.3 million. The total value traded was $418.49 million, while total net assets reflected $9.8 billion.

Bitcoin and Ethereum Price Concerns

Considering the impacts of ETF flows on digital asset prices, market participants are seemingly concerned about how the latest trend tends to impact BTC and ETH prices. Bitcoin has retraced significantly over the past few days, coinciding within the same period with unimpressive ETF outings.

At the time of press, flagship crypto changed hands at about $93,150, reflecting a 1.7% upswing in the past 24 hours. It boasts roughly $1.8 trillion in market capitalization, with about $96.7 billion in 24-hour trading volume. On the other hand, Ethereum is changing hands at about $3,420. Despite a 0.4% decline in the past 24 hours, its price extremes within the same time frame fluctuated between $3,262.47 and $3,436.26.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.