Highlights:

- BTC ETFs’ persistent outflows enter their third consecutive day with over $200 million outflows.

- Ethereum ETFs rebound significantly with over $100 million to terminate their back-to-back outflow trend.

- Market experts predict that altcoin bull season is imminent following the recent surge.

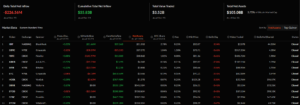

Bitcoin (BTC) and Ethereum (ETH) Exchange Traded Funds (ETFs) flow data for December 23 have emerged, revealing that BTC commodities outflows persisted, while ETH ETFs rebounded after two consecutive outflows. Per renowned on-chain ETF tracker SosoValue, Bitcoin ETFs latest $227 million loss implied that the commodities woes have extended into their third straight day.

Bitcoin spot ETF had a total net outflow of $227 million on December 23, with net outflows for three consecutive days. The total net asset value of Bitcoin spot ETF is $105.084 billion.https://t.co/59u0BnEqLG pic.twitter.com/aPC9KmJSDT

— Wu Blockchain (@WuBlockchain) December 24, 2024

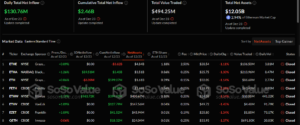

On the other hand, Ethereum ETF flow data finally turned green after attracting $131 million in cash inflows. Considering Ethereum’s declining market actions, the latest profitable input could spur a positive turnaround for the embattled cryptocurrency if it remains sustainable.

On December 23, the total net inflow of Ethereum spot ETFs was $131 million. The net inflow of BlackRock ETF ETHA was $89.5129 million, and the net inflow of Fidelity ETF FETH was $46.3713 million. https://t.co/Tvs2oCSxTg pic.twitter.com/6yL1VRJ8W7

— Wu Blockchain (@WuBlockchain) December 24, 2024

Bitcoin ETFs Record Heightened Activeness

On December 23, eight Bitcoin entities were active, highlighting a significantly busy ETF market. Unfortunately, only BlackRock Bitcoin ETF (IBIT) registered profits, as the remaining seven commodities attracted losses. IBIT’s attracted gains were about $31.64 million, which seemed meager compared to its previous outings.

In losses, Fidelity Bitcoin ETF (FBTC) topped the chart with approximately $145.97 million in cash outflows. Four other ETFs recorded losses above $10 million. They include Grayscale Bitcoin ETF (GBTC) ($38.39 million), Invesco Bitcoin (ETF) ($25.56 million), Bitwise Bitcoin ETF (BITB) ($23.75 million), ARK 21Shares Bitcoin ETF (ARKB) ($15.75 million).

Other entities that attracted cash outflows include Grayscale Mini Bitcoin ETF (BTC) with $6.18 million and VanEck Bitcoin ETF (HODL) with $2.62 million. Following the fresh setback, Bitcoin ETF cumulative net inflows dropped from $36.05 billion to about $35.83 billion. Similarly, the total value traded declined from $4.09 billion to $3.52 billion. Meanwhile, the total net assets reflected $105.08 billion, representing 5.7% of Bitcoin’s $1.868 trillion market capitalization.

ETHA Leads Ethereum ETFs Surge

Unlike Bitcoin, Ethereum ETFs recorded reduced market actions, with only four active entities. Grayscale Mini Ethereum ETF (ETH) experienced the only outflows valued at about $6.09 million. Meanwhile, the profitable entities include BlackRock Ethereum ETF (ETHA) ($89.51 million), Fidelity Ethereum ETF (FETH) ($46.37 million), and Bitwise Ethereum ETF (ETHW) ($963.72K).

With the new gainful contribution, Ethereum ETF cumulative net inflows increased from about $2.33 billion to approximately $2.46 billion. In addition, the total value traded was roughly $494.25 million, while the total net assets reflected $12.05 billion. It is worth noting that the total net assets represented 2.94% of Ethereum’s $409.4 billion market capitalization.

ETH ETFs Resurgence Spews Altcoins Incoming Rally Sentiments

According to several market experts and analysts, Ethereum ETFs’ recent rebound indicates that the altcoin bull season seems imminent. Communicating a similar sentiment, TedPillows noted in one of his recent tweets that Bitcoin dominance is dropping.

Still, in the same tweet, he cited Ethereum ETFs’ latest net inflow, adding that the time for Ethereum has arrived, which invariably implies that the altcoins market rally would kick off soon.

The time for Ethereum has arrived, as I mentioned in an earlier tweet.

Altseason is on the horizon, with Bitcoin dominance rapidly declining.

Ethereum ETF inflow👇🏻 pic.twitter.com/Y8h4G3sWoV

— Ted (@TedPillows) December 24, 2024

Ethereum Recovers Slightly Amid Positive ETFs Outing

At the time of press, Ethereum is changing hands at approximately $3,400, reflecting a 3.4% upswing in the past 24 hours. In addition, its price extremes ranged between $3,270.40 and $3,460.89. The 24-hour price limits highlighted the possibility of reclaiming $3,500 soon.

On the other hand, Bitcoin is down by about 0.9%, displaying roughly $94,300 in selling price. In the past 24 hours, BTC has fluctuated between 92,441.87 and $96,386.08 as minimum and maximum prices, respectively. BTC’s price limit highlights BTC’s struggle despite the short time interval.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.