Highlights:

- BTC and ETH ETFs record massive spikes as BlackRock commodities welcome strong capital Inflows.

- Bitcoin and Ethereum ETFs saw only inflows and zero activities from their commodities, with none registering outflows.

- Bitcoin and Ethereum prices sustained remarkable price actions, with a potential breakout in sight.

According to Spotonchain’s most recent Exchange Traded Funds (ETFs) flow data, Bitcoin (BTC) and Ethereum (ETH) commodities saw strong rebounds, following significant capital Inflows from BlackRock. Notedly, the flow statistics revealed an impressive $136 million net inflows for Bitcoin ETFs. Similarly, Ethereum ETFs registered net profits of roughly $62.5 million.

Interestingly, activities from the commodities on the Bitcoin and Ethereum ETF marketplace were few on September 24, 2024. However, all active entities only recorded net inflows, underscoring a considerable profitable market outing. Meanwhile, market participants would wish for similar trend repetitions, with the potential to catalyze BTC and ETH price spikes.

🇺🇸 Spot ETF: 🟢$136M to $BTC and 🟢$62.5M to $ETH

🗓️ Sep 24, 2024👉 Notably, the net flows for both BTC and ETH ETFs rebounded sharply with no outflows, primarily driven by strong inflows from #BlackRock.

Follow @spotonchain and check out the latest updates about #Bitcoin and… pic.twitter.com/hH0O8GZxTw

— Spot On Chain (@spotonchain) September 25, 2024

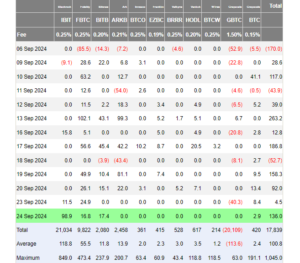

Bitcoin ETFs Massive Rebound Details

Before its most recent flow data, Bitcoin ETFs previous statistics revealed that the commodities witnessed net inflows of less than $10 million. For context, Grayscale Bitcoin ETF (GBTC) contributed significantly to the September 23 outflows. However, the reverse has become the case in today’s ETF flow coverage.

GBTC and six other entities had zero activities. The remaining four commodities welcomed only inflows as BlackRock Bitcoin ETF (IBIT) registered remarkable profits of about $98.9 million. With its impressive inflow rate, IBIT has sustained its position as the most profitable Bitcoin ETF. Its net gainful valuation has run into about $21.034 billion, averaging roughly $118.8 million per trading day.

Meanwhile, other Bitcoin ETFs that welcomed profits include Bitwise Bitcoin ETF (BITB), Fidelity Bitcoin ETF (FBTC), and Grayscale Mini Bitcoin ETF (BTC). They witnessed inflows of about $17.4 million, $16.8 million, and $2.9 million, respectively.

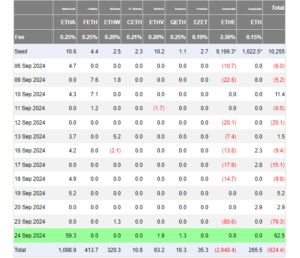

Ethereum ETFs Welcome Inflows from Three Entities

Unlike Bitcoin, Ethereum’s September 23 flow data registered losses of about $79.3 million. Meanwhile, Similar to Bitcoin and Ethereum, the losses recorded in the former flow data emanated mainly from Grayscale Ethereum ETF (ETHE). Notedly, ETHE welcomed roughly $80.6 million in outflows.

However, the September 24 statistics revealed that Ethereum ETFs welcomed inflows from BlackRock Ethereum ETF (ETHA), VanEck Ethereum ETF (ETHV), and Invesco Ethereum ETF (QETH). For context, these entities registered roughly $59.3 million, $1.9 million, and $1.3 million, respectively, in inflows.

Among the Ethereum ETFs, BlackRock has continued to dominate in accumulated net inflows with approximately $1.098 billion. On the other hand, ETHE is leading the losses chart with roughly $2.848 billion. Consequently, Ethereum ETFs’ total net flow has remained negative, with $624.4 million in losses.

Bitcoin and Ethereum Prices Sustain Positive Trends

At the time of writing, Bitcoin is changing hands at approximately $63,950, reflecting a 1% upswing in the past 24 hours. Within the same time frame, the flagship crypto has recorded minimum and maximum prices, ranging between $62,853.58 – $64,755.49.

Considering the price extremes above, it becomes apparent that BTC is edging closer to breaking above $65,000. If such happens, chances abound that Bitcoin could reclaim $70,000 in no distant time.

Conversely, Ethereum is down by 1% in its 24-hour-to-date price change with approximately $2,620 in selling price. Within the same period, ETH saw price extremes between $2,593.60 – $2,672.04. In its 7-day-to-date price change, Ethereum recorded a 12.6% upswing, with minimum and maximum prices ranging between $2,293.30 – $2,684.16. Ethereum’s price change in the past week underscores resilience in the token’s recovery prospect.