Highlights:

- BTC and ETH ETFs recorded inflows on the last trade day of the week.

- Bitcoin ETFs concluded the week with a net profit exceeding $1 billion.

- Bitcoin and Ethereum saw slight price upswings in their 24-hour price change index, underscoring a relatively stable market.

Bitcoin (BTC) and Ethereum (ETH) Exchange Traded Funds (ETFs) saw inflows in their September 27 flow data. With the recent flow data, Bitcoin ETFs concluded the week with net profits, having seen gains in the five trading days. Per Spotonchain, the BTC commodities welcomed weekly gains of approximately $1.11 billion, its highest since July 19.

Similarly, its Ethereum counterpart also concluded the week profitably. However, it recorded three days of net inflows out of five possible occasions. In summary, Ethereum’s weekly gain was at roughly $84.6 million. Interestingly, the weekly profit was the highest the entities have ever attained since August 9.

🇺🇸 Spot ETF: 🟢$494.4M to $BTC and 🟢$58.7M to $ETH

🗓️ Sep 27, 2024👉 The total flow for BTC ETFs this week is +$1.11B, with inflows on all 5 trading days. This marks the largest weekly inflow since July 19.

👉 The total flow for ETH ETFs this week is +$84.6M, with inflows on… pic.twitter.com/Bzi34u72LS

— Spot On Chain (@spotonchain) September 28, 2024

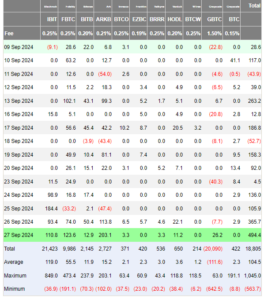

ARKB Rebounds Strongly Again as it Leads Inflows For BTC ETFs

In yesterday’s ETF flow, ARK 21Shares Bitcoin ETF (ARKB) led Bitcoin ETF inflows with over $100 million in gains. In the most recent flow data, ARKB has topped the chart again. However, this time, it contributed a whopping $203.1 million in profits, underscoring a potent rebound. Aside from ARKB, two other Bitcoin ETFs registered over $100 million in inflows. They include Fidelity Bitcoin ETF (FBTC) with $123.6 million and BlackRock Bitcoin ETF (IBIT) with $110.8 million.

Meanwhile, five other ETFs were active on September 27. Three entities recorded gains above $10 million, while the remaining two saw values less than $5 million. Those with profits above $10 million include Grayscale Bitcoin ETF (GBTC), Bitwise Bitcoin ETF (BITB), and VanEck Bitcoin ETF (HODL). For context, they welcomed $26.2 million, $12.9 million, and $11.2 million, respectively.

Other profitable commodities were Invesco Bitcoin ETF (BTCO) and Valkyrie Bitcoin ETF (BRRR), with profits of about $3.3 million each. Notably, three entities that had zero activities include Franklin Bitcoin ETF (EZBC), Grayscale Mini Bitcoin ETF (BTC), and WisdomTree Bitcoin ETF (BTCW). With the recent flow data, Bitcoin ETF cumulative netflow has soared profitably to about $18.8 billion. According to SosoValue ETFs flow data, the total value traded was $1.86 billion, while total net assets reflected $61.21 billion.

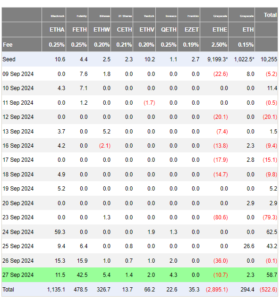

FETH Leads Ethereum ETFs Inflow Surge

Like Bitcoin, Ethereum ETFs were significantly active, as only Franklin Ethereum ETF (EZET) saw zero activities. Meanwhile, seven other entities registered gains, while Grayscale Ethereum ETF (ETHE) saw the only outflows with $10.7 million. For gains, Fidelity Ethereum ETF (FETH) and BlackRock Ethereum ETF (ETHA) led the inflows chart with $42.5 million and $11.5 million, respectively.

Other entities that witnessed profits were Bitwise Ethereum ETF (ETHW), Invesco Ethereum ETF (QETH), Grayscale Mini Ethereum (ETH), VanEck Ethereum ETF (ETHV), and 21Shares Ethereum ETF (CETH). They registered inflows of approximately $5.4 million, $4.3 million, $2.3 million, $2 million, and $1.4 million, respectively.

Bitcoin and Ethereum Price Reactions

At the time of press, Bitcoin is changing hands at approximately $65,800, reflecting a slight 0.6% upswing in the past 24 hours. The flagship cryptocurrency boasts about $1.3 trillion in market capitalization, with $28.18 billion in 24-hour trading volume.

Similarly, Ethereum is up by about 0.7% in the past 24 hours, with about $2,670 in selling price. The world’s number one altcoin boasts roughly $322.7 billion in market capitalization. Unlike its slightly increased selling price, Ethereum’s 24-hour trading volume is down by about 10.04% with a $15.68 billion valuation.