Highlights:

- 21Shares files for Spot Solana ETF with SEC, following VanEck’s similar move.

- The ETF will trade on the Cboe BZX Exchange, mirroring Solana’s performance.

- Coinbase Custody Trust Company will custody the SOL assets for the ETF.

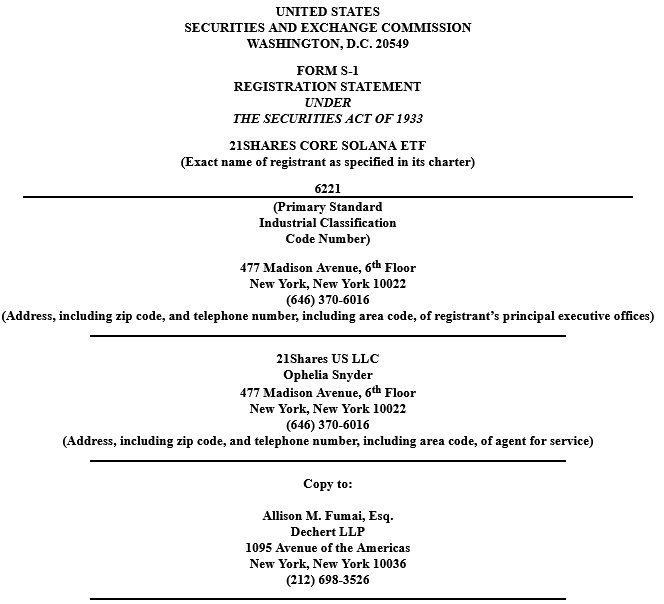

Swiss-based asset manager 21Shares has filed for a spot Solana ETF with the US Securities and Exchange Commission (SEC). This move follows a similar filing by VanEck just a day earlier. The proposed 21Shares Core Solana ETF aims to offer investors exposure to Solana (SOL) without direct investment. If approved, the ETF will trade on the Cboe BZX Exchange.

Filing Details and Structure

According to the filing, the ETF’s objective is to track the performance of Solana’s native token, SOL, adjusted for the fund’s expenses and liabilities. The SOL held by the ETF will be custodied by Coinbase Custody Trust Company, ensuring regulated and secure storage. The ETF will not directly invest in derivatives, but it will maintain its holdings in SOL to match the value of its shares accurately.

21Shares US LLC, the sponsor, will manage the trust’s operations. Authorized participants can create and redeem shares by depositing cash with the trust. This cash purchases SOL from designated third parties, SOL counterparties. These counterparties handle the transactions and transfer SOL to the trust’s custodian.

The trust plans to redeem shares by transferring SOL to the counterparties, who will then sell the SOL and deposit the cash proceeds back to the trust. This method allows efficient asset management while providing liquidity to investors.

However, the trust will be terminated if Solana is determined to be a security and the ETF sponsors choose not to comply with additional regulatory requirements. This provision underscores the ongoing regulatory uncertainties in the cryptocurrency market.

Growing Trend in Crypto ETFs

The introduction of the 21Shares Core Solana ETF signifies a growing trend of institutional involvement in the cryptocurrency sector. The filing follows VanEck’s similar application, suggesting increasing confidence in Solana’s potential among institutional investors. This movement reflects a broader trend toward integrating digital assets into mainstream financial products, offering investors more diversified options for portfolio management.

Solana Could Surge 9x with Spot ETF Approval

According to a recent Crypto2Community report, GSR Markets projects a substantial price increase for Solana, potentially surging by nine times its current value if a spot Solana ETF gains approval in the U.S. This optimistic outlook coincides with VanEck’s recent filing for a spot Solana ETF, reflecting the growing interest in Solana’s potential.

GSR’s analysis, released on June 27, underscores Solana’s advanced technology and strong market demand, positioning it as a strong candidate for an ETF. VanEck’s filing on the same day emphasizes Solana’s increasing recognition within the financial sector.

This prediction highlights the potential impact of regulatory approval on Solana’s market performance. If the spot Solana ETF is approved, it could catalyze significant growth, aligning with GSR’s optimistic forecast.

Learn More

- Brett Price Forecast: Is BRETT Set to Continue Its Upward Surge?

- DePIN Crypto Projects to Watch In 2024 – Top 10 DePIN Coins

- Best Metaverse Coins to Invest – Next Metaverse Coins