Highlights:

- BTC ETFs recorded a significant recovery on October 11 to conclude the week in net profits.

- Ethereum ETF woes continue with another net outflow that saw it conclude the week in losses.

- Bitcoin’s price surged considerably, as Ethereum’s price appreciated slightly to edge closer to $2,500.

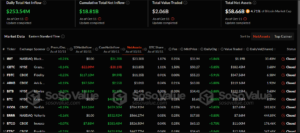

After losing over $100 million in yesterday’s Exchange Traded Funds (ETFs) flow news coverage, Bitcoin (BTC) ETFs witnessed a massive rebound in its most recent data. According to SosoValue’s statistics, the commodities welcomed a whopping $253.54 million on October 11. With the latest flow data, BTC ETFs concluded the week with only two profitable trading days out of five.

Despite the fewer gainful outings, the entities still concluded the week with net profits of about $308.76 million, underscoring a significantly profitable outing. Unlike Bitcoin, its Ethereum (ETH) counterparts welcomed net outflows in its October 11 flow data. Per the on-chain ETF tracker, the ETH entities saw losses of approximately $97.11K. Consequently, Ethereum ETFs concluded the week with only one profitable day, two days of seeing losses, and two other days of experiencing zero flows. Overall, Ethereum ETFs recorded roughly $5.22 million in weekly losses.

On October 11, the total net inflow of Bitcoin spot ETFs was $254 million. The inflow of Fidelity ETF FBTC was $117 million, and the inflow of ARKB was $97.5837 million. The net outflow of Ethereum spot ETF was $97,100. https://t.co/59u0BnEqLG

— Wu Blockchain (@WuBlockchain) October 12, 2024

Bitcoin ETFs Attract Investors with Heightened Activities

According to SosoValue’s tabulated flow statistics, six Bitcoin ETFs recorded activities, while five saw zero flows. Grayscale Bitcoin ETF (GBTC) registered the only outflow at about $22.09 million. Interestingly, Fidelity Bitcoin ETF (FBTC) and ARK 21Shares Bitcoin ETF (ARKB) topped the profits chart with $117.1 million and $97.58 million, respectively.

Other entities that witnessed inflows include Bitwise Bitcoin ETF (BITB), VanEck Bitcoin ETF (HODL), and Invesco Bitcoin ETF (BTCO). They welcomed profits of approximately $38.81 million, $14.26 million, and $7.88 million, respectively. Consequently, Bitcoin ETF cumulative net inflow soared to about $18.81 billion. Interestingly, the total value traded and net assets spiked significantly to roughly $2.06 billion and $58.66 billion, respectively.

Ethereum ETFs See Minor Activities on the Last Trading of the Week

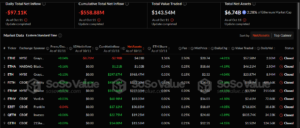

Unlike Bitcoin, Ethereum ETFs witnessed a drastic reduction in market actions. Per the on-chain ETF tracker, only two commodities were active yesterday. Notedly, Grayscale Ethereum ETF (ETHE) attracted the only outflows with $8.71 million. Conversely, Fidelity Ethereum ETF (FETH) registered the only gains with about $8.61 million.

Following the latest flow data, Ethereum ETFs’ cumulative net inflow has remained red, depicting losses of about $558.88 million. Meanwhile, the total value traded and net assets recorded slight increments, bringing their new valuations to about $143.54 million and $6.74 billion, respectively.

Bitcoin Price Records Significant Increment, Mirroring the Positive ETF Flow

At the time of writing, Bitcoin displayed a 3.2% upswing in the past 24 hours with about $62,700 in selling price. Within the same time frame, the flagship cryptocurrency fluctuated between $60,784.54 and $63,361.72, underscoring a remarkable jump in just a day. Other relevant market variables revealed that BTC boasts about $1.24 trillion in market capitalization. Meanwhile, its 24-hour trading volume is down by about 3.77% with a $29.03 billion valuation.

Ethereum Records a Slight Spiked as it Edges Closer to $2,500

Ethereum recorded a 1.4% upswing in the past 24 hours, with about $2,445 in selling price. Its minimum and maximum price limits in a daily time frame were $2,409.99 – $2,464.47, reflecting a significantly stable price movement. Notedly, Ethereum’s market capitalization was $294.4 billion. Its 24-hour trading volume is down by 16.15%, with a $12.59 billion valuation.