Highlights:

- BTC and ETH ETFs face fresh setbacks as both succumbed to net outflows on December 30.

- Ethereum ETFs latest cash outflows terminated its four consecutive profitable outings.

- Bitcoin ETFs extended their losing streak to the second day with a fresh net outflow.

On December 30, 2024, Bitcoin (BTC) and Ethereum (ETH) Exchange Traded Funds (ETFs) succumbed to net outflows as the commodities debuted a day before this year’s conclusion. According to the on-chain ETF tracker SosoValue, Ethereum ETFs’ latest loss implies that the commodities’ four-day profitable streak has terminated. Notedly, following the most recent market outing, the Ethereum entities forfeited $55.41 million.

On December 30, the Ethereum spot ETF had a total net outflow of $55.4094 million, the first net outflow after the net inflow in the past 4 days. Grayscale ETF ETHE had a net outflow of $17.3633 million in a single day. https://t.co/Tvs2oCSxTg pic.twitter.com/KPAfriFkIG

— Wu Blockchain (@WuBlockchain) December 31, 2024

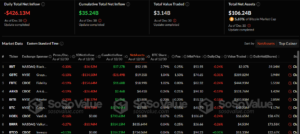

On the other hand, BTC ETFs’ fresh negative flow stretched their net outflows to the second consecutive day. Per SosoValue’s ETF flow data, the Bitcoin commodities suffered losses valued at approximately $426.13 million. As expected, the persistent negative trend has spurred considerable concerns for market participants, especially with Bitcoin’s present price struggles.

On December 30, the Bitcoin spot ETF had a total net outflow of $426 million, with net outflows continuing for two consecutive days. Grayscale ETF GBTC had a net outflow of $135 million per day, and the current historical net outflow of GBTC is $21.487 billion.… pic.twitter.com/iedtMbOnqX

— Wu Blockchain (@WuBlockchain) December 31, 2024

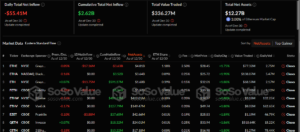

Detailed Statistics of Ethereum ETFs’ Latest Outing

According to the December 31 flow data, four Ethereum ETFs recorded market activeness, while the remaining five recorded zero flows. The active entities experienced only outflows led by Fidelity Ethereum ETF (FETH) after forfeiting $20.41 million. Two other commodities registered losses above $10 million. Grayscale Ethereum ETF (ETHE) shed $17.36 million, while Grayscale Mini Ethereum ETF (ETH) forfeited $13.75 million.

Only Franklin Ethereum ETF (EZET) witnessed losses below $10 million. It contributed $3.88 million to the total net outflows. Moreover, the recent flow data implies that Ethereum ETFs’ cumulative net inflows dropped from $2.68 billion to $2.62 billion. The total value traded was $336.26 million, while the total net assets reflected approximately $12.27 billion.

FBTC’s Concerning Outflows Persist

Like Ethereum, all seven active Bitcoin ETFs recorded only losses to compound the commodities predicament. Fidelity Bitcoin ETF (FBTC) topped the losses chart after forfeiting $154.64 million. FBTC’s consistent outflows have continued to deplete its cumulative net inflow. Notedly, the metric has dropped from over $12 billion to $11.68 billion. Moreover, Grayscale Bitcoin ETF (GBTC) also recorded over $100 million in outflows, having shed $134.50 million.

Aside from the above two entities, other Bitcoin commodities experienced over $10 million in outflows. They include BlackRock Bitcoin ETF (IBIT), Grayscale Mini Bitcoin ETF (BTC), Bitwise Bitcoin ETF (BITB), ARK 21Shares Bitcoin ETF (ARKB), and Valkyrie Bitcoin ETF (BRRR). They forfeited $36.52 million, $31.73 million, $31.37 million, $26.40 million, and $10.96 million, respectively.

Following the latest negative input, Bitcoin ETF cumulative net inflows depreciated from $35.66 billion to $35.24 billion. Other relevant statistics revealed that the total value traded was $3.14 billion. The total net assets, representing 5.69% of Bitcoin’s $1.86 trillion market capitalization, reflected $106.24 billion.

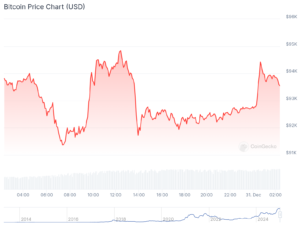

Bitcoin and Ethereum Price Reactions Amid ETF Outflows

At the time of writing, Bitcoin is changing hands at approximately 93,800, reflecting a subtle 0.1% upswing in the past 24 hours. Within the same timeframe, BTC’s minimum and maximum prices fluctuated between $91,375.39 and $94,838.16, highlighting the tendency for price slum below $90,000. Moreover, aside from its short-term price change variable, Bitcoin’s 7-day-to-date, 14-day-to-date, and month-to-date data displayed declines of about 0.1%, 12.7%, and 3.4%, respectively.

On the other hand, Ethereum’s price has depleted by 0.9% in the past 24 hours, reflecting roughly $3,380 in selling price. While Ethereum attempts to reclaim $3,500, its recent price struggles have reduced its market capitalization to about $407.48 billion. Meanwhile, despite its unimpressive price actions, Ethereum’s 24-hour trading volume has remained positive, with a 39.95% upswing and a $25.4 billion valuation.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.