Highlights:

- BTC and ETH ETFs have attracted significant cash inflows in their October 17 data.

- Bitcoin commodities saw over $400 million in profits, while Ethereum entities welcomed over $40 million.

- Bitcoin and Ethereum prices seem unshaken despite the impressive gains.

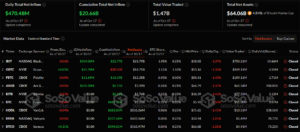

In their most recent flow data, Bitcoin (BTC) and Ethereum (ETH) Exchange Traded Funds (ETFs) attracted significant cash inflows to continue their impressive market runs. According to on-chain ETF tracker SosoValue, the Bitcoin commodities welcomed $470.84 million in gains.

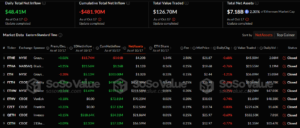

Meanwhile, its ETH counterparts recorded profits of about $48.41 million. Notedly, BTC ETFs latest recorded gains marked its fifth consecutive profitable outing. On the other hand, Ethereum ETF inflows marked their second straight gainful day.

It is worth noting that the over $400 million inflows imply that the BTC commodities have never recorded values less than $350 million this week. Meanwhile, the over $40 million gains became Ethereum ETFs’ weekly highest inflows after exceeding the $24.22 million recorded on October 16.

On October 17, the total net inflow of Bitcoin spot ETFs was $470 million. The inflow of BlackRock ETF IBIT was $309 million. Ark Invest and 21Shares' ETF ARKB had a net inflow of $100 million. Ethereum spot ETF inflow was $48.4 million. https://t.co/59u0BnEqLG

— Wu Blockchain (@WuBlockchain) October 18, 2024

BlackRock Dominates Bitcoin ETFs Inflows for the Third Consecutive Day

Relative to the past few days, Bitcoin ETFs’ October 17 flow data witnessed a slight reduction in commodities’ activeness. Notably, only five of eleven entities were active. However, all attracted cash inflows, while the remaining six registered zero flows.

Interestingly, BlackRock Bitcoin ETF (IBIT) continued its domineering performance with a third straight day of recording profits above $200 million. For context, IBIT saw approximately $309 million in gains in its most recent flow statistics.

Aside from IBIT, only ARK 21Shares Bitcoin ETF (ARKB) attracted over $100 million in inflows with about $100.2 million. Other Bitcoin entities that contributed profits include Grayscale Bitcoin ETF (GBTC), with $45.07 million, Fidelity Bitcoin ETF (FBTC), with $11.69 million, and Franklin Bitcoin ETF (EZBC) with $3.88 million.

Following the recent flow values, the Bitcoin entities’ cumulative net inflow has surged considerably to about $20.66 billion. Meanwhile, the total value traded was about $1.47 billion, while total net assets reflected $64.06 billion. The total net assets represent about 4.84% of Bitcoin’s market capitalization.

FETH Leads Inflows Surge

Unlike Bitcoin, Ethereum ETFs witnessed heightened investors’ interest in seven of nine commodities. Grayscale Ethereum ETF (ETHE) registered roughly $15.74 million in losses to mark ETH commodities-only outflows. For inflows, only two entities recorded values above $10 million. They include Fidelity Ethereum ETF (FETH) with $31.12 million and BlackRock Ethereum ETF (ETHA) with $23.56 million.

Meanwhile, Grayscale Mini Ethereum ETF (ETH) welcomed profits above $5 million. Notedly, it witnessed roughly $5.13 million in gains. Other profitable entities include 21Shares Ethereum ETF (CETH), Bitwise Ethereum ETF (ETHW), and Invesco Ethereum ETF (QETH). These entities attracted gains of approximately $2.33 million, $1.49 million, and $518.64K, respectively.

Consequently, the cumulative net inflows losses dropped to about $481.9 million. Other relevant data revealed that the total value traded was $126.7 million, while total net assets reflected $7.18 billion. The total net assets value represents 2.3% of Ethereum’s $316.95 billion market worth.

Bitcoin and Ethereum Price Reactions Amid Impressive Inflows

At the time of writing, Bitcoin is changing hands at about $67,900, reflecting a 1% upswing in the past 24 hours. Interestingly, the flagship crypto boasts a $1.34 trillion market capitalization, while its 24-hour trading volume is down by 3.53% with a $35.81 billion valuation.

On its part, Ethereum displayed a subtle 0.2% surge with about $2,630 in selling price. Within the past 24 hours of recording the slight spike, ETH saw minimum and maximum price limits, ranging from $2,580.10 – $2,649.89. The price extremes reflect possible consolidation after periods of recording upswings.